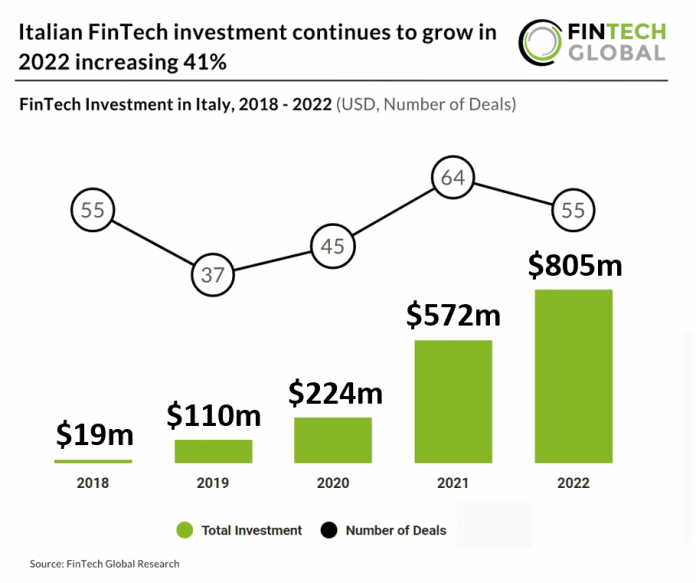

Italian FinTech investment stats in 2022:

• Italian FinTech funding reached $805m in 2022, increasing 41% from previous year.

• Italian FinTech deal activity decreased 14% last year

• Large FinTech deals over $100m accounted for 77.6% of total capital invested in 2022

Italian FinTech investment has seen its fifth consecutive year of funding raised by Italian companies rising with 2022, setting a new record at $805m. FinTech funding in the country has increased at a CAGR of 122% from 2018 – 2022. FinTech deal activity in Italy saw a 14% drop in 2022 from the previous year although this is in line with global trends and similar countries such as France which saw a 14% drop in 2022.

Satispay, a bank account enabled mobile payment platform, was the largest Italian FinTech deal in 2022, raising $310m in their latest Series D funding round led by Addition. The latest funding makes Satispay Italy’s second unicorn as their valuation exceeds €1bn valuation. Alberto Dalmasso, co-founder and CEO of Satispay, wants to create what he says will be the next leading payment network in Europe and the funds will allow this to happen. He also said “Not only do we believe we have the necessary capital, but we also have the experience and expertise. In the last two years, we have experienced exceptional growth, more than doubling our customer base and launching in three new markets,”.

The success of Italian FinTech investment in 2022 can be attributed to three deals which in aggregate raised $625m and accounted for 77.6% of investment in the country. These deals were previously mentioned Satispay ($310m), Scalapay ($213m), a buy now pay later service, and Casavo ($102m), a digital residential platform for buying and selling homes. Italy has a very cash orientated economy and the payments companies mentioned have disrupted this by offering digital payment methods. Cash made up 27% of all in-store payments in Italy during 2021 down from 60% in 2019.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global