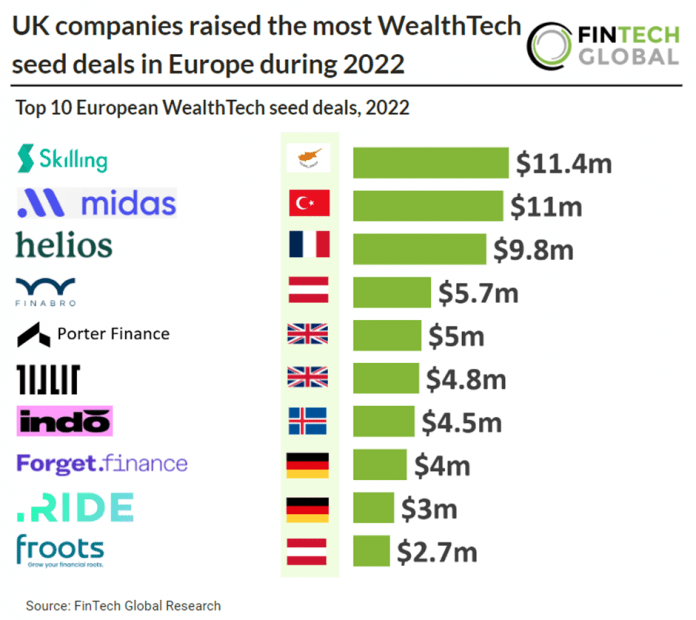

Key European WealthTech seed investment stats in 2022:

• Overall, there were 64 European WealthTech seed deals in 2022, an 11% share of total European seed deals in 2022

• The UK was the most active WealthTech country with 18 seed deals, a 28% share of European WealthTech seed transactions in 2022

• The average European WealthTech seed deal size in 2022 was $2.3m

European early stage WealthTech investment saw an active year in 2022 with 64 seed deals raised, accounting for 11% of total seed deals in the region. This activity can be mainly accredited to the UK which accounted for 28% of European WealthTech seed deals in 2022. France was the second most active WealthTech seed country in Europe with a 12.5% share of deals and Turkey was third with a 9.4% share.

Skilling, an online trading and investment platform, was the largest European WealthTech seed deal in 2022, raising $11.4m. The company will deploy its fresh capital to accelerate the recruiting of top talent and further advance its proprietary trading tech to remain adaptive in the ever-changing world of investing and online trading. Skilling had an eventful year with the launch of various products and services, including its introducing broker and affiliate program with a custom partnership portal that provides additional functionality and transparency for partners. Additionally, the Skilling Copy platform was launched, allowing customers to copy or track thousands of trading strategies offered by other traders. This has resulted in a capital raise for the company.

WealthTech investment appetite is also driven by a rise in neobanks in Europe. European and UK neobanks have increased their Android users by 11% whilst legacy banking apps were down by 1.5% in 2022 from the previous year.

There was a global slowdown in retail investing and trading compared to 2021 with a 5.5% decrease to 1.5m retail investors having bought or sold shares in 2022. There were 42.2m transactions carried out by retail investors in EU equities over the year, down 24% on the previous year.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global