Key Latin American FinTech investment stats in Q1 2023:

• Latin American FinTech investment declined 96% YoY to $137m in Q1 2023

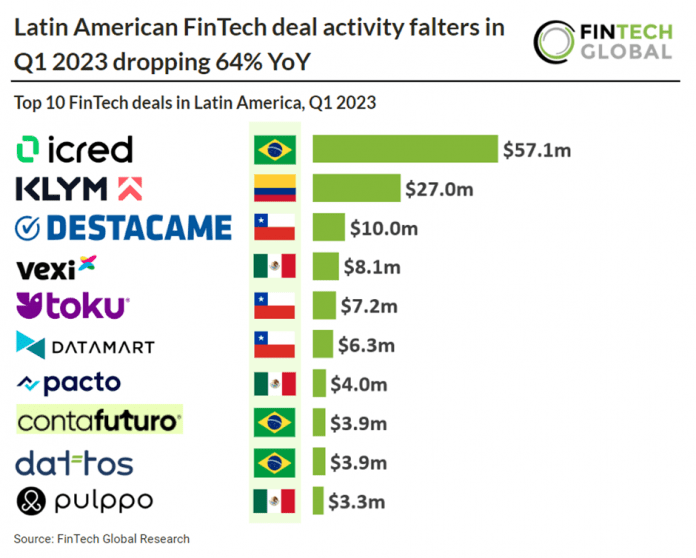

• Latin American FinTech deal activity reached 45 deals in Q1 2023, a 64% decline from Q1 2022

• Brazil was the most active FinTech country with a 47% share of total deals

Latin American FinTech recorded a slow start to 2023 with both investment and deal activity hitting their lowest figures in the past five years. Latin American FinTech funding reached a total of $137m in Q1 2023, a dramatic 96% decline from Q1 2022. Latin American FinTech deal activity also saw a decline in Q1 2023 with only 45 transactions completed by FinTech companies, a 64% drop YoY. Overall Latin American FinTech companies raised a combined $5.4bn in 2022, based on Q1 2023 results, overall 2023 investment is on track to reach $548m, an 89% reduction from 2022.

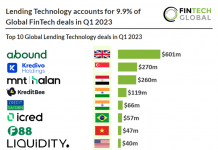

iCred, a payroll loan provider, was the largest Brazilian FinTech deal in Q1 2023, raising $57.1m in their latest venture funding round. “With this new funding, iCred can facilitate a payroll loan for INSS beneficiaries who need credit at fair rates, starting at 1.49% per month, considering today’s yield curve. No doubt we will be very competitive,” says Tulio Matos, co-founder of iCred, in a statement. Initially, iCred provided loans exclusively to employees who had resources in the Brazilian social security fund, Employee’s Severance Guarantee Fund (FGTS), which caters to workers across various sectors. In 2022, the company made significant progress, having successfully processed over $50 million in loans and pre-approved more than one million loan applications. This marks iCred’s second achievement in a short span of time. In the previous year, iCred had announced the raising of $20 million via a FIDC (Receivables Investment Fund), a type of investment where shareholders’ earnings are tied to the company’s resources derived from a particular source.

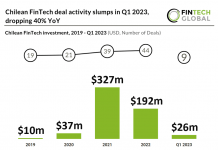

Brazil was the most active Latin American FinTech country in Q1 2023 with 20 deals, a 46% share of total deals. Chile was the second most active FinTech country with 10 deals, a 23% share of transactions. Mexico and Colombia were the joint third most active FinTech countries with six funding rounds each.

Lending Technology was the most active FinTech subsector in Latin America during Q1 2023 with 10 deals, a 23% share of total deals. This was followed by Blockchain & Crypto which had nine deals and WealthTech which saw six deals completed.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global