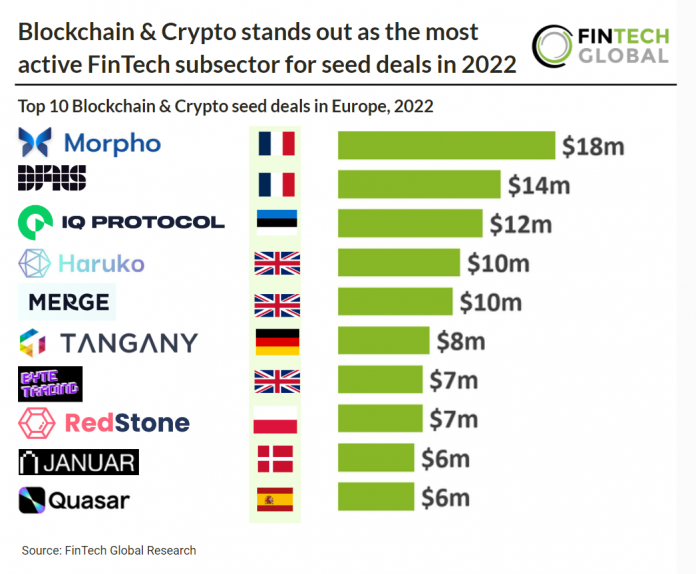

Key European Blockchain & Crypto seed investment stats in 2022:

• European Blockchain & Crypto companies raised 111 seed deals in 2022, an 18.4% share of total seed deals in Europe during 2022

• The UK was the most active Blockchain & Crypto seed country in 2022 with 27 transactions

• In 2022 $263m was raised by European Blockchain & Crypto companies at the seed stage

Blockchain & Crypto saw re-invigorated interest in 2022 with 111 seed deals announced by European companies. This makes Blockchain & Crypto the most active and innovative FinTech sector in 2022. The UK is heading this innovation with 27 deals taking place in the country, which accounts for 24% of Blockchain & Crypto seed deals in Europe last year. Switzerland was the second most active country with 15 deals and France was third with 14 deals. In total $263m was raised by European Blockchain & Crypto companies via seed deals during 2022.

Morpho, a decentralised lending platform, was the largest European Blockchain & Crypto seed deal in 2022, raising $18m in their seed round led by a16z Crypto and Variant. The round also saw participation from 80 additional investors, which included advisors, founders, power users and builders. Morpho-Compound has already been live for a few weeks and has already accumulated $30m of liquidity. Morpho said, “Our focus with Morpho is to bring the most efficient, unbiased, and secure lending services to anyone who needs them. By improving the native yields, we believe Morpho can enhance the current state of DeFi and extend its reach to much broader horizons.

In October 2022 the European Council approved the Markets in Crypto-Assets (MiCA) Regulation, one of the first attempts globally at a comprehensive regulation of cryptocurrency markets. The regulation extends to money laundering, consumer protection, the accountability of crypto companies and environmental impact. The European Union (EU) is a pioneer in digital regulation, and the breadth of MiCA means that it will have a significant global impact.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global