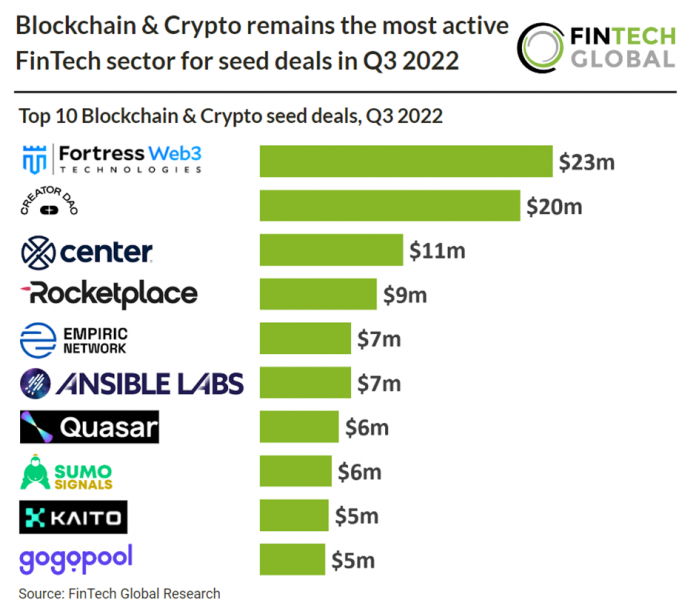

• Blockchain & Crypto was the most active FinTech subsector for seed deals in Q3 2022 with 73 deals in total, a 22% share of total seed deals this quarter. The WealthTech sector was the second most active seed deal sector with a 15% share.

• The United States dominated Blockchain & Crypto seed deal activity in Q3 2022 with a 54% share of total deals this quarter. The Financial Stability Oversight Council (FSOC), a US regulatory panel comprising top financial regulators, recommended in early October 2022 that Congress pass legislation addressing risks digital assets pose to the financial system, including bills to bolster oversight of crypto spot markets and stablecoins. The FSOC has previously pushed Congress to pass legislation although this recommendation may have more backing. In September, the Biden administration published a series of reports recommending that US government agencies double down on digital asset sector enforcement and identify holes in regulation.

• Fortress Web3 Technologies, a financial, regulatory, & technology infrastructure provider, was the largest Blockchain & Crypto seed deal in Q3 2022 raising $23m in their seed round led by Ayon Capital. The US based company says the funding will enable Fortress to continue to write software, begin to extend its regulatory services globally, and build the sales and operational teams to support a wide variety of B2B customers across numerous industries.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global