Key European PropTech Seed Investment Stats in 2022:

• A total of 70 European PropTech seed deals were announced in 2022

• The PropTech sector accounted for 11.8% of all European FinTech seed deals in 2022

• The UK was the most active country with 18 PropTech seed deals

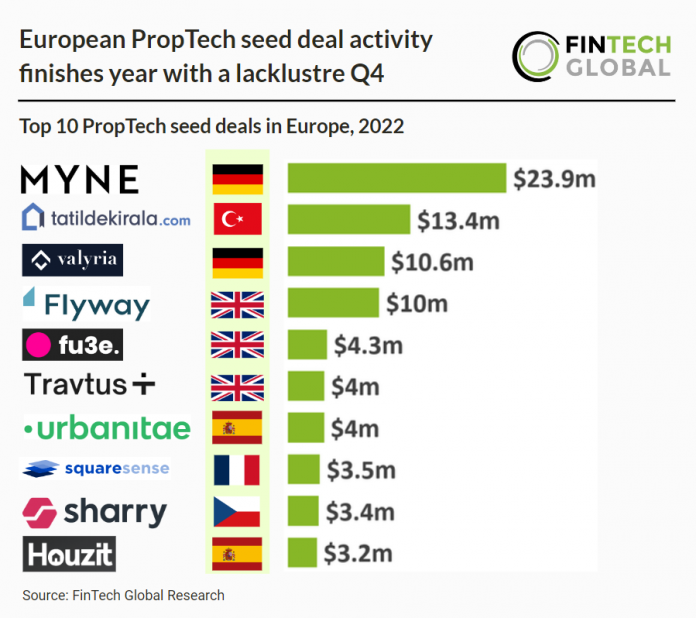

European PropTech seed deal activity slowed down considerably in Q4 2022 reaching 13 deals in total, a 40% drop from Q1 levels. Even with a weak Q4 the sector saw a sizeable chunk of European seed deal activity in 2022. The PropTech sector accounted for a 11.8% share of all FinTech seed deals in Europe which was 0.8% higher than the Lending Technology sector for comparison.

MYNE, a digital co-ownership platform for vacation properties, was the largest PropTech seed deal in 2022. The company raised $23.9m in their Seed funding round from 11 investors including TruVenturo, Rivus Capital and embedded/capital. The company intends to use the funds to open up the platform to users across Europe, further develop the business including the European expansion of its technology and financing platform, as well as growing property offering to Italy and France.

The UK was the most active PropTech seed country with 18 deals announced in 2022, a 26% share of total deals. Germany was the second most active with 15 deals announced and joint third were Spain and France with five deals each.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global