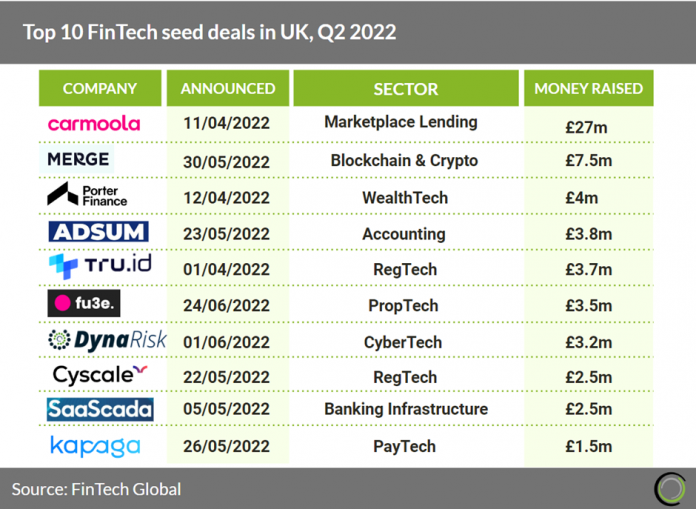

· Carmoola, a flexible car financing provider, was the largest FinTech seed deal during the second quarter if the year, raising a sizeable £27m in their seed round from Jaguar Land Rover’s investment fund, InMotion Ventures, VentureFriends, BCI, Truesight Ventures and California-based Clocktower Ventures. The investment will be used to develop the product and launch the initial stages of the business.

· Seed deal activity in the UK for 2022 reports a very low second quarter with 24 deals in total, a 49% drop for Q1 2022 levels but more worryingly this is an 89% drop from Q4 2021 which had 224 seed deals in total. Reasons for this could be that Interest rates have risen to 1.25% but this is only a 0.1% rise from December 2021 and is unlikely to be the culprit. More likely causes are a possible recession in the short term for the UK where start-ups struggle to keep afloat due to cost-cutting and a lower risk appetite from investors.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global