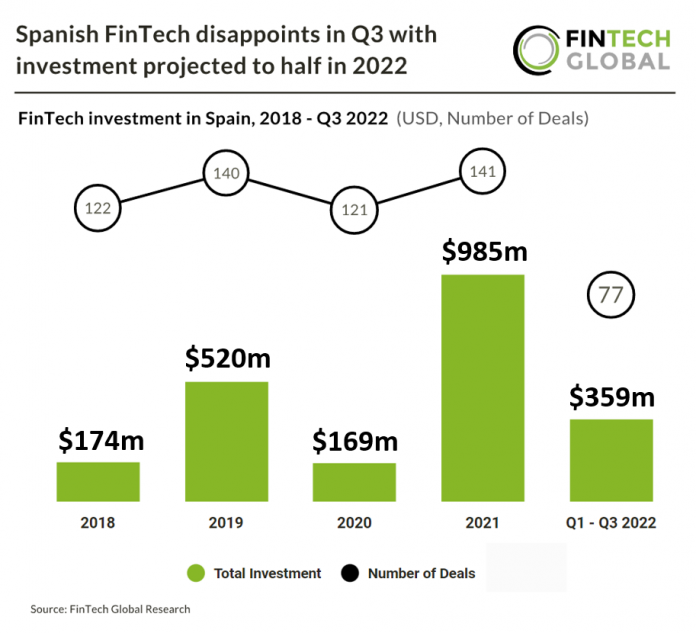

• Spanish FinTech investment reached $52m in Q3 2022, a 26% decrease from the previous quarter and this was also Spain’s lowest quarter for FinTech investment since 2020. FinTech investment in the country is on track to reach $479m for 2022, a 51% decrease from 2021 levels.

• Deal activity has also slightly faltered in Q3 2022 with 19 funding rounds announced, a 14% decrease from Q2 2022. Overall deal activity is expected to reach 103 deals in total based on investment activity in the first nine months, a 27% drop from last year.

• bit2me, a crypto currency exchange, was the largest FinTech deal in Spain during Q3 2022 raising $29.4m in their latest corporate funding round led by Telefonica. The funds will give the exchange support to keep operating during this cryptocurrency market downturn, in which other exchanges have been forced to lay off staff and take operating cost-cutting measures. Telefonica, Spain’s largest telecoms company will now start accepting cryptocurrency payments of up to $490 for tech hardware and phones as a way of measuring the interest of the public in this payment alternative.

• Currently Crowdfunding and Blockchain & Crypto are the only FinTech subsectors being actively scrutinised by Spain. Crowdfunding platforms in Spain currently need authorisation from the Spanish National Securities Market Commission (CNMV) to operate, this is to comply with EU regulation passed in 2020. It was expected that this move from the CNMV was temporary, expecting to end on 10th November 2022 although no new information has been stated about this. Blockchain & Crypto companies cannot currently release an authorised initial coin offering (ICO) in Spain. The CNMV has affirmed that it has not authorised any entity to operate an initial coin offering (ICO) with the agency’s official sanction.

Spanish FinTech disappoints in Q3 with investment projected to half in 2022

Investors

The following investor(s) were tagged in this article.