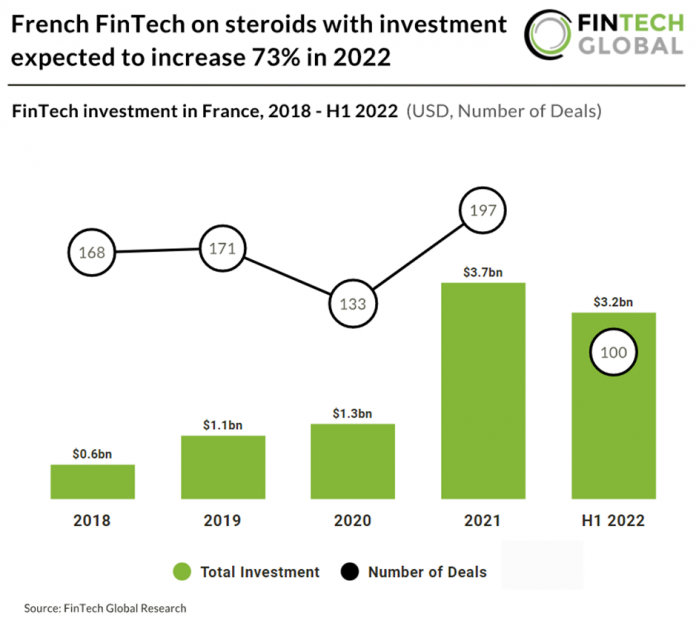

• FinTech investment in France is projected to reach $6.4bn in 2022 based on investment in the first half of 2022, a 73% rise from 2021 levels. Deal activity in France is expected to reach similar levels to 2021 with a slight 1% increase. Paris clearly stands out as the leading FinTech hub in the country accounting for 67% of the 100 total deals in H1 2022 and the next most active city was Lyon that had a 4% share of total deals.

• Qonto, an all-in-one bank account for SMEs, was the largest French FinTech deal in H1 2022, raising a huge $552m in their latest Series D funding round led by TCV and Tiger Global Management which brought the company’s valuation to $5bn. The capital will be used to expand the company’s product offerings, strengthen market presence in Germany, Italy, and Spain, and new market entries as well as quadruple the headcount to over 2,000 employees by 2024.

• New FinTech guidelines have been released by the ACPR (Autorité de Contrôle Prudentiel et de Résolution) In January 2022 for FinTechs wishing to launch a project in France, which aims to help FinTech companies better understand the legal and regulatory framework to which they may be subject, and which may fall under ACPR supervision. It explains the steps a FinTech company must follow with the ACPR to obtain the licence or registration necessary to conduct its business.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global