- Last year investments poured into the tech markets driven by the increased demands from the pandemic and the FinTech sector benefitted greatly. Out of the 457 new unicorns recorded last year, a third were FinTech businesses.

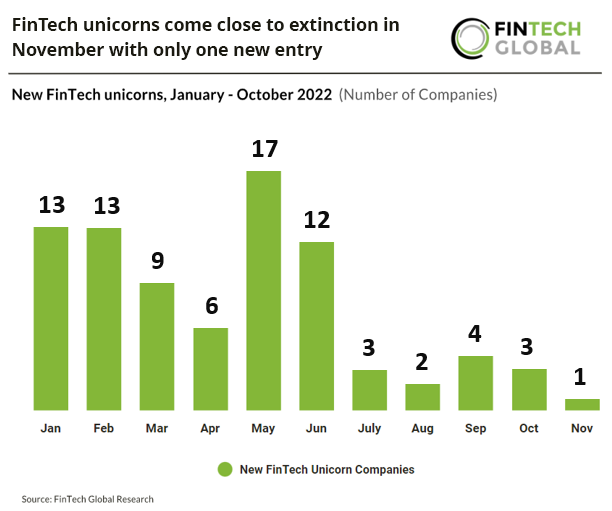

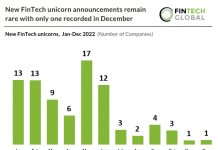

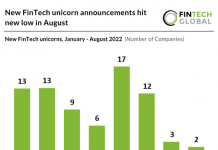

- However, this year with the increased talks of a recession looming and collapse in public market valuations, the number of new unicorns has fallen off a cliff. Nothing illustrates this better than the recent FTX collapse given the company was the highest valued new unicorn in the FinTech sector in 2022. Those trends have spooked investors and as a result new unicorns births have collapsed in the second half with just one being recorded in November.

- BeZero, a provider of carbon credit scoring, risk assessments and analysis, was the only FinTech company to enter the unicorn club last month. The company raised $50m in a Series B transaction led by US investment firm Quantum Energy Partners. BeZero Carbon’s freely-available carbon credit methodology allows investors and end-buyers of carbon credits to probe the efficiency of a specific offset on the market before closing on any eventual deal. The London-headquartered startup cites estimates showing carbon permit trading will reach $50 billion of value by 2030.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global