There has been a global trend within FinTech over the past year – a drop in total funding volume. However, Asia seems to be defying this trend.

A recent report from data consultancy firm KPMG found that global FinTech investment dropped by 30%, sitting at a total of $164bn invested. In tandem with this, the number of deals fell from 7,321 in 2021 to 6,006.

It also found that the investment volume across the Americas declined from $108.9bn to $68.6bn, while in the EMEA, the funding fell from $79bn to $44.9bn. One region to buck this trend was the Asia-Pacific region. According to KPMG, FinTech funding in the Asia-pacific region increased from $50.2bn in 2021 to $50.5bn. While it is only a marginal increase, its stability is much desired by other regions.

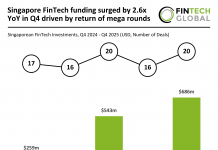

However, while funding remained strong in some Asia-Pacific countries, it wasn’t clear sailing for all countries. For example, Singapore’s total FinTech funding declined from $3.4bn in 2021 to $2.4bn during 2022. Despite this 29% decline, the country set a new record for total deals, ending the year on 232.

Another country to see a drop during 2022 was the Philippines. Funding fell from $764m in 2021 to $381m, this was across 36 and 21 deals, respectively. One country in Asia that has hit a series of tough years for FinTech is Japan. Total investment has dropped each year since 2018 where $4.8bn. Funding hit dire levels in 2022, with just $360m raised across 32 deals, which is compared to $1.2bn through 120 deals in 2021 and $1.4bn across 232 funding rounds in 2020.

Commenting on the attractive Asia-Pacific FinTech market, Nagesh Devata – senior vice president for the APAC region at payment platform Payoneer – said, “Asia is home to a vibrant startup ecosystem, having produced the likes of Grab in Singapore, Tokopedia in Indonesia, and Coupang in South Korea. There is a strong investor interest especially in the FinTech sector. Many investors recognize the potential of FinTechs in the region and are willing to provide the funding and support to help these companies scale and expand their operations.”

Another reason Asia-Pacific’s FinTech scene is doing well, according to Devata, is the favourable support from regulators. He said, “Governments recognise the potential of the sector to drive economic growth and have introduced policies and regulations to support its development and operations.”

An example of a supportive regulator Devata pointed to was the Hong Kong Money Authority (HKMA), which has introduced the Faster Payment System (FPS) and virtual banking licence to support the development of the FinTech space. These are just some of the initiatives it has launched.

“These initiatives help to create a favourable regulatory environment for FinTech companies and enable them to bring innovative services to market.”

In another bid to support Hong Kong’s FinTech landscape, the HKMA recently announced a pilot scheme that would offer subsidies to FinTech practitioners. As part of the initiative, practitioners that have attended FinTech professional qualifications will qualify for a reimbursement of up to 80% of training costs. Through this it hopes to support around 1,500 people with the aim of promoting professional development of FinTech talent in Hong Kong.

While the regulatory landscape is supportive, that does not mean the region is not against tightening rules. Staying in Hong Kong, the HKMA recently issued a circular to banks on buy now pay later products to implement new consumer protection measures. One of these measures is to include a message of ‘To borrow or not to borrow? Borrow only if you can repay!’ in the advertising and promotional materials for BNPL products. Similarly, banks will need to clearly outline that buy now pay later products are credit products and entail borrowing.

Another active regulator in the APAC region is the Monetary Authority of Singapore (MAS). The regulator offers the FinTech Regulatory Sandbox framework, which lets financial institutions and FinTechs experiment with products in a safe and controlled environment. Some of its other recent developments was signing a memorandum of understanding with the UK, creating a link between Singapore’s PayNow service and India’s Unified Payments Infrastructure, and a partnership with India to facilitate regulatory collaboration and partnership in FinTech.

Devata added, “The MAS establishes rules for financial institutions and formulates guidelines to encourage best practices among financial institutions. To receive a coveted licence to maximise existing services, a company must prove that they meet all the necessary requirements, such as financial track record and governance structure. Such a system helps Singapore to achieve the outcome of a sound and progressive FinTech sector.”

What can the world learn from Asia?

As the financial market continues to be tough, there are potential lessons other regions can look to Asia for inspiration. Devata boiled it down to three key areas: collaboration, regulatory support and customer centricity.

In terms of collaboration, Devata said that FinTechs have core advantages when compared to their traditional finance counterparts. The latter are playing catchup with digitalisation, whether that is user experience, transparency or speed. Rather than the two competing, Devata urged FinTechs to pivot their efforts to become a bridge and improve access between themselves and the target market. “This partnership approach creates greater network effects and helps gain wider spread of adoption.”

As for regulation, Devata stated that governments in Asia have served a key role in supporting the growth of the FinTech sector. These friendly regulations are a catalyst for greater financial innovation and Fintech adoption, creating more benefits to customers and the greater financial industry.

Finally, as for customer centricity, Devata said, “A customer-centric approach involves designing financial products and services that are tailored to the specific needs and preferences of the end users. Asia’s FinTechs operate effectively by focusing on alleviating potential friction points along the entire customer journey, ensuring that they are delivering exceptional customer experiences— wherever their end users are, and whenever they reach out.”

Keep up with all the latest FinTech news here

Copyright © 2023 FinTech Global