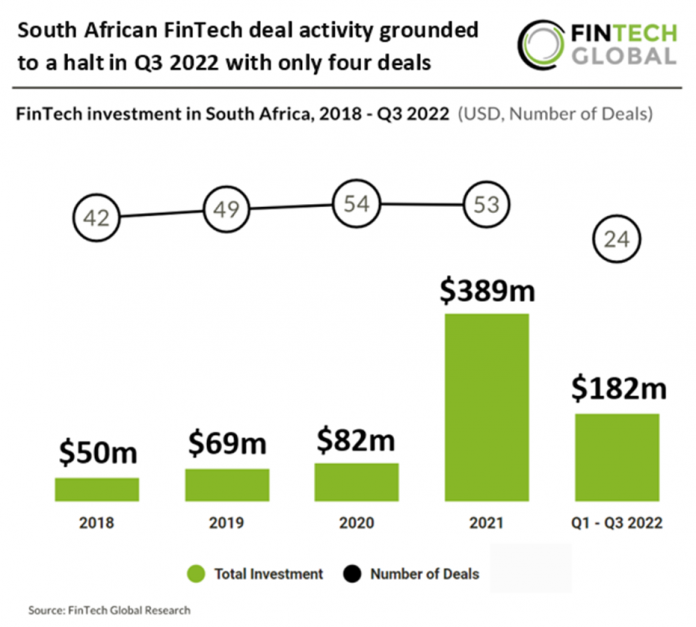

- South African deal activity reached four deals in total during the third quarter of 2022, a 55% reduction from Q2 2022. Overall deal activity from Q1-Q3 2022 reached 24 deals in total which puts deal activity on track to reach 32 deals in 2022, a 40% drop from the previous year.

- MFS Africa, a digital payment platform, was the largest FinTech deal from Q1-Q3 2022 in South Africa raising $100m which extends their latest Series C funding round led by Admaius Capital Partners. The fresh capital will be used to help MFS Africa boost its expansion across Africa and into Asia through its team up with LUN Partners to enable cross-border digital payments between Africa and China. The new funds will also go towards integrating into the global digital payment ecosystem and furthering its growth plans for the BAXI network of merchants and agents in Nigeria and beyond, according to the company.

- PayTech was the most active FinTech sector in South Africa during the first three quarters of 2022 accounting for six deals, a 25% share of total deals. WealthTech was second with five deals and Blockchain & Crypto was third with three deals. The digital payments market is projected to reach $14.3bn in 2022, a 13% increase from the previous year.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global