Valkyrie Investments, an investment manager focused on digital assets, has closed an $11.5m strategic investment round.

This capital injection was supplied by NY Mellon, Wedbush Financial Services, Coinbase Ventures, C-Squared Ventures, Clearsky, Zilliqa Capital, Belvedere Strategic Capital, SenaHill Partners and others.

With the round closed, the FinTech company hopes to deepen its technology infrastructure and hire more staff.

Valkyrie Investments is an investment manager with eight protocol trusts, a DeFi hedge fund, three Nasdaq-traded ETFs and a protocol treasury management business.

The FinTech company recently surpassed $1bn in assets under management across all divisions.

Valkyrie Investments co-founder and chief investment officer Steven McClurg said, “This fundraise shows the breadth of interest in both our industry and what we are building at Valkyrie.

“This strategic round will enable us to better service the broader market, and to integrate with traditional financial services platforms.”

Valkyrie Investments recently joined the BNY Mellon Accelerator Program.

The cryptocurrency industry continues to grow. A recent study by BrokerChooser found that 41% of first-time investors in the UK see cryptocurrencies as the most important assets to have.

With high interest in the sector, it is unsurprising there have been many big-ticket deals this year. Most recently, Indonesia-based PINTU closed its Series B on $113m to support the development of its crypto asset trading platform.

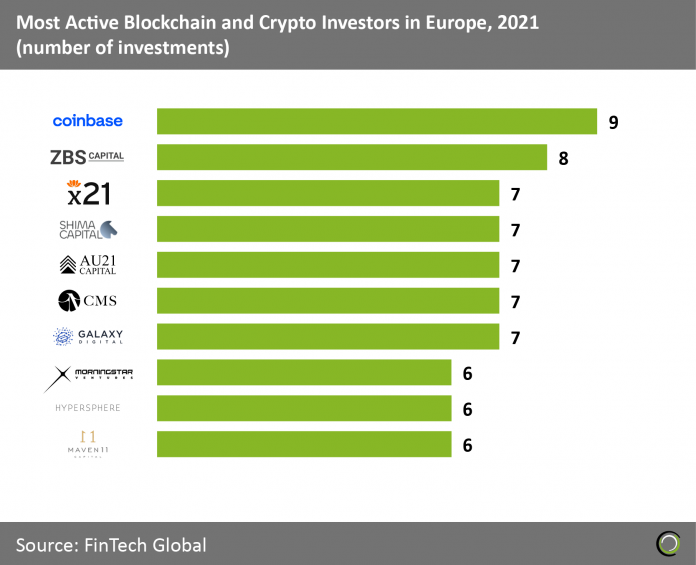

There are a lot of investors in the sector, but Coinbase was the most active in Europe during 2021, completing nine deals.

Copyright ? 2022 FinTech Global

Copyright ? 2022 FinTech Global