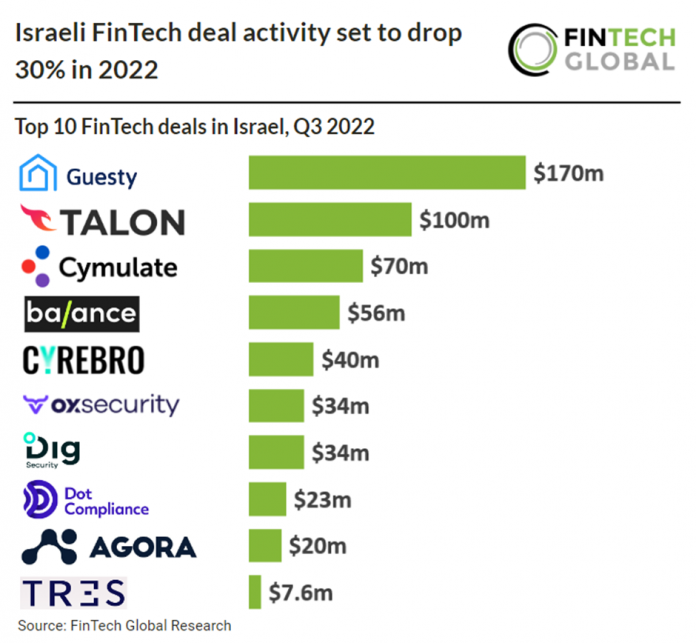

• Israeli FinTech companies raised $585m in Q3 2022 across 22 deals, which puts total investment in the country on track to reach $3bn in 2022, a 15% drop from 2021 levels. Average deal size has increased 24% from the previous quarter to $26m. CyberTech continues to be Israel’s most innovative FinTech subsector accounting for eight deals, a 36% share of total deals.

• Guesty, a property management platform, was the largest FinTech deal in Israel during Q3 2022 raising $170m in their latest Series E funding round led by Apax Digital, MSD Partners and Sixth Street Partners. The funds will be used to expand the company’s presence internationally. It is currently active in the US and Canadian markets and plans to bolster its business in the UK followed by mainland Europe. Chief executive Amiad Soto said the round is a vote of confidence in travel and short-term rentals in an “exceptionally challenging fundraising climate”.

Israeli FinTech deal activity set to drop 30% in 2022

Investors

The following investor(s) were tagged in this article.