• FinTech deal activity in the UAE reached 15 deals in total, no change from the previous quarter although this was a significant 45% drop from Q1 2022. FinTech Deal activity is projected to reach 76 deals in the UAE for 2022, a 24% drop from the previous year although this is inline with global trends.

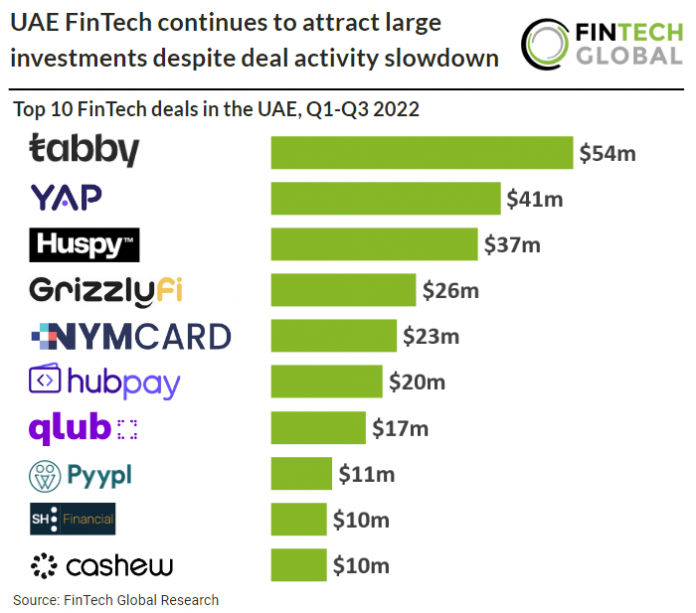

• Tabby, a buy now pay later service, was the largest FinTech deal in the UAE during Q1-Q3 2022 raising $54m in their latest Series B funding round led by Sequoia Capital India and STV. Tabby will use the funding to expand into markets where the company see direct overlap either from a consumer or a merchant perspective. The Tabby app is downloaded 3,000 times every day and has over 400,000 active users as of March 2022. “While BNPL is still in its relative infancy in the GCC (Gulf Cooperation Council), the sector has witnessed one of the fastest rates of consumer adoption globally, with 24% of consumers in the region reporting having used the option in 2021,” Tabby said in a statement. “This fundraising clearly illustrates the growth prospects for the payment method in the region.”

• Financial services in the UAE are regulated either by the UAE Central Bank, DFSA or the SCA depending on the nature of the activity. The most recent regulatory update involves the Blockchain & Crypto sector. The DFSA has announced plans to draw up a regulatory framework for cryptocurrency sector. Although details of any such plan remain unclear. The regulations are rumoured to come into effect some time in early 2023, and will apply to digital assets and cryptocurrencies. In a statement, the DFSA said that it will be creating “a regulatory regime for digital assets.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global