Quona Capital, an emerging markets venture capital firm, has closed its Fund III at $332m, which it plans to use to fund financial inclusion in emerging markets in Latin America, India, Southeast Asia, Africa and MENA.

The final close at $332m exceeds the initial $250m target.

This is the third fund from Quona Capital since its inception, bringing the firm’s aggregate committed capital to over $745m.

Quona Capital was established as an independent venture capital firm in 2015 by co-founding managing partners Monica Brand Engel, Jonathan Whittle, and Ganesh Rengaswamy.

Quona focuses its investments on innovative technology companies that are expanding access to financial services for underserved consumers and businesses in Latin America, India, Southeast Asia, Africa and MENA.

The Fund III investors include an array of leading global asset managers, insurance companies, investment and commercial banks, university endowments, foundations, family offices and development finance institutions.

The majority of Fund III investors returned from prior Quona funds, joined by more than 20 new relationships.

Monica Brand Engel, who leads Quona’s investments in Africa and MENA, said, “Since our earliest days, Quona has been dedicated to expanding the frontiers of financial inclusion—investing with conviction in markets and technology-enabled models improving access and quality of financial services for the masses.

“Our prior fund performance, robust pipeline of inclusive fintechs, and growing LP interest in our offerings are ringing endorsements of our view on the prospects of impact-oriented venture investing in emerging markets.”

Jonathan Whittle, who leads Quona’s investments in Latin America, added, “Financial services in emerging markets are being transformed by the power of technology, and Quona’s portfolio companies have been at the front lines of that transformation.lThe pace of innovation in Latin America is accelerating due to a combination of regulatory reform, a maturing venture capital ecosystem, and a wave of founders who cut their teeth with the first generation of successful technology companies in the region.”

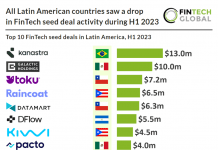

FinTech Global Research recently revealed that Latin American companies announced 17 FinTech seed deals in Q3 2022, a 32% decrease from the previous quarter.

Copyright © 2022 FinTech Global