Key European InsurTech investment stats in Q3 2023

• European InsurTech deal activity hit 21 transactions during Q3 2023, a 23% increase from Q2 2023, the third consecutive rise in deal activity QoQ

• European InsurTech companies raised a combined $180m in Q3 2023, a 69% drop from Q3 2022

• The UK was home to the highest number of InsurTech deal on the continent in Q3 with seven deals, a 33% share of all investments.

European InsurTech investment and deal activity continue to report disappointing results in 2023 compared to previous years but deal activity has risen for the third consecutive quarter marking a possible turnaround for the sector. In the third quarter of 2023, there were a total of 21 European InsurTech deals, marking a 23% uptick compared to the second quarter of 2023. European InsurTech deals in Q3 2023 dropped 61% YoY. In the third quarter of 2023, European InsurTech firms secured a combined total funding of $180m, reflecting a significant 69% decline when compared to the same period in 2022.

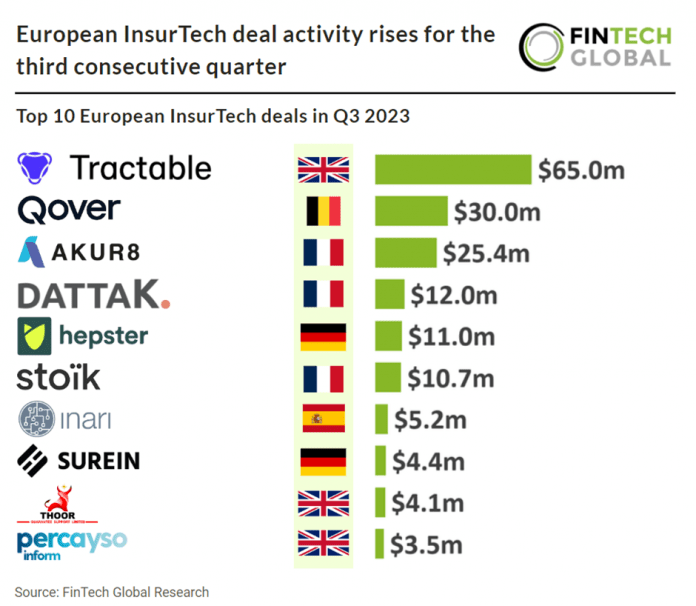

Tractable, an artificial intelligence developer for accident and disaster recovery, had the largest European InsurTech deal in Q3 2023, after raising $65m in their latest Series E funding round, led by SoftBank Vision Fund. The company intends to use the funds to accelerate its expansion across the auto and property ecosystems to apply AI to cars and homes that need to be repaired, protected, recycled or sold. Today’s investment represents the latest milestone in Tractable’s growth journey. The company recently brought on Venkat Sathyamurthy as Chief Product Officer (formerly head of platform at Adobe), Mohan Mahadevan as Chief Science Officer (formerly computer vision lead at Amazon) and Andrew Shimek as President to oversee global operations and sales. Tractable will use the new funds to accelerate its research and development capabilities, creating new features that power the end-user experience to provide instant, comprehensive and integrated vehicle assessments.

The UK was the most active InsurTech country in Europe during Q3 2023, with seven deals, a 33.3% share of total deals. This was closely followed by France with five deals, a 23.8% share of deals and Germany was the third most active InsurTech country with four deals.

The latest InsurTech regulatory update came from the UK with repeal and replacement of The Retained EU Law (REUL) by the UK’s treasury. There is a significant amount of REUL, and the repeal and replacement work will have a direct impact on UK operations. This includes the Insurance Distribution Directive (IDD). The latest step was a FCA Consultation Paper in September 2023. The IDD was designed to establish standards and transparency measures for insurance distributors, ensuring fair treatment and clear information for consumers when purchasing insurance. It covered aspects like business conduct standards and transparency requirements, such as providing comprehensive information to consumers. Efforts were underway to replace certain regulations related to the IDD, in collaboration with the Treasury, for regulatory consistency.