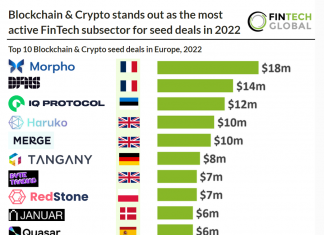

- WealthTech businesses raised 15% of all FinTech seed deals in the UK and the sectors shared the spot with Marketplace Lending as the second most active FinTech sector in the UK during the first quarter of 2022. Blockchain & Crypto took first place with 17% of seed deals in the UK, this follows global seed deal trends which also saw Blockchain & Crypto as the most dominant seed deal sector accounting for 23% of global seed deals in Q1 2022.

- London continues to stand as the UK’s FinTech hub accounting for 79% of the seed deals in the first quarter of 2022 at a total of 57. No other region in the UK recorded more than a singe seed deal demonstrating the concentration of deal activity in the capital. The UK was third in seed deal activity, representing 7.7% of global seed deals in the first quarter of 2022 only behind India (8%) and the US (38%).

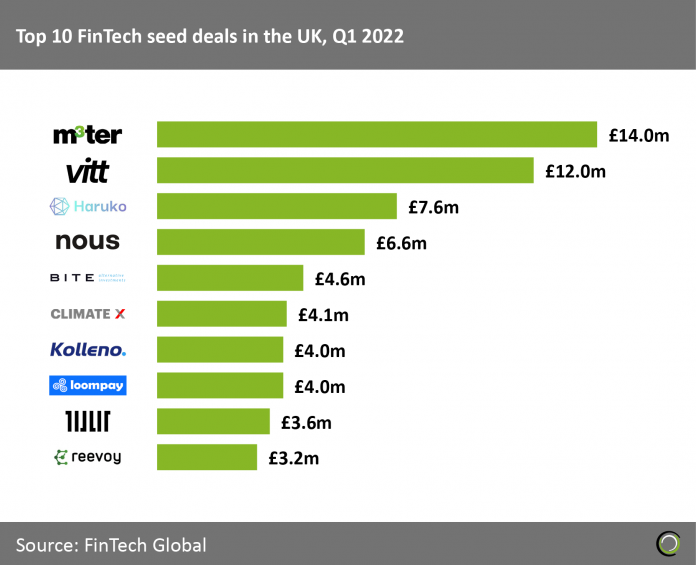

- m³ter, a metering and pricing engine for SaaS companies, was the largest seed deal in the UK for Q1 2022 raising a sizeable £14m from Insight Partners, Union Square Ventures and Kindred Capital.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global