Nigeria-based Maplerad has reportedly raised $6m for its seed round, as it establishes a global banking-as-a-service platform aimed at Africa.

The company has launched out of stealth and is valued at $30m, according to a report from TechCrunch.

Peter Thiel’s Founders Fund led the round, with commitments also coming from Golden Palm Investments Corporation, ex-Venmo COO Michael Vaughn, Fintech Fund, Kuda CEO Babs Ogundeyi, Armyn Capital, Dunbar Capital, Strawhat Investment, Polymath Capital, Unpopular Ventures, Sean Mahsoul and MyAsiaVC.

The founders of Maplerad, Miracle Anyanwu and Obinna Chukwujioke, have also invested in the company.

Maplerad will use the seed capital to acquire more customers, gain additional licences, hire more staff and bolster its presence across Africa.

Whilst in stealth, the FinTech company processed millions of dollars each month for over 100 businesses on its platform. These included a few banks, Pastel, Spleet, Crowdforce and many others.

Maplerad started its journey in 2020, when the first product was launched, Wirepay, the report said. This app enabled international payments in fiat or cryptocurrency. The service has now shifted into an all-in-one finance product that enables users to receive, hold and make payments, as well as pay bills and create virtual cards.

Wirepay raised $125,000 in a pre-seed round last year from OnDeck, Golden Palm Investments and Greenhouse Capital.

The Maplerad platform is a banking-as-a-service infrastructure that enables firms to implement financial services into their product. The embedded financial services include payments, issuing, accounts and FX, and can be built within minutes.

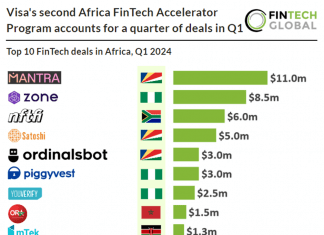

Nigeria’s FinTech sector had a strong 2021. A total of $739m was raised across 85 deals during the year, according to data by FinTech Global. However, 2022 has had a slow start. In the first six months of the year, $175m has been invested across 48 deals.

Copyright © FinTech Global 2022