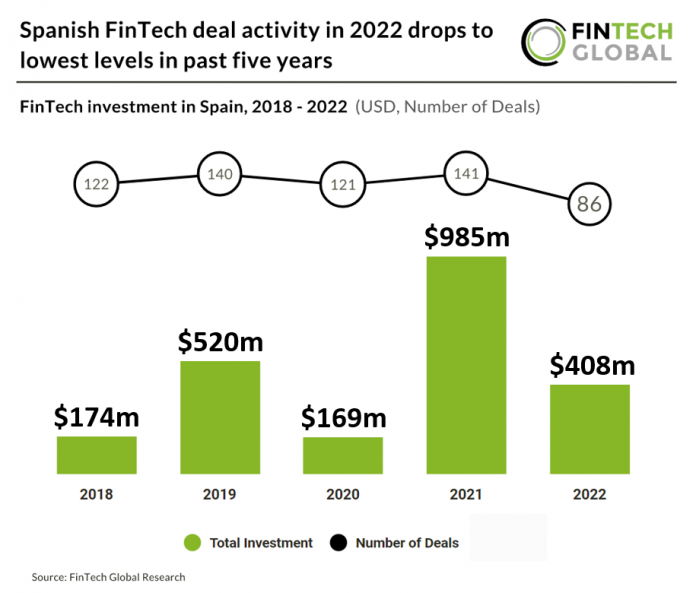

Key Spanish FinTech investment statistics in 2022:

• FinTech deal activity reached 86 transactions in 2022, a 39% decline from 2021’s levels

• FinTech capital invested fell by 59% in 2022 reaching $408m in total

• Spanish FinTech companies only raised $49.4m in Q4 2022

Spanish FinTech recorded its worse year for deal activity in 2022 announcing only 86 deals in total, a 39% reduction from 2021 levels. FinTech Investment also suffered with a 59% drop in 2022. Q4 2022 was the lowest quarter for activity and investment. Only $49.4m was raised by nine Spanish FinTech companies during the quarter. This is going against Industry trends which saw a slight uptick in activity during the fourth quarter of 2022.

IriusRisk, an automated threat modelling platform, was the largest FinTech deal in Spain during Q4 2022, raising $28.7m in their latest Series B funding round. The round saw existing investors Paladin Capital Group lead the round. IriusRisk said the new funding would be used to support R&D, grow its community platform, and support continued hiring. The firm said it more than quadrupled its partner base across 2021 and grew its users of its free community edition version of the platform by 120%, with over 4,000 projects running through the platform over the last year.

The most recent FinTech regulation changes in Spain targets crowdfunding platforms and crypto publicity. As of November 2022 crowdfunding platforms must follow the EU’s regulation on European Crowdfunding Service Providers. Crowd Funding platforms have 24 months to update their current practises from Spain’s current domestic regulation. Spain also established rules regulating publicity of crypto assets in January 2022. These rules require providers of crypto asset services and certain other legal and natural persons, among other obligations, to inform the National Securities Market Commission (CNMV) of crypto asset publicity campaigns that target more than 100,000 investors 10 days in advance and to include risk warning disclaimers.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global