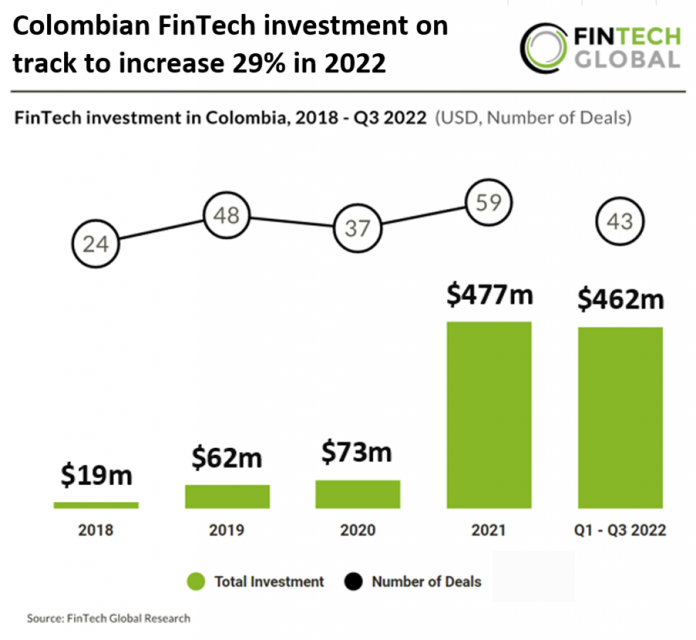

- Colombian FinTech investment is on track to reach $616m in 2022 based on investment in the first three quarters of 2022, a new record for the country. Deal activity is expected to reach similar levels in 2022 compared to the previous year with a slight 3% decrease.

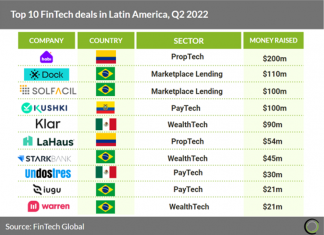

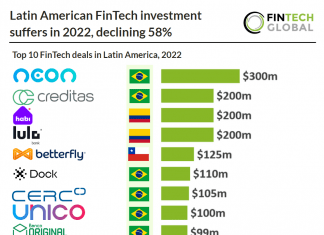

- Habi, a platform for buying and selling property, was the largest FinTech deal in Colombia for Q1-Q3 2022 raising an impressive $200m in its latest Series C funding round led by Homebrew and SoftBank Latin America Funds. The funding round has propelled the company to unicorn status and Habi will use the investment to continue to expand into other major cities across the region and increase its offering, with a focus on embedded financial services. Habi is active in more than 15 cities in Mexico and Colombia and posted over a 20-fold growth in revenue for 2021.Colombia had the highest FinTech adoption rate in Latin America, with 76% of its population using FinTech services in 2019.

- The country also had the first regulatory “sandbox” in Latin America, a two-year arrangement that allows start-ups in the financial sector to experiment with business models without meeting all the requirements of a traditional financial services license, as long as they are under a regulator’s supervision. Decree 1234 of 2020 introduced a major announcement as the sandbox will also allow testing cryptocurrency operations in a controlled environment.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global