Idolised by visionaries, dismissed by sceptics, artificial intelligence (AI) undeniably has the potential to transform entire industry ecosystems, according to InsurTech Tractable.

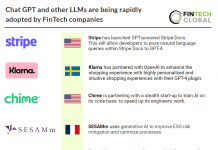

The scale of AI advancement is unlike anything seen before, with companies like OpenAI releasing ChatGPT, then GPT-4, quickly followed by the AI language models from Google, Bard, and Microsoft, Bing.

This AI explosion unfolded in just a matter of weeks and tech leaders across the globe leaped into the game, questioning both how their businesses should be leveraging the tech, and what risks it presents as it continues to advance.

This happened against a backdrop of a rocky start to the year, with skyrocketing inflation, labour shortages mixed with workplace layoffs, an escalating war in Ukraine and subsequent continued supply chain disruptions.

Business leaders who had hoped to be bouncing back from the disruptions caused by the Covid-19 pandemic were instead presented with complex and unforeseen challenged that put a strain on their bottom lines. This forced them to rethink their fundamental processes and operating standards. As such, advancements in technologies such as AI have been greater in an effort to navigate these challenges.

Industries from banking to healthcare, auto insurance to art, have begun to use AI in real life situations. It is already bringing real value, enabling businesses in these sectors to work more effectively, make decisions more quickly and optimise entire processes.

Tractable has been focussed on applied AI since day one, aiming to transform the speed and ease in which people recover from accidents and natural disasters. Tractable’s AI leverages deep learning for computer vision, as well as other machine learning techniques to make accurate decisions. The technology is also able to make recommended repair operations and guides the claims management process.

According to Tractable, widespread adoption of AI has the potential to transform entire industry ecosystems.

In its first edition of a whitepaper series, Tractable explored the impact AI is having on the planet within the insurance, property and automotive ecosystems.

The company dived into the impact the technology is bringing, including making the end-to-end P&C claims cycle 10x faster with automation, helping home insurers navigate rising costs and volume of claims due to increasing frequency of natural disasters and salvaging reusable auto parts from scrap vehicles to benefit the entire automotive ecosystem– among many more real world examples. Read the full whitepaper here.

Earlier this year, Tractable partnered with global data and analytics provider Verisk to offer AI-powered estimates for property damage.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global