Of the $1.5bn that was raised across this week’s 26 FinTech funding deals, marketplace lending accounted for 6 of them and $1bn.

While there were also six deals within the PayTech sector, not nearly as much was raised across these deals. Between them, Brite Payments, Peach Payments, Stitch, Rainforest, Perk Labs and MoneyHash, raised a total of $127m.

In terms of other sectors represented in this week’s deals, there were five infrastructure and enterprise software companies to close funding. Cardata and Stampli were the two biggest, raising $100m and $61m, respectively. The other three deals, which were raised by Loop, Pivot and Debtist, pulled in a combined $45m.

There were four WealthTech deals this week (OneChronos, Farther, Frec and Vyzer) and three CyberTech deals (Nexusflow, Evo Security and Mitiga). The last two deals were RegTech startup Saidot and data & analytics company Revio.

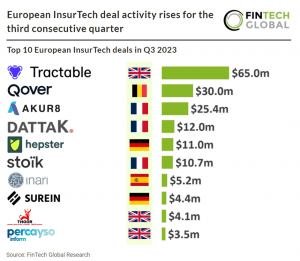

While there weren’t any InsurTech deals recorded this week, the sector has had a very strong year. A report published by FinTech Global this week found that European InsurTech deal activity hit 21 transactions during Q3 2023, a 23% increase from Q2 2023, the third consecutive rise in deal activity QoQ. While deal activity is showing positive signs, like most sectors, 2023 has proved to be slower than previous years. In fact, European InsurTech companies raised a combined $180m in Q3 2023, a 69% drop from Q3 2022.

As is the case with most weeks, the US accounted for the majority of the FinTech deals. The country housed 16 of the deals and accounted for $1bn of the invested capital. The US companies are: Octane, Lendbuzz, Cardata, Stampli, OneChronos, Loop, Farther, Kafene, Frec, Rainforest, Nexusflow, Vyzer, Revio, Evo Security, Mitiga and MoneyHash.

There was a big gap between the US and the next most active company, with Canada and South Africa both tying on two deals each. The Canadian deals were Clearco and Perk Labs, while the South African FinTechs were Peach Payments and Stitch.

The remaining deals were from companies based in Finland (Saidot), France (Pivot), Germany (Debtist), India (DPDzero), Indonesia (Investree) and Sweden (Brite Payments).

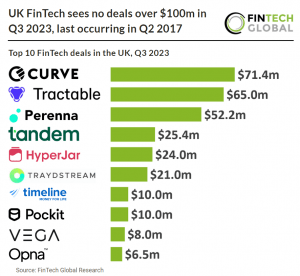

It is interesting to note that the UK did not see any FinTech deals close this week, despite its major FinTech sector. The warning signs of the UK’s FinTech sector has been felt across 2023. Research from FinTech Global this week found that there were no deals over $100m during Q3 2023, which is the first time to happen since 2017.

While funding volumes and deal activity are generally down across the world, the UK seems to have been hit quote hard. UK FinTech companies raised a combined $401m in investment during Q3, a 71% drop YoY. As for deal activity, UK FinTech deal activity reached 85 deals in Q3 2023, 43% decline compared to the same period in 2022.

Here are this week’s 26 funding rounds we covered.

Octane completes $380m asset-backed securitisation

FinTech Octane has successfully completed a $380m securitisation named “OCTL 2023-3.”

This securitisation is backed by fixed-rate instalment loans for power-sports and recreational vehicles originated through its in-house lender, Roadrunner Financial, Inc.

Octane is at the forefront of reshaping how consumers make significant recreational purchases, providing innovative financing solutions for these acquisitions.

The newly secured $380m will further fuel Octane’s growth and expansion efforts. It will enable Octane to continue connecting people with their passions and enhance the buying experience.

This milestone marks Octane’s ninth securitization since its program launch in December 2019. To date, the company has completed over $3bn in asset-backed securitisation, underlining its strong presence in the market.

Lendbuzz accelerates FinTech innovation with $345m investment boost

Lendbuzz, a vigorous FinTech player, announced a fundraising milestone today, securing $345m in an investment round.

The firm raised the funding through a meticulously structured investment that involved a $45m equity funding and a $300m forward flow facility. The investment round witnessed leadership from Group 1001 and also saw meaningful participation from existing investors such as 83North, O.G. Venture Partners, and MUFG Innovation Partners.

Lendbuzz operates at the intersection of finance and technology, utilising a mélange of alternative data, machine learning, and deep neural networks to devise auto loans that cater to a broad spectrum of borrowers. This allows the firm to navigate the complexities and variables in providing auto loans, especially in situations that involve varied borrower profiles.

The freshly secured funds are earmarked for a comprehensive investment strategy, focusing on product innovation, technology, and research and development. The objective is clear: to fortify Lendbuzz’s standing in the market by enhancing its service delivery to both consumers and dealership partners, ensuring it retains a competitive edge in the sector.

Investree’s mega $231m boost set to revolutionise Middle Eastern SME lending.

Indonesia’s digital lending giant, Investree, is on the brink of clinching a significant series D funding, amassing up to €220m ($230.8m) via the establishment of a new joint venture based in Doha.

This financial milestone has been made possible through a collaborative effort with JTA International Holding, the front-runner in this funding round, according to a report from TechinAsia. Notably, Investree also garnered support from its existing investor, SBI Holding.

This strategic partnership will birth a new entity named JTA Investree Doha Consultancy. Serving as the nexus for Investree in the Middle East, the entity is poised to extend state-of-the-art digital lending solutions for SMEs. One of the standout services includes an advanced AI-powered credit scoring mechanism.

Delving into Investree’s core services, since its inception in 2015, the firm has been at the forefront of the digital lending domain, proffering a quartet of lending solutions tailored for MSMEs. Their comprehensive suite comprises invoice financing, working capital term loans, buyer financing, and the much-acclaimed micro productive loans. Their track record is a testament to their prowess, with a whopping $916.3m in loans disbursed as of the current month.

Cardata secures impressive $100m investment to drive growth

Cardata, a company specialising in streamlining employee car reimbursement processes, has successfully raised a substantial $100m in a funding round.

The investment was led by Wavecrest Growth Partners, with significant participation from MassMutual Ventures.

Founded in 1999, Cardata has been a pioneer in offering a comprehensive suite of reimbursement software, compliance programs, and business intelligence tools. The company primarily serves organisations where employees use their personal vehicles for work-related purposes. One of Cardata’s core solutions involves collaborating with businesses to identify suitable auto insurance policies for their employees, ensuring driver compliance, and automating policy renewals.

Cardata intends to utilise the newly acquired funding to expand its market coverage and accelerate the pace of innovation across its core systems and new product offerings. The company aims to provide more efficient vehicle programs to deliver benefits and savings to both employers and employees.

Blackstone spearheads $61m boost for AP automation firm Stampli

Stampli, a frontrunner in AI-powered accounts payable automation, has made waves in the FinTech world after securing $61m.

The firm has successfully amassed the funding in its Series D venture funding round. This was masterminded by Blackstone, and saw notable contributions from stalwarts like Insight Partners, SignalFire, Bloomberg Beta, and NextWorld Capital.

Stampli, founded in 2015, has rapidly ascended the ranks to become one of the premier providers of accounts payable automation and ePayment services. As of August, the firm processed an impressive one million invoices which cumulatively exceeded $5bn in value.

Whilst the exact deployment of the funds remains under wraps, the sheer magnitude of the AP automation and B2B payments market signals exciting opportunities. Every business, regardless of size, has an accounts payable arm, indicating the vastness of this industry. In 2021, Deutsche Bank Research approximated the US revenue potential of AP automation and ePayments to be around $70bn, with international prospects magnifying this value by three to five times.

Stampli’s AI capabilities have garnered trust from over 1,300 accounts payable automation clients. Known as a game-changer in financial AI, Stampli’s AI addresses invoice capture, expense allocation, fraud detection, and more, ensuring utmost accuracy. This technological prowess comes at a time when CFOs are looking to integrate AI for its myriad benefits, including cost-efficiency and expediting workflows.

Clearco secures $60m in Series D funding to empower ecommerce growth

Clearco, the Toronto-based FinTech firm, unveiled its recent triumph of securing $60m in a Series D investment raise.

Today’s announcement showcased a multifaceted approach to strengthening the firm’s financial stature, including a noteworthy equity raise and a novel asset-based financing structure.

The pivotal $60m Series D funding round saw key participation from enduring Clearco investors like Inovia Capital and Founders Circle Capital. In tandem with the equity funding, Clearco confirmed the successful conclusion of a unique committed asset-backed financing agreement with Pollen Street Capital, a global luminary in alternative asset management. This strategic collaboration with Pollen Street will allow Clearco to channel revenue-based funds to e-commerce firms that gain approval through its advanced AI-backed underwriting technology.

Describing this defining moment, Clearco CEO Andrew Curtis expressed, “We are thrilled to announce this new round of funding and the launch of a new asset-backed facility as part of a broad recapitalisation, which substantially delevers the company and creates a new and improved Clearco. All of these actions allow us to continue to support the growth of e-commerce businesses during a time of funding challenges for many companies. We are firm believers in the continued resilience and growth of e-commerce as an industry, and are committed to providing the capital and resources these businesses need to succeed.”

Brite Payments secures $60m to drive global expansion

Swedish FinTech Brite Payments has successfully secured $60m in a recent funding round led by Dawn Capital, with participation from Headline and existing investor Incore Invest.

With the newly secured funding, Brite Payments is poised for expansion on an international scale. The company’s strategic objectives include strengthening its presence in existing markets and making substantial investments in product development.

Brite Payments, founded in 2019 by Lena Hackelöer, operates as an instant payments provider that harnesses open banking technology to facilitate real-time account-to-account (A2A) payments between consumers and online merchants. Currently, the company boasts connections to 3,800 banks across 25 European countries.

In a remarkable feat, Brite Payments reported more than doubling its transaction volume and revenue in 2022, which ultimately led to achieving profitability. This milestone coincided with the appointment of a new Chief Financial Officer (CFO) and Chief Operating Officer (COO) in July this year.

OneChronos harnesses AI to reshape financial markets with $40m Series B injection

OneChronos, a technology company focused on leveraging advances in auction theory and artificial intelligence (AI) to optimise financial markets, has announced the successful completion of its Series B investment round, raising $40m.

The financing round was spearheaded by Addition, drawing considerable attention to OneChronos’ unique approach to capital market transactions.

The company operates Smart Market periodic auctions at a pace, scale, and resilience demanded by the most exigent electronic capital markets. Beginning with U.S. equities, these auctions prioritise “best execution,” creating a competitive environment based on transaction quality rather than speed. Since its launch in Q3 2022, OneChronos has facilitated over $60bn in institutional securities transactions, witnessing a staggering monthly volume growth of more than 35%.

OneChronos intends to utilise the newly secured funding to expand to new markets and introduce novel products that enable additional strategy-level constraints within auctions. The objective is to unlock trading opportunities that are missed by conventional auction and market formats, and subsequently, enhance the potential execution quality of trading algorithms and workflows.

Loop bags $35m in Series B to revolutionise transportation logistics

Loop, a cutting-edge audit and payment platform designed for the next-generation supply chain, has proudly announced its successful acquisition of a $35m Series B investment.

The latest funding round witnessed significant participation and was co-led by financial giants, J.P. Morgan Growth Equity Partners and Index Ventures. Loop’s platform has attracted major global shippers such as Great Dane, GILLIG, and JPMorgan Chase, in addition to key logistics service providers including Convoy and Loadsmart.

Diving deeper into Loop’s operations, it provides an unparalleled solution to the prevalent issues within the transportation and logistics sector, which constitutes more than 8% of the global GDP.

Age-old systems, still in use today, result in the entrapment of millions of dollars due to inefficient and manual document processing like invoices and delivery receipts. This outdated method causes about 20% of freight invoices to contain rate errors, thereby escalating costs. However, with Loop’s robust data infrastructure, clients can benefit from a comprehensive view into their expenses and simultaneously unlock potential savings. Loop’s AI system offers crucial insights ranging from linking varied documents to renegotiating contracts.

WealthTech firm Farther achieves $131m valuation after bagging $31m

Farther, a progressive wealth management company, recently celebrated the closure of its Series B funding round on $31m.

With this significant milestone, the firm’s valuation soared to an impressive $131m.

This recent funding round generated $31m for Farther, thanks to participation from renowned investors such as Lightspeed Venture Partners who collaborated with existing backers to achieve this feat.

At its core, Farther is not just a typical wealth management company. Founded by Taylor Matthews and Brad Genser, the firm fuses expert advisory services with state-of-the-art technology. This unique blend empowers financial advisors, allowing them to dedicate their time and resources towards delivering a premium experience to their clients.

The firm’s vision to utilise modern technology in wealth management has been met with positivity. The capital will be used to further enhance their service offering and continue their impressive growth trajectory.

Over the course of its existence, Farther has showcased substantial growth. Since its establishment four years ago, the WealthTech firm reported a substantial 5x increase in its Assets Under Management (AUM) year-over-year. As of April 2023, they managed almost $700m in assets, and with their rapid expansion, surpassing the $1bn mark seems imminent.

Farther’s primary service revolves around a unified platform where clients can access all their accounts and products with a single login. For advisors, this platform offers the tools required to boost and expedite their book’s growth, eliminating cumbersome administrative duties and letting them concentrate on solving intricate client problems.

Peach Payments secures $30m in funding

Peach Payments, trading under Baobab Payments, has successfully closed a funding round amounting to €29m/$30m.

The funding round was announced in April and managed to secure capital primarily from Apis Growth Fund II, a private equity fund operated by Apis Partners LLP, a UK-based asset manager.

Specialising in offering an enterprise-level digital payment service, Peach Payments facilitates online transactions in Africa for businesses spanning various sizes. The company has adeptly carved a niche in rendering a comprehensive toolkit to manage, accept, and disburse payments through mobile and web platforms.

With a stronghold in South Africa, Kenya, and Mauritius, Peach Payments looks after the digital transaction needs of a plethora of sellers, ranging from popular food delivery services and e-commerce side hustles to comprehensive travel services.

In a move aimed at amplifying its growth trajectory, Peach Payments will leverage the newly secured funding to craft new products and forge into new African territories. Furthermore, the company aspires to bolster its presence in current markets including South Africa, Kenya, and Mauritius. This will involve growing market share, enhancing headcount, and launching innovative products, all with an unwavering focus on aiding their merchants in scaling operations, as elucidated by CEO and co-founder, Rahul Jain.

Peach Payments intends to eliminate the complexity tied to the fragmentation of payment methods for businesses targeting African consumers across the continent. As Jain articulates, the platform currently abstracts this complexity for merchants in operational countries and seeks to extend this convenience to more nations within Africa.

Kafene amasses $31m Series B to boost point-of-sale financing options

Kafene, a point-of-sale financing platform, has recently garnered $12.6m in new equity capital to amass $31m in a Series B.

Kafene recently announced the extension of its Series B funding round, successfully securing an additional $12.6m in new equity capital. This augmentation elevates the total of Kafene’s Series B to a substantial near $31m.

The financing was spearheaded by Third Prime, which was also a prominent leader in the initial fundraise, alongside a cohort of existing investors.

Kafene operates with a robust focus on providing transparent LTO agreements, thus delivering more flexible purchase options to consumers who often find themselves navigating through limited financial alternatives. The platform has adeptly financed over $100m in LTO agreements in a commendably brief span, less than three years since its product was first launched. Kafene diligently serves a demography exceeding 100 million consumers in America, especially those struggling to access ample credit on equitable terms, while simultaneously focusing on unfulfilled needs in big ticket categories, such as furniture and appliances.

The fresh capital is earmarked to fortify Kafene’s merchant partnerships and bolster its overarching commercial operations. Furthermore, Kafene is poised to underwrite a broader consumer base, capitalising on an opportunity spawned by a wider market withdrawal among consumer financing enterprises.

Frec unveils with $26.4m and a suite of savvy investment products

In a defining moment for retail investors, Frec, a financial technology company, has emerged from stealth, boasting a robust set of automated, self-service investment products.

Distinctively, Frec seeks to deconstruct and streamline intricate investment offerings that have typically been the preserve of wealth managers, enabling them to permeate the retail investor landscape with unprecedented accessibility and simplicity.

Bathing in the fresh influx of $26.4m, raised through a combination of seed and Series A funding, Frec has been propelled forward by notable investors. Greylock has assumed the mantle as lead investor, with the investment round further bolstered by the involvement of Social Leverage, amongst others.

Delving deeper into the mechanics, Frec’s inaugural product, dubbed “Frec Direct Indexing”, presents itself as a trailblazer among direct-to-consumer offerings. It facilitates customers in tracking S&P indices, thereby intertwining the advantages of index investing with supplementary tax savings and tailoring capabilities. This unique product can generate an additional 2.11% on top of market returns annually, through an adroit algorithm that performs daily tax loss harvesting, capturing up to 45% of an investment’s value in capital losses.

In terms of the fiscal utilisation of the new funding, Frec manifests a firm commitment to its mission: the democratisation of access to refined financial products. Furthermore, the investment is anticipated to fuel the development and optimisation of their groundbreaking products like direct indexing, portfolio lines of credit, and high yield treasury funds, enhancing their potential to steadfastly support investors amid market volatility.

Stitch secures $25m in Series A and looks to become global payments leader

Embedded payments pioneer Rainforest garners $11.75m from notable investors

Rainforest, a Payments-as-a-Service (PaaS) platform, has recently confirmed the successful completion of an $11.75m seed funding round.

The round saw significant involvement from esteemed backers including Accel, who took the lead, as well as support from Infinity Ventures, BoxGroup, The Fintech Fund, Tech Square Ventures, Ardent Venture Partners, and a host of strategic angel investors.

Notably, the funding round also comprised a $3.25m venture debt facility granted by Silicon Valley Bank (SVB), a prominent division of First Citizens Bank.

Delving deeper into Rainforest’s offering, this cutting-edge platform has fashioned an embedded payments solution meticulously crafted for software platforms. The unique selling proposition lies in its ability to offer platforms optimal economic benefits coupled with minimal operational and compliance hassles. Remarkably, Rainforest has pioneered the introduction of contractual merchant portability. Complemented by expert, white glove service, this ensures platforms achieve their overarching objectives of enduring success and widespread adoption.

By 2030, analysts anticipate a drastic shift in the payments landscape, with close to 75% of consumer payments bypassing direct bank processing. With a myriad of software companies lacking the capital to establish in-house payment systems, Rainforest stands out.

Their platform not only simplifies but also empowers these firms to seamlessly embed and reap financial benefits from payments. While many existing payment providers are fine-tuned for direct merchants, Rainforest’s robust platform actively aids software companies in circumnavigating the intricate web of risk management and compliance.

Gen AI firm Nexusflow clinches $10.6m in seed funding round

Nexusflow, a pioneering force in the Generative AI sector, has made headlines today by announcing a $10.6m seed round investment.

The funding endeavour, spearheaded by Point72 Ventures, also witnessed considerable contributions from Fusion Fund and several renowned AI experts from the heart of Silicon Valley.

Diving deeper into what Nexusflow does, this dynamic company was conceived by AI maestros, Professor Jiantao Jiao and Professor Kurt Keutzer from the Berkeley AI Research (BAIR) Lab.

They collaborated with industry AI trailblazer, Jian Zhang, who boasts a stellar background including a Ph.D. from the Stanford AI Lab and a tenure as the Machine Learning Director at SambaNova Systems – a noteworthy AI startup valued at over $5bn. Their combined experience spans years of intensive research and adept productization in the sphere of AI algorithms and systems.

What truly sets Nexusflow apart is its revolutionary approach. The firm empowers enterprises with cutting-edge AI models, all while safeguarding their sensitive data. In terms of efficacy, when benchmarked against widely-used security applications, Nexusflow consistently clocks an impressive accuracy rate of 95%. To put this in perspective, even OpenAI’s acclaimed GPT-4 model delivers an accuracy of 64%.

Vyzer nabs $6.3m seed funding to supercharge WealthTech with AI

Vyzer, the trailblazing digital wealth management platform, has successfully wrapped up its seed funding round.

The firm managed to gather a noteworthy $6.3m, with backing from industry heavyweights like iAngels, Guy Gamzu, MonetaVC, Jonathan Kolber, and Rafi Gidron.

Using advanced AI technology, Vyzer turns raw data into potent wealth-building strategies. It allows investors to gain a comprehensive perspective of their portfolio. Its offerings range from financial analysis and advanced planning to automated data management and forecasting, all accessible through a unified dashboard.

As the FinTech sector witnesses the most massive wealth transition in its history, a new breed of tech-savvy investors is emerging. Catering to over 22 millionaires in the US alone, the demand for comprehensive and transparent wealth management tools has skyrocketed.

Vyzer aims to meet this demand, offering a holistic solution that simplifies the challenging task of managing a plethora of financial assets. With this funding, the firm seeks to further its reach and enhance the platform, aiming to make billionaire wealth management techniques available to the average investor.

Vyzer’s AI-driven platform not only simplifies wealth management but also makes it affordable. By eliminating the hefty fees associated with traditional wealth management and offering a robust alternative for those favouring a DIY approach, Vyzer empowers its users to have better control over their finances.

Pivot scales procurement prowess with €5m ($5.2m) injection

In an exciting step towards reshaping the realm of business-to-business (B2B) procurement, ex-leaders of Qonto and Swile, Marc-Antoine Lacroix and Romain Libeau respectively, have launched a promising FinTech enterprise, Pivot, according to a report from Sifted.

Founded on the robust expertise of its creators, Pivot arises from the prolific backgrounds of its founders in developing potent financial solutions, fortifying its stance as a new contender in the financial technology arena.

A substantial €5m funding has been pooled for Pivot, spearheaded by the Berlin-based venture capital firm Visionaries Club. Further amplifying the initial round, London’s micro fund, Cocoa VC, and several notable French business angels have also entered the fray, offering their financial backing and confidence in the nascent FinTech initiative. With this solid financial foundation, Pivot embarks on its journey with a pre-money valuation soaring to €20m.

India’s credit solution pioneer DPDzero raises $3.25m led by Blume Ventures

DPDzero, a groundbreaking FinTech firm in India, has successfully concluded its latest funding endeavour. The company, which focuses on AI-powered collections and debt recovery solutions, raised an impressive $3.25m in a funding round.

This seed funding round was prominently led by notable entities, Blume Ventures and IndiaQuotient. Furthermore, distinguished figures in the banking and FinTech sectors such as Sunil Gulati and Nikhil Kumar played active roles in this investment.

Established in March 2022, DPDzero was the brainchild of its founders, Ananth Shroff and Ranjith BR. The duo, who are also recognised for their roles in the foundational team of FinTech API infrastructure platform Setu, created DPDzero with a distinct vision in mind. Their primary aim is to address the evident challenge of credit penetration in India and to bridge the gap in the financial infrastructure that would serve the underprivileged.

DPDzero intends to channel the freshly acquired funds to bolster its product distribution, expedite its product development, and recruit an adept team of professionals who align with the company’s objectives.

FinTech firm Revio boosts community bank growth with $2.5m funding

Revio, a revenue-enabling, customer-insights SaaS platform, has secured a substantial investment to enhance its operations in the banking sector. Today, the company announced a successful Series A venture funding round, garnering $2.5m.

Leading this financial boost were BankTech Ventures, a fund keenly focused on uplifting community banks, and EJF Ventures, renowned for their investment in FinTech and banking technology.

Specialising in the enrichment of core banking data, Revio has established itself as a pivotal player in sales enablement and marketing personalisation. The company provides a unique platform for community and regional banks to spotlight potential growth areas, aiming to foster stronger customer ties, extended customer lifetime value, and heightened profitability.

With this fresh investment, Revio aspires to hasten the adoption rate of its growth-focused, customer-insights platform. The platform’s strength lies in its ability to turn vast amounts of customer data into actionable insights using machine learning. By doing so, Revio offers solutions across various banking verticals like commercial and retail deposits, loans, credit cards, insurance, wealth management, and more. Armed with this data, bank sales teams, marketers, and relationship managers can efficiently segment and prioritise customer outreach for a more personalised marketing approach.

Saidot secures €1.75m ($1.8m) in seed funding to enhance AI governance

Saidot, a Finland-based entity offering a SaaS governance platform, recently announced a noteworthy achievement in its financial journey.

This AI governance and alignment company is not only pioneering safe AI-driven businesses but also enhancing transparent communication about their AI applications in various public and private organisations.

In a recent development, Saidot successfully secured €1.75m in a seed funding round. A consortium of investors including Crowberry Capital and Ventic took the lead in this financial venture, with additional participation noted from Business Finland, elevating the company’s financial prowess to pave the way forward in its unique offering in the realm of artificial intelligence.

The company operates by providing a robust platform that enables enterprises and governments to navigate through the complexities and challenges of using AI safely and ethically. It stands out by providing systematic AI governance and equipping organisations with the tools necessary to communicate transparently about their AI usage and policies. The blend of expertise across various fields such as machine learning, technical safety, policy, digital transformation, and human-centred design within its interdisciplinary team enriches its capability to deliver top-notch services.

Evo Security lands $1m investment from Strategic Cyber Ventures

Strategic Cyber Ventures, a prominent VC firm focusing on cybersecurity, has proudly announced its latest investment in Evo Security.

The firm has invested a sum of $1m into Evo Security’s newest funding round.

Evo Security specialises in crafting enterprise-level identity and access management tools, specifically designed for IT Managed Service Providers (MSPs). Their products aim to meet the stringent demands of MSPs, ensuring secure identity verification and access across crucial MSP systems.

While the specific utilisation of the funds hasn’t been detailed, Strategic Cyber Ventures’ commitment indicates a reinforcement of their dedication to enhancing national security. Their focus remains on supporting nascent cybersecurity enterprises and nurturing innovations pivotal for safeguarding the nation.

The Washington D.C.-based venture capital firm is on a quest to identify pioneering startups that can significantly influence the realm of national cybersecurity. Their support extends beyond monetary investment, with the firm leveraging its expansive industry network and experience to assist startups from their nascent stage to their eventual exit.

Perk Labs raises CAD$471k, fortifying its payment and ordering technology offerings

Perk Labs, a company specialising in ordering and payment technology, recently declared the successful closure of a non-brokered private placement of units and convertible debentures, cementing a promising financial stride for the technology firm.

Perk Labs, through its ownership of Getit Technologies Inc. and Perk Hero Software Inc., plays a pivotal role in linking businesses and consumers via mobile apps and web-based payment services, designed to streamline both the consumer experience and merchant digitalisation.

The financial details reveal that the company managed to raise gross proceeds of CAD$21,000 through the private placement of 1,312,500 units at CAD$0.016 per unit. Each unit comprises one common share of the company and one common share purchase warrant. These warrants enable holders to purchase an additional common share at a price of CAD$0.05 per common share for a 24-month duration from the closing date. Alongside, the firm garnered gross proceeds of $450,000 through the private placement of convertible debentures that bear a 15% per annum interest and mature one year post-issuance.

Diving deeper into what Perk Labs Inc. offers, the company has crafted a niche in developing applications, payment processing, and loyalty rewards. Its innovative technology aims to bridge merchants and consumers through user-friendly mobile applications and digital payment services. This interconnection not only enhances consumer experience but also augments merchant digitalisation, providing a seamless, efficient transactional environment for both parties.

With the fresh influx of CAD$471,000, the net proceeds from the private placements will be channelled towards general working capital purposes. This financial bolstering will also address accounts payable and employee salaries, providing a steady financial base for the company to navigate through its operational demands and perhaps, further innovation in its technological offerings.

Germany-based FinTech firm Debtist secures pre-seed investment

Mitiga scores investment from Cisco Investments for its IR2 platform

MoneyHash receives financial boost from GitHub co-founder

US-based Egyptian FinTech, MoneyHash, a leading integrated suite of payment products and the region’s first payment orchestration platform, has garnered attention with its recent investment news.

MoneyHash has successfully secured funding from Tom Preston-Werner, co-founder of GitHub, in a seed financing round whose amount remains undisclosed.

Established in late 2020 by Nader Abdelrazik, Mustafa Eid, and Anisha Sekar, MoneyHash provides businesses with the capability to craft a customised payment stack suited to their specific needs.

While the exact figures remain undisclosed, the infusion of funds from Tom Preston-Werner will further propel MoneyHash’s product development, enhancing their position in the FinTech landscape.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global