Australia-based Grapple, which offers working capital loans to SMEs, has reportedly collected $35m in a warehouse debt facility from Sydney-based financier Global Credit Investments (GCI).

With the funds, Grapple hopes to scale and maintain its growth trajectory, according to a report from FinTech Futures. Funds will also help the Fintech company to meet their surging demand for its solution.

Founded in 2018, Grapple allows suppliers to be paid in full instantly, with Grapple paying the invoice on the customer’s behalf. The customer then pays Grapple back over four instalments.

Speaking on the funding, Grapple founder and CEO Dawson said, “The current conditions, with falling property prices and rising interest rates, are making it harder for SMEs to secure business funding from banks and large financiers.

“Invoice financing is an increasingly attractive option to businesses looking to improve cashflow, increase working capital and accelerate their growth. We expect the influx of new customers to continue over the next 18 months.”

Late last year, fellow Australian FinTech company Wagepay bagged $10m in funding to support the expansion of its capabilities. The company offers employees real-time access to a portion of their earned wages.

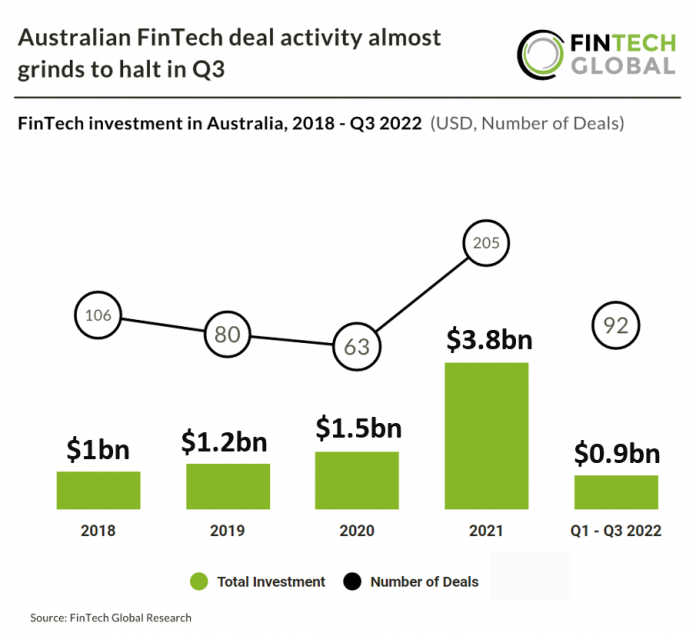

FinTech funding in Australia significantly slowed down in Q3 2022, with just 18 deals completed. This represented a 25% drop-in deal activity on the previous quarter.

The whole of the year experienced a slump in funding, according to data by FinTech Global. In the first three quarters of the year, $900m was invested through 92 deals, compared to the full 12 months of 2021 which saw $3.8bn invested.

Copyright © 2023 FinTech Global