Key Indian FinTech investment stats in Q2 2023:

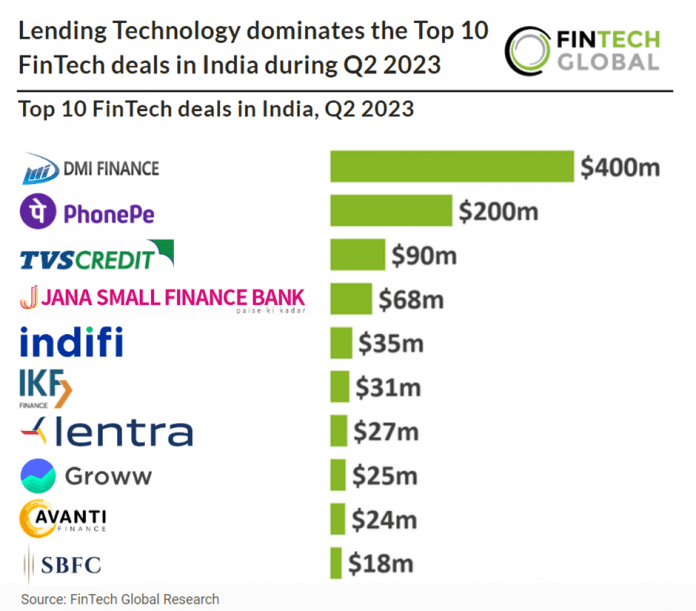

• Lending Technology accounted for nine out of the top ten FinTech deals in India during Q2 2023

• Indian FinTech deal activity reached 75 deals in Q2 2023, a 33% drop from Q2 2022

• Indian FinTech companies raised a combined investment of $1bn in Q2 2023, 44% drop YoY

Indian FinTech saw a continued drop in investment and deal activity in Q2 2023. In Q2 2023, there was a 33% decrease in Indian FinTech deal activity compared to Q2 2022, with a total of 75 transactions recorded. In the quarter, Indian FinTech companies secured a total combined investment of $1bn, indicating a year-over-year decrease of 44%.

DMI Finance, a digital lender, had the largest FinTech deal in India during Q2 2023, raising $400m in their latest private equity funding round, led by MUFG Bank. DMI Finance will use the new funds to continue expanding existing businesses. In an interview with FE, Shivashish Chatterjee, co-founder and co-managing director of DMI Finance, said “We have been one of the country’s most active digital finance companies for the past few years, and we intend to continue to expand our business at a similar pace. The products we are involved in are consumer loans, personal loans, and MSME credit (micro, SMEs). We hope to use the money to expand each product,” he said. “Going forward, we think MSME will be an area of greater focus for us than in the past. We used to be primarily a consumer finance company, but we will have a meaningful MSME finance book,” Chatterjee added.

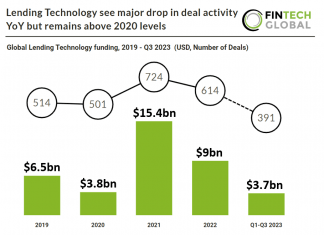

Lending Technology companies completed nine out of the top ten FinTech deals in India during Q2 2023. Overall Lending Technology was also the most active FinTech subsector in Q2 2023 with 24 deals, a 32% share of all funding rounds. Digital lending in India grew exponentially from $9bn in 2012 to nearly $150bn in 2020. It is expected that the digital lending market will reach a value of around $350bn by 2023 according to Statista.

In the 2023-2024 financial budget, the Indian Government allocated INR 1,500 crores for FinTech and banks. Earlier, they had announced an incentive of INR 2,600 crore to promote Unified Payments Interface transactions (UPI) for FinTech startups and banks. Additionally, measures were introduced to encourage investments in tech, FinTech, and startups in India, along with tax-related relaxations such as extending timelines for funds relocation to IFSC GIFT City until March 31, 2025. Furthermore, the IFSCA introduced an incentive scheme to facilitate market access for domestic and foreign FinTechs to IFSCs in India and overseas markets.