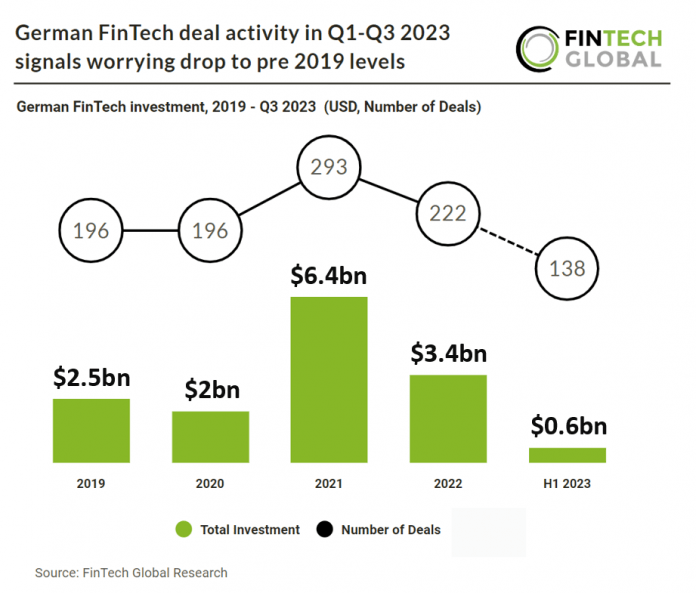

Key German FinTech investment stats in Q1-Q3 2023

• German FinTech companies raised a combined $634m from in the first nine months of 2023, a 75% drop YoY

• German FinTech deal activity reached 138 transactions in the first three quarters, an 18% drop from Q1-Q3 2022

• InsurTech and PropTech were the joint most active FinTech sectors in Germany during Q3 2023

Germany’s FinTech sector like many other countries has seen a major drop in investment during 2023 although their deal activity has fared better compared to others. German FinTech firms secured a total of $634m in funding during the first three quarters of 2023, marking a significant 75% year-on-year decrease. The German FinTech deal landscape witnessed 138 transactions in the first three quarters of 2023, reflecting an 18% decline compared to the same period in 2022. German FinTech deal activity in Q3 2023 reached 41 deals, 25% drop from Q3 2022. This is much better compared to Europe’s 56% drop over the same period.

Solarisbank, a banking-as-a-service platform, had the largest German FinTech deal in Q3 2023, with their latest Seies F funding round raising $41.6m (€38m) from Lakestar, Samsung Catalyst Fund and BBVA. The company will use the funds in order to strengthen and improve its governance and compliance, as well as to start its process of development. The company’s strategic objective is to incorporate Contis in the near future, with the aim of advancing and expanding its technology and range of services. Additionally, Solaris intends to streamline its operations further, concentrating on aligning its products with the requirements, preferences, and expectations of its customers. s of today, the company offers an extensive range of approximately 400 distinct APIs spanning various categories such as banking and card services, payments, lending, ID verification, and digital currencies. It’s worth noting that in 2021, this number stood at 180 APIs, indicating significant growth in the company’s API offerings.

InsurTech and PropTech were the joint most active FinTech sectors in Germany during Q3 2023 with six deals each, a 14.6% share of total deals. Data & Analytics and RegTech were the joint second most active FinTech subsectors with five deals each, a 12.2% share of deals.