Australian payments company Till Payments has reportedly laid off 120 employees, whilst adding three new board members.

The redundancies were made across its operations in Australia, New Zealand, the UK and North America, according to a report from the Australian Financial Review. The PayTech blamed inflationary pressures and a shrinking global economy.

This redundancy represents a 40% cut in the company’s workforce and will be felt across all business functions.

Despite the trouble, the company is still looking to launch on the Nasdaq in the future.

Speaking on the announcement, Till Payments co-founder and CEO Shadi Haddad said, “Despite our significant successes, we aren’t immune to the headwinds of the global inflationary pressure and economic contraction.

“Unfortunately, in this instance, we have needed to take decisive action to mitigate these headwinds and align our strategy to a more sustainable growth model for the longevity and success of our business.”

Australian Financial Review claims Till Payments is currently in the process of raising $70m in funding.

The Australian payments company previously raised $110m in its Series C funding round.

Till Payments allows small, medium and large businesses to access various payment methods. It supports both online payments and in-person payments with point-of-sale terminals, payment links and self-service payment tools.

Fellow Australian FinTech company Grapple, recently netted $35m in a warehouse debt facility from Sydney-based financier Global Credit Investments. The funds will help the company to maintain its growth and meet rising demand.

Grapple allows suppliers to be paid in full instantly, with Grapple paying the invoice on the customer’s behalf. The customer then pays Grapple back over four instalments.

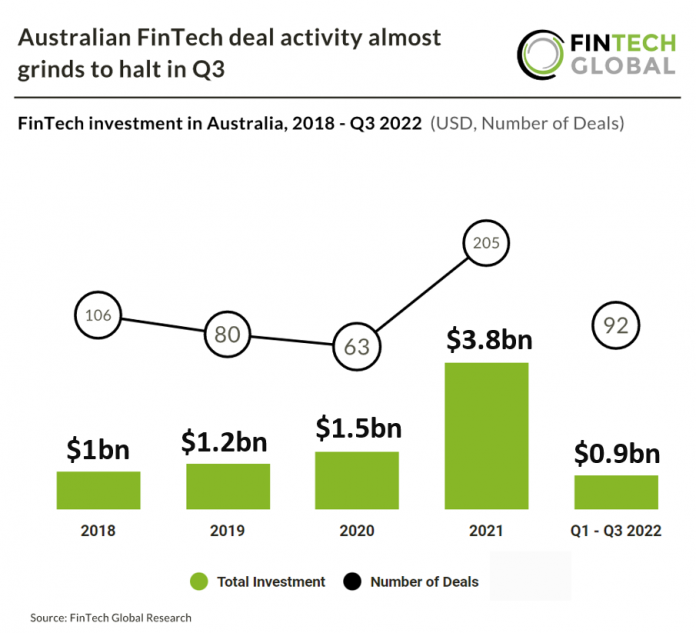

FinTech investment slumped in 2022, according to data from FinTech Global. In the first three quarters of the year just $900m was invested, significantly down from 2021 when $3.8bn was deployed.

Copyright © 2023 FinTech Global