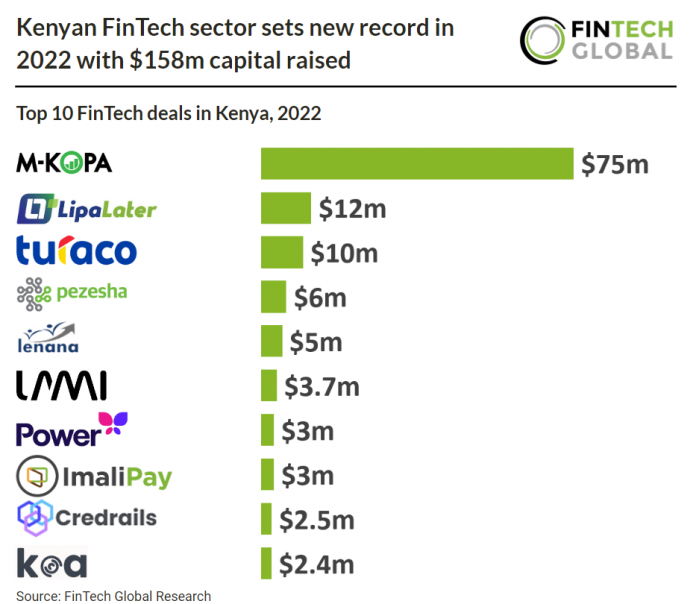

Key Kenyan FinTech investment stats in 2022:

• FinTech deal activity in Kenya reached 48 deals in total during 2022, a 14% increase from 2021 levels

• FinTech investment in the country set a new record in 2022 with companies raising $158m, a more than three-fold increase from 2021

• Nairobi accounted for 87% of FinTech deals in Kenya during 2022 with 41 in total

Kenya had a great 2022 with both investment and deal activity setting a new record for the country. Kenyan FinTech investment saw a more than three-fold increase to $158m and deal activity reached 48 deals in total, a 14% increase from the previous year. M-Kopa, a connected asset financing platform, accounted for 47.4% of FinTech investment in 2022 and when removing this deal, FinTech investment still saw an 80% increase from 2021.

M-Kopa, a connected asset financing platform, was the largest Kenyan FinTech deal in 2022 raising $75m in their latest Venture funding round, led by Broadscale and Generation Investment Management. The fresh capital will allow it to serve two new West African markets, Ghana and Nigeria, with financing for the purchase of smartphones. Since launching in Nigeria, M-KOPA has acquired over 50,000 customers, its executives said. For Ghana, its newest market, they say it “has grown two times as fast as any of its previous markets.”

Nairobi, the country’s capital, was the most active FinTech city in Kenya with 42 deals announced, an 87% share of total deals announced this year. The only two other areas with FinTech deal activity were Westlands with four deals and Mombasa with two deals.

The ‘Regulatory Sandbox Policy Guidance Note’ was approved by the Capital Markets Authority (CMA) in March 2019, and the first call for applications to the sandbox was opened. The CMA collaborated with the technology and finance sectors for over a year to design and develop the sandbox. Unlike other regulatory sandboxes that only admit firms in annual cohorts, the Kenyan CMA accepts applications throughout the year to keep up with new fintech innovations. Applications from firms incorporated in Kenya or those licensed by regulatory partners in the Global Financial Innovation Network, a group of international regulators and central banks, offering products and services in Kenya are accepted by the CMA.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global