Despite the FinTech sector hitting a troubling time, a total of $1.7bn was raised by 34 companies this week.

With rising levels of inflation, higher costs of living and other troubling market conditions, some companies are feeling the push.

Earlier in the week, US digital bank Varo Bank announced that it had cut 75 people from its team, which was around 10% of its total team size. This week also saw UK neobank Starling reveal it has withdrawn its application for an Irish banking licence. It stated the bank was going to seek other opportunities it deemed had ‘superior return.’

A report from the Financial Times claimed that almost a trillion dollars has been wiped from the valuation of FinTech companies. It stated that over 30 companies have listed in the US since the start of 2020. The report highlights that shares in recently listed FinTechs have fallen by an average of over 50% since the start of the year. This is compared to a 29% drop in the Nasdaq Composite.

One of the biggest indications of the troubled market was Klarna’s fundraise last week. The company raised $800m in a funding round that put its valuation at $6.7bn – an 85% drop from its valuation in 2021. The FinTech company has also cut its global workforce by 10%. Last year, Klarna was valued at $46bn, but a downround had been rumoured for several months.

The company blamed the drop on the worst stock downturn in 50 years. In a statement it said, “The fresh investment in Klarna occurred during possibly the worst set of circumstances to afflict stock markets since World War II: high inflation, rising interest rates, mounting fears of a recession, the aftereffects of the first global pandemic since 1918, strains on commerce caused by supply chain disruptions, rising gas prices, and, especially in Europe, the dislocations caused by the war in Ukraine.”

Klarna highlighted that its drop is similar to what other companies are experiencing in the market.

While the market is hitting a rough patch, some companies are still closing sizable deals. This week’s biggest funding round was raised by Italian PropTech platform Casavo. The company raised $409m in its Series D funding round, which included a mixture of debt and equity.

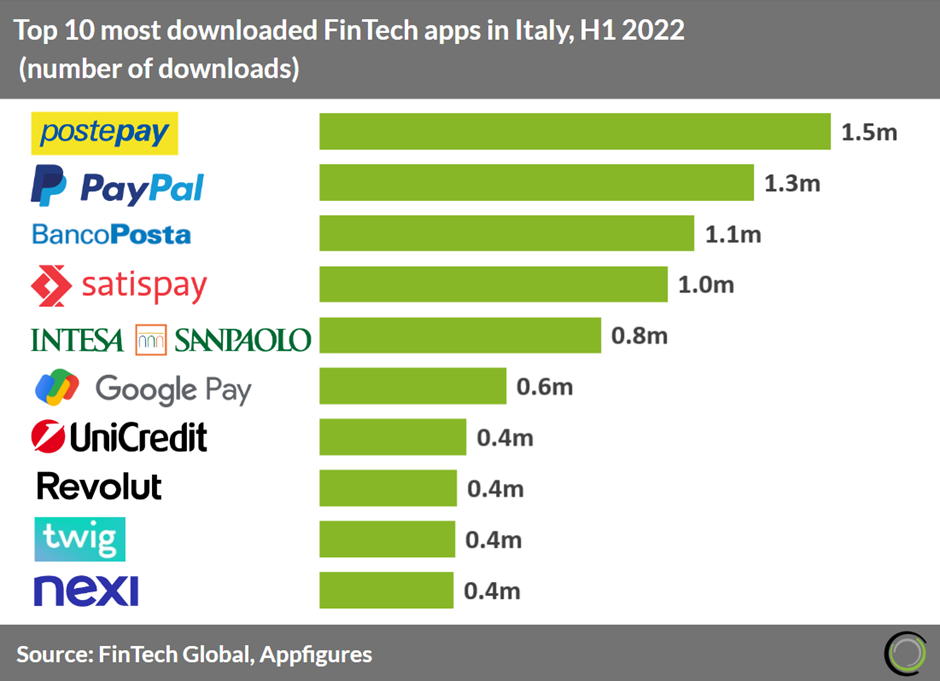

Research from FinTech Global this week highlighted that PostePay, a payment service provider owned by Poste Italiane, was the most downloaded FinTech app in Italy during the first half of 2022. This year it has had 1.5 million downloads and in total, Postepay has 12.3 million total downloads as of 30th June 2022, which equates to one in five Italians

US companies made up five of the ten biggest deals this week. WebBank, ALT, AirBase, Halborn and Zesti.ai raised a total of $723m. The rest of the top ten consisted of Stori (Mexico), Insurance SuperMarket International (Canada), Neon (Brazil) and mx51 (Australia).

US companies made up five of the ten biggest deals this week. WebBank, ALT, AirBase, Halborn and Zesti.ai raised a total of $723m. The rest of the top ten consisted of Stori (Mexico), Insurance SuperMarket International (Canada), Neon (Brazil) and mx51 (Australia).

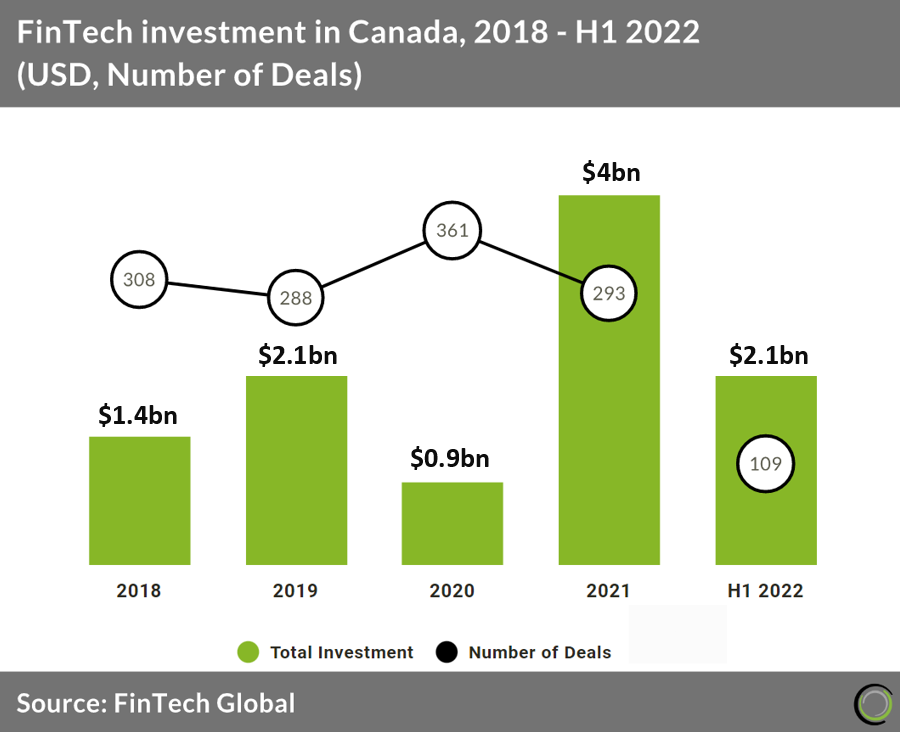

Another piece of research from FinTech Global this week showed that the country could see a new record year for funding. In the first six months of the year, $2.1bn was invested through 109 deals, which is just over half last year’s total funding of $4bn in 293 deals. The country is on track to a record year due to a stellar first quarter, with Q2 only seeing $210m raised by companies.

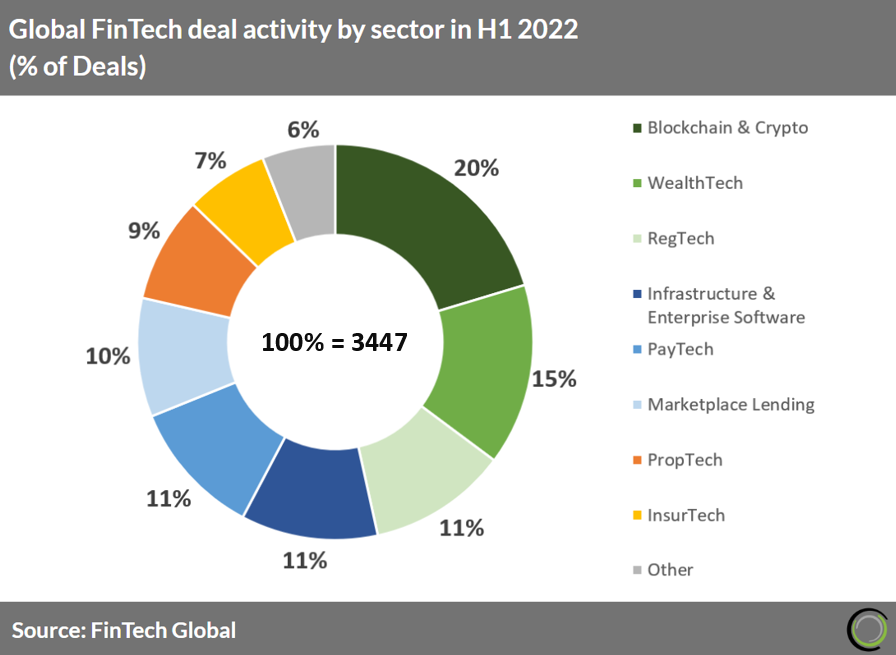

The top ten deals were spread quite evenly across sectors. However, WealthTech companies took the lead with three. The sector has had a strong 2022, according to data by FinTech Global. Of the 3,447 deals completed in H1 2022, 15% have been with WealthTech companies, making it the second most popular. Blockchain and cryptocurrency companies topped the chart with 20% of deal activity and RegTech came in third with 11% of the deals. Despite their popularity, no blockchain and cryptocurrency or RegTech company featured in this week’s top ten deals.

Here are this week’s 34 funding rounds.

Here are this week’s 34 funding rounds.

Casavo collects €400m ($409m) to simplify home-buying and selling

Casavo, a European PropTech platform aiming to redefine home selling and buying, has raised €400m.

The capital comprises €100m in Series D equity funding, plus an additional €300m in debt secured from Intesa Sanpaolo, Viola Credit and others.

The Series D round was led by Exor, and Casavo said it represents Europe’s largest PropTech financing to date. Existing investors included Greenoaks, Project A Ventures, 360 Capital, P101 SGR, Picus Capital and Bonsai Partners.

The equity round also saw participation from new investors including Neva SGR (Intesa Sanpaolo Group), Endeavor Catalyst, Hambro Perks, Fuse Venture Partners, as well as angel investors such as Sébastien de Lafond (founder of MeilleursAgents).

Founded in 2017, Casavo vision is to free people from the complexity of selling and buying homes. The company began as a home-buying platform, but has since evolved into a marketplace where homeowners can start their selling or buying journey while being fully supported by Casavo.

WebBank invests $250m into digital financial solution dev Avant

WebBank will invest up to $250m into digital financial solution developer Avant, as part of a securitisation deal.

The funds are secured by credit card receivables. WebBank’s investment will be applied over a three-year revolving term.

With the funds, Avant hopes to meet the demand and growth of the Avant Mastercard Credit Card, which is issued by WebBank.

Avant claims to offer a credit card that brings people closer to their goals. Its platform helps people build credit scores with credit limits from $300 – $3,000. Its services include personal loans, credit cards and mobile banking services.

Investing platform ALT raises $200m in debt

Investment platform ALT has raised $200m in debt financing, which was led by Atalaya Capital Management.

This funding comes shortly after ALT released ALT Advance, a lending product that lets investors borrow cash against their vaulted assets without having to sell them. This service gives liquidity against graded collectibles such as trading cards, watches and sneakers.

Through the Advance service, borrowers send their graded collectibles to ALT’s secure vaulting facility for safekeeping. The borrower then reviews the terms and conditions, which are offered in real-time against the portfolio. The borrower then prepays on a flexible payment schedule, with the option for early payments.

Spend management app Airbase has secures $150m in debt

Spend management platform Airbase has secured $150m in debt financing from Goldman Sachs.

The funds will enable Airbase to expand its innovative change card program to its increasing customer base. It claims the demand for its services has surged as more companies seek visibility and control over employee spending.

Airbase offers software-enabled corporate cards. It boasts automated approval workflows that map to a company’s policies and accounting entries. Its solution handles all non-payroll spend, including corporate cards, bill payments, purchase orders and employee expense reimbursements.

Stori becomes the latest FinTech unicorn in Mexico

Credit card company Stori has become the latest Mexican company to join the unicorn club, following the close of a $150m Series C-2 funding round.

This investment brings the company’s valuation to $1.2bn. Marlene Garayzar, chief governance officer and co-founder, has become the first Mexican woman to have founded a unicorn technology startup in the country.

The round included a $50m equity investment from BAI Capital, GIC, GGV Capital, Lightspeed Venture Partners, General Catalyst, Vision Plus Capital, Goodwater Capital, Tresalia Capital and Davidson Kempner Capital Management.

It also included a $100m debt facility from Davidson Kempner.

This Series C-2 round comes just nine months after Stori closed a $200m funding round, which is one of Latin America’s largest Series C rounds.

With the fresh capital, Stori plans to hire more staff and expand its product offering beyond the credit card. Funds will also help the FinTech company increase its geographical reach across Latin America.

Founded in 2018, Stori provides underserved populations with access to credit card products. It currently boasts 1.4 million customers in Mexico. The whole user experience, from applying for the card to paying bills is all carried out through the Stori mobile app.

Gallatin Point backs Canadian life insurer ISI

Insurance Supermarket International (ISI), a digital life insurance provider in Canada, has closed a $100m minority investment from funds managed by Gallatin Point Capital.

ISI established its digital distribution and administration platform in 2015, the deal is its first institutional equity round since the launch.

Following the investment, Matt Botein, GPC’s co-founder and managing director, will be appointed to the ISI board of directors.

ISI will use the revenues for its expansion of its life insurance business across North America. And to expand its technology-driven platform offerings and distribution networks

CyberTech platform Halborn raises $90m in funding

Halborn, a cybersecurity platform for traditional finance and blockchain-based companies, has completed a $90m funding round.

The investment was led by Summit Partners, a Boston-based private equity firm.

Founded in 2019, Halborn aims to secure the blockchain and protect users against data and monetary losses. It offers a suite of products and services that identify and close vulnerabilities in Web3 applications, helping to create the security standards that the market currently lacks.

Its current client base includes Layer 1 blockchains, infrastructure providers, financial institutions, and application and game developers.

Halborn offers security advisory services, with its technology continuously assessing an organisation’s vital assets, boosting automation and offering support. Its features include code audits, API pan-testing, technical security compliance, blockchain protocol security assessment, web-application pen-testing, and more.

Brazilian neobank Neon lands $80m

Neon, a FinTech and digital bank driven by the vision of improving the lives of working Brazilians, has raised $80m.

The capital was raised in the company’s first Credit Rights Investment Fund (FIDC) focused on credit cards. The investment increased the total fund to $170m in equity.

This is the second fundraising made by Neon in the private credit market this year, having previously raised just over $40m for its private payroll deductible FIDC at the beginning of 2022.

Neon believes it can create a conscious path to credit with solutions and innovations that can help the customer to obtain credit in a simple and fair way. For example, it recently launched the elastic limit, which makes it possible to expand credit for one-off purchases, based on credit assessment.

Zesty.ai pulls in $33m for AI-driven property risk

Zesty.ai, a provider of property risk analytics solutions powered by artificial intelligence (AI), has raised $33m in conjunction with their Series B led by Centana Growth Partners.

The oversubscribed round also saw participation from current investors and Brex.

Zesty.ai provides insurers and real estate companies with access to precise intelligence about every property in North America. The company partners with about half of the top 50 property & casualty insurance carriers in the US to underwrite and rate homeowners and business insurance.

Many of the company’s climate risk products, such as its predictive AI wildfire risk model Z-FIRE, have seen widespread regulatory approval and commercial adoption across all states in the US by the likes of Amica, Aon, Berkshire Hathaway, Cincinnati Insurance and Farmers Insurance. Moreover, the California FAIR Plan and many others are making Zesty.ai’s models an important part of their risk management strategies.

Zesty.ai said it will use the funding to expand the breadth of its existing products within insurance and develop new products for the real estate market.

Australian FinTech startup mx51 scores $32.5m

Australian FinTech company mx51 has reportedly raised $32.5m in its Series B funding round.

This investment was led by an unnamed FinTech investor, according to a report from Business News Australia. Other commitments came from Mastercard, Acorn Capital, Commencer Capital, Rampersand and Artesian.

This equity burst will help mx51 bolster its domestic growth initiatives and launch its international expansion plans. In addition to this, the company plans to enhance its core in-store, online payments and merchant dashboard solutions.

mx51 also hopes to enhance its capabilities that assist in fraud prevention and data-driven customer insights.

The company provides businesses with a robust and secure payments system for merchants

India-based neobank Niyo scores fresh funding months after former round

India-based neobank Niyo Solutions has reportedly received $30m in funding, just months after closing its Series C on $100m.

The fresh equity burst was supplied by Multiples Alternate Asset Management, a Mumbai-based private equity firm, according to a report from Your Story.

With the capital, Niyo plans to expand its product capabilities and increase its customer base via organic and inorganic opportunities. Additionally, funds will help the company build its brand and hire more staff.

Mexican FinTech company Arrenda scores round of debt and equity

Mexican FinTech startup Arrenda has reportedly collected $26.5m in a funding round composed of debt and equity.

Fasanara Capital served as the lead investor, with commitments also coming from Kube Ventures and ODX, according to a report from Nasdaq.

The company has around $12m in finance requests pending and hopes to provide $2.5m this year. It also stated it hopes to increase its rate of financing next year.

Arrenda claims to empower trust and liquidity in LatAm real estate. A user begins by inputting personal data, information about the property and calculating the advance. Arrenda will then validate the information and send a contract with the funds to be received.

Its website claims that its loans offer up to 12 months of the applicant’s income, has no commission for opening, and can approve advances in 24 hours.

X1 backed by Google Ventures co-founder in Series B

Challenger credit card X1 Card has raised $25m from a Series B round headed by FPV, a venture firm headed by Google Ventures co-founder Wesley Chan.

Also taking part in the round were Craft Ventures, Spark Capital, Harrison Metal, SV angel, Abstract Ventures, the Chainsmokers and Global Founders Capital. To date, the X1 has raised a total of $45m.

While currently in a waitlist-only beta, X1 Card claims it will become the fastest ever-growing challenger credit card by purchase volume, growing to $50m monthly volume in just six months and projected to hit $1bn in annualised spend this year.

X1 card will be opening applications to the general public in the US market over the coming weeks, with over 500,000 people on the waitlist. The card has been used in over 100 countries globally and has members in all 50 US states.

The new funding will be used to invest in product innovation and scale as the X1 card opens to general availability.

Dot Compliance bags $23m in its Series B

Dot Compliance, a ready-to-use compliance platform, has bagged $23m for its Series B round, which was led by Israel Growth Partners.

Contributions also came from existing investors Vertex Ventures and TPY Capital.

With the capital, the company plans to accelerate its hypergrowth, which has been driven by the demand for its quality management system, Dot Compliance stated. Funds will also be used to expand its global presence, invest into its products and improve its offering.

Dot Compliance claims to offer an industry first ready-to-use quality and compliance solution. It offers out-of-the-box solutions that allow life science customers to deploy flexible and scalable solutions.

Dot Compliance founder and CEO Doron Sitbon said, “Dot Compliance has shaken up a traditionally slow-moving space, setting a new standard for easy-to-deploy QMS solutions.

“We are excited about the partnership with IGP and their trust in our vision. The additional funds will allow us to advance our efforts in enabling life sciences organisations to quickly automate their development and manufacturing processes while ensuring compliance.”

Dot Compliance has experienced a strong period of growth, including a triple digit annual growth over three consecutive years and exceeding 200 customers in more than 15 countries.

With the close of the round, the company has raised a total of $33m in funding.

TomoCredit bags $22m in Mastercard-backed Series B

TomoCredit, a US startup creating a credit card to help first-time borrowers build credit history, has secured $22m from a Series B financing raise.

The round was backed by Mastercard and Morgan Stanley’s Next Level Fund as well as participation from Asian Hustle Network, Hyphen Capital and GoldHouse. TomoCredit recently secured $100m in debt financing from Silicon Valley Bank.

TomoCredit is attempting to target the 40 million credit-invisible immigrants and international students that currently hold no credit history in the US.

TomoCredit’s underwriting algorithm identifies high potential borrowers without a credit score and then offers a credit card that requires no credit check, no deposit, no APR and no fees.

With the new funding, the firm is planning to expand into auto loans and mortgages.

Crypto firm Meow bags $22m in Series A

Meow, a compliant crypto yield offering for corporate treasuries, has scored $22m in a Series A funding round.

The round was headed by Tiger Global and saw participation from QED Investors, FTX and a number of other investors.

Meow provides institutional and corporate investors with a compliant-first approach to participating in emerging cryptocurrency investment opportunities.

Meow claims since its launch earlier this year and previous seed financing, its offering has been rapidly embraced by corporate treasury departments – with the firm growing corporate assets under management to nearly $100m due to rapid adoption of the cash-in-cash-out, short-term high-yield investment opportunities by a range of businesses.

The investment will be used to support the company’s rapid growth with new hires and enhanced product features. The firm also has a number of new product enhancements under development, and plans to launch a GAAP accounting solution as well as rolling out features of a B2B stablecoin suite, including cross-border payment solutions.

AI-powered automation platform AppViewX secures $20m

Automated machine identity management platform AppViewX has secured $20m in its Series B round.

The capital injection was led by growth equity firm Brighton Park Capital.

With the funds, the company plans to maximise its go-to-market operations, product development and overall revenue growth strategies.

AppViewX’s mission is to help Global 2,000 organisations reduce risk by securing and orchestrating enterprise identities and applications.

The company’s automation platform helps reduce risk and ensures compliance with regulations in the financial services, banking, healthcare, manufacturing and high-tech sectors.

Its platform is a modular software application that enables automation and orchestration of network infrastructure and helps improve agility, enforce compliance, eliminate errors, and reduce cost.

Services include certificate lifecycle automation, lifecycle management for DevOps, smart discovery, CLM-as-a-service and more.

Charles bags $20m from Salesforce-led Series A

Charles, an all-in-one conversational-first operating system bringing ecommerce into chat apps, has raised $20m from a Series A financing round.

The round was headed by Salesforce Ventures and also saw participation from previous investors HV Capital and Accel.

Charles claims it enables businesses to sell products, send newsletters and support with ongoing personalisation and deep system integration via chat.

The company originally started as a solution to a problem its founders had personally experienced, with them being unable to find any software that combined service, sales and newsletter functionalities for chat apps in a single place. From this, they created software in the field of ‘cCommerce’.

Charles has already seen several of its software customers hitting seven-digit WhatsApp revenues this year and driving 10-40% of their sales via chat. In addition, clients have had more than 90% opening rates and 8x more revenue per recipient via WhatsApp newsletters than via email.

Through the new funding, Charles is planning to expand its operations from Germany into key European markets and is also targeting larger enterprise clients.

Mahalo Banking secures $20m for credit unions

Mahalo Banking, which provides online and mobile banking solutions for credit unions, has raised $20m in funding.

The round was led by Ohio-based Superior Credit Union, Park Community Credit Union, and Dover Federal Credit Union.

Based in Michigan, the Mahalo platform, which was designed by individuals who have worked in the credit union industry as well as in security, aims to help all credit unions achieve a technology advantage in the marketplace.

The capital will enable Mahalo to continue the “resounding momentum” that is has experienced over the past two years and will be heavily allocated toward research and product development.

Italian InsurTech startup Wallife scores €12m ($12.2m) in its Series A

Italian InsurTech startup Wallife has nabbed €12m in its Series A funding round, which it claims is the seventh largest in Europe in the sector during 2022.

United Ventures, an Italian venture capital firm, served as the lead investor to the round. Participation also came from a group of Italian and international investors and business angels, including Aptafin.

Capital from the round will drive Wallife’s international growth, develop new products and bolster the technological infrastructure. The InsurTech company also plans to expand its team.

Wallife was founded in 2020 by Fabio Sbianchi and Maria Enrica Angelone with the aim of protecting individuals from emerging risks arising from technological innovation and scientific progress. The company aims to develop innovative insurance products for existing and unknown risks that traditional insurance has not covered.

Its current areas of interest include genetic manipulation (e.g. the preservation of biological material and genetic identity), biohacking (the use of technologies inside the human body, such as prostheses and implantable medical devices) and the use of digital data (such as fingerprints and facial recognition).

Trucking insurance startup Koffie Insurance startup secures Series A round

Koffie Insurance, an InsurTech startup aimed at the trucking and transportation sector, has collected $11m in its Series A.

Anthemis Group served as the lead investor, with existing backers Lerer Hippeau Ventures and Plug and Play Ventures also committing capital. First-time Koffie investors included, CP Overture, Breakout Capital, Two Lanterns Venture Partners and a group of unnamed strategic angel investors.

Koffie Insurance supplies trucking and transportation companies with fast and affordable insurance coverage that rewards and incentivises safety. It claims the technology helps save money and time through underwriting, loss control, claims handling and fleet operations.

Founded in 2018, the company claims to have insured over 1,000 trucks.

Its services are currently available in Tennessee, New Jersey and Illinois, but Koffie plans to scale to ten states by the end of the year. Funds from the Series A will help Koffie enhance its product offering and hire more staff.

‘Fairness-as-a-service’ lender FairPlay bags $10m

FairPlay, a company seeking to reduce algorithmic bias in lending, has scored $10m in Series A funding.

The round was headed by Nyca Partners and saw participation from Cross River Digital Ventures, Third Prime, Financial Venture Studio, TTV Nevcaut Ventures and Jonathan Weiner.

FairPlay describes itself as a ‘fairness-as-a-service’ provider for algorithmic decision-making. The company helps companies embed fairness considerations into their automated decision-making systems and reduce algorithmic bias.

The firm is aiming to address the bias faced by people of colour, women and other disadvantaged groups when it comes to credit decisions.

FairPlay will use the funding to strengthen the company’s engineering and data science teams and expand its products into the insurance, marketing and fraud industries.

Ivory Coast-based PayTech Bizao scores $8.2m Series A

Ivory Coast-based FinTech company Bizao has reportedly received $8.2m in its Series A funding round.

The capital was supplied by AfricInvest, Adelie and Seedstars Africa, according to a report from Disrupt Africa.

With the funds, Bizao plans to scale its commercialisation and expand into more countries.

The company, which was founded in 2019, is accelerating digital payments across Africa. Its platform offers a variety of payment services, including mobile payments, online transactions and point-of-sale terminals.

It also boasts a dashboard to help companies monitor their payments and improve user experiences to build customer loyalty.

Kiwi InsurTech Javln lands funding and eyes ASX listing

New Zealand-based InsurTech Javln has raised NZ$7.4m in partnership with Australian IPO fund manager Bombora Investment Management.

According to a report from NZ Herald, the raise included a NZ$4.4m private offer, which was revised from NZ$3.6m.

Founded in 2011, Javln provides end-to-end policy management software to insurance agents, brokers and underwriters which allows them to save time and money, whilst delivering “quintessential” customer experience.

Dale Smith, CEO at Javln, said the fresh capital will allow the company to expand further into Australia, and further afield. He said Australia is Javln’s largest commercial opportunity for the company currently.

The capital will also be put towards boosting its staffing, which currently stands at 60, with staff based across Auckland, Hamilton and Australia.

Smith also said the company was looking at a future ASX listing in 12 to 24 months’ time, as opposed to floating its shares on the New Zealand Stock Exchange, because of Bombora’s experience with taking companies public there.

Visa and Y Combinator-backed Bloom raises $6.5m

Sudan-based Bloom, a FinTech which offers financial products aimed at improving the lives of East Africans, has raised $6.5m in a seed round.

According to a report by Web Times, the round saw participation from Visa, Y Combinator, Global Founders Capital (GFC), Goodwater Capital and UAE-based early-stage firm VentureSouq.

Other investors included angels Arash Ferdowsi, Dropbox co-founder Nicolas Kopp, former US CEO of N26 and footballers Blaise Matuidi and Kieran Gibbs, as well as early employees at Revolut and Tide.

Bloom offers fee-free accounts for users to save in dollars and buy and spend in Sudanese pounds. It also provides local and dollar cards and a feature where they can receive remittance free of charge from several countries globally.

The backing from Visa came as Bloom partnered with the company by participating in the global card’s FinTech Fast Track Program, which saw it switch its cards from Mastercard to Visa.

Earlier this year, Bloom announced that it was part of Y Combinator’s winter batch this year, following its launch from stealth that month.

Bloom’s founders said his seed round will help the Sudanese- and Dubai-based startup execute its expansion plan across the Anglo-East African region such as Ethiopia, Kenya, Rwanda, Tanzania and Zambia.

The round is also thought to be the largest in Sudan.

HiddenLayer emerges from stealth with $6m and flagship product launch

HiddenLayer has launched its flagship product, which is a security platform built to detect and prevent cyberattacks that target machine-learning-powered systems, following a stealth period.

The company claims its product is the industry’s first and only machine learning detection and response solution that protects enterprises and their customers from their emerging attack vector.

Hidden Layer claims its MLDR solution uses a ML-based approach to analyse billions of model interactions per minute to identify malicious activity without any access to or prior knowledge of the user’s ML model(s) or sensitive training data. It detects and responds to attacks against ML models to protect IP and trade secrets from theft or tampering and ensure users are not exposed to attacks.

The firm said, “HiddenLayer’s MLDR is a non-invasive and easy-to-use security solution that does not require access to raw data or algorithms. It identifies patterns in ML model traffic through contextless vectorised data points to provide comprehensive defence from adversarial attacks targeting the deployed ML model in production.

Alongside the product launch, the company also raised $6m in a seed funding round headed by Ten Eleven Ventures.

Jupiter Exchange nets $5m seed funding

Alternative asset exchange Jupiter Exchange has closed a $5m seed funding round headed by White Hilt Capital.

Jupiter curates iconic objects and makes fractional ownership available to anyone through its digital marketplace and exchange.

The company establishes a simple process where the ownership of each carefully curated item, such as things like fine art and pop culture memorabilia, is minted as an NFT and fractionalised into individual ownership tokens.

Once sold out on the Jupiter marketplace, the item is listed on the Jupiter Exchange and available through a traditional bid-ask model.

Accelex secures $5m to transform how investors work with data

Accelex, a SaaS platform redefining alternative investment data management, has raised $5m in funding.

The round saw participation from existing investors Illuminate Financial, AlbionVC, Expon Capital and SixThirty Ventures. They were joined by new investor MassMutual Ventures.

Founded in 2018, Accelex provides data acquisition, analytics and reporting solutions for alternative investors and asset servicers, enabling firms to access the full potential of critical investment performance and transaction data.

The company said the funding will support its ambitions to further product development, client acquisition and support.

Push Security scores $4m in seed raise

Push Security, a UK-based provider of technology enabling secure SaaS adoption and usage, has bagged $4m from a seed funding round headed by Decibel.

The round was also backed by co-founder of Duo Security Jon Oberheide and CEO and founder of Thinkst.

Many employees today are moving fast and adopting SaaS platforms to get things done. While SaaS makes productbity gains and innovation accessible for companies of all sizes, it also introduces risk to the business unless its properly managed.

To support this move towards productivity and flexibility, Push believes the best way to is adopt a user-centric approach and equip employees to improve their own security while using SaaS.

With this new funding, the company plans to develop technology that ‘guides employees to make smart decisions while they are using company SaaS platforms’, enlisting their help to boost security.

Atlantic Money launches in UK market and bags $3m seed extension

Atlantic Money has revealed its low-cost money transfer service is now available to everyone in the UK.

The company claims that everyone in the UK can now transfer up to £1m abroad for a fixed fee of £3 and at the interbank mid-market rate with no FX mark-up.

Users of Atlantic Money simply download the app, go through a verification process and can then begin transferring money. They are also able to select standard delivery or opt for express delivery for a small additional fee of 0.05%.

Customers are able to send money from the UK in GBP into nine currencies including USD, EUR, AUD, CAD, SEK, NOK, DKK, PLN and CZK.

Alongside the launch, Atlantic has secured an additional injection of $3m in seed capital, which was led by Amplo. This was in addition to the initial funding of $4.5m.

Vietnam-based MFast collects $2.5m

Vietnam-based FinTech company MFast has reportedly collected $2.5m in its latest funding round.

The capital injection was led by Ascend Vietnam Ventures, with participation also coming from Wavemaker Partners, JAFCO Asia and Do Ventures, according to a report from technode.global.

With the funds, the company plans to hire more staff for its team, including the technology, marketing and sales divisions. Capital will also be used to upgrade its platform, grow its agent network and deploy new business models.

Alongside this, the company plans to expand into other Southeast Asian countries.

MFast is a mobile app that aims to help consumers improve their income. Users perform online jobs available through the app and receive commission from doing the work. Examples of jobs include, selling scratch cards, guiding customers to open online bank accounts, selling bus tickets, selling non-life insurance and helping introduce customers that need a loan.

Flat6Labs backs 7 Jordan-based startups

MENA seed and early-stage venture capital firm Flat6Labs has announced seven new Jordan-based startups it has invested into.

One of the companies was QuiqClaim, a peer-to-peer settlement and investments platform aimed at the medical insurance industry.

Another company to receive funds was iPass, a one-stop shop for worldwide identity verification solutions, which leverages deep pixel biometric fraud detection tools.

The firm has provided each of the seven companies with $115,000. It will also give the companies a four-month acceleration program, which includes a selection of workshops and mentoring sessions designed to cover all aspects of business development.

It will also supply them with workspaces, marketing and legal support, and access to a regional network of partners and investors.

Flat6Labs targets companies in sectors, including information and communication technologies, software solutions, education, healthcare, digital content and games, hardware, electronics, manufacturing solutions, renewable energy, agricultural solutions, big data and analytics, FinTech and payment solutions, media, and entertainment.

Other companies in the cohort include mental health services and counselling Arab Therapy, ‘try before you buy’ software for e-commerce storefronts BloomIt, data-driven real estate marketplace Khareta, logistics service Shop4me, and mindfulness mobile app Sukoon Awakening.

Zero trust cybersecurity platform Xage secures more funding this year

Zero trust cybersecurity company Xage has raised additional funding from Chevron Technology Ventures.

With the capital, Xage plans to accelerate the use of zero trust in protecting energy and other critical infrastructure from cyber threats.

Xage claims to be the first and only zero trust real-world security company. Its flagship product Xage Fabric accelerates and simplifies the way enterprises secure, manage and transform digital operations.

Fabric is specifically designed to bring a zero-trust security model to complex environments without requiring an equipment overhaul. It overlays every machine, app and data point within an organisation to impose granular control over all digital interactions.

It also offers identity and access management, zero trust remote access and dynamic data security solutions.

Copyright © 2022 FinTech Global