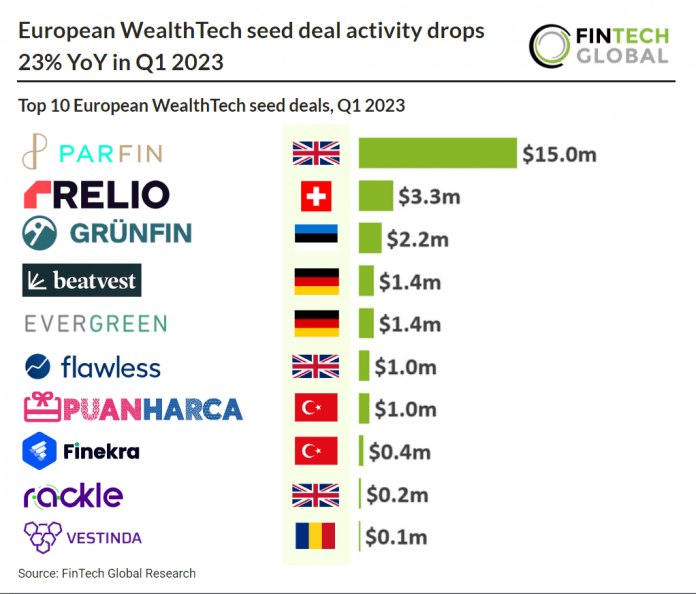

European WealthTech seed deal investment stats in Q1 2023:

• 14 European WealthTech seed deals were completed in Q1 2023, a 23% drop from the same period last year

• The average European WealthTech seed deal size was $1.86m during the first three months of the year

• The UK was the most active WealthTech seed country with three transactions.

European WealthTech saw a reduced interest in early stage companies in Q1 2023 compared to the previous year with only 14 seed deals raised by European WealthTech companies, a 23% drop from Q1 2022 levels. Based on activity in Q1 2023, WealthTech seed deal activity in Europe is on track to drop slightly by 7% compared to 2022 levels reaching 56 deals in total during 2023. Despite this drop in seed deal activity, the global WealthTech sector continues to see increased deal activity, growing 28% in 2022. This could indicate that WealthTech is a maturing sector with less innovation opportunity than others. The average European WealthTech seed deal size was $1.86m in Q1 2023.

Parfin, a modular platform for secure digital asset custody, trading and management, was the largest European WealthTech seed deal in Q1 2023, raising $15m to extend their seed funding round, led by Framework Ventures. Parfin will use funds to expand internationally, extend its product portfolio and launch new solutions. “Raising these funds in such a complex and challenging market deepens our confidence in Parfin’s market strategy, technology, and products,” said Marcos Viriato, CEO and co-founder of Parfin. “As the leading digital asset infrastructure solution in Latin America, we plan on using these funds to both solidify our lead and accelerate our global expansion during this crucial building period,” he added.

The UK was the most active WealthTech seed deal country in Q1 2023 with three deals, a 21% share of deals. Switzerland, Germany and Turkey were the joint second most active FinTech countries in Q1 2023 with two deals each.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global