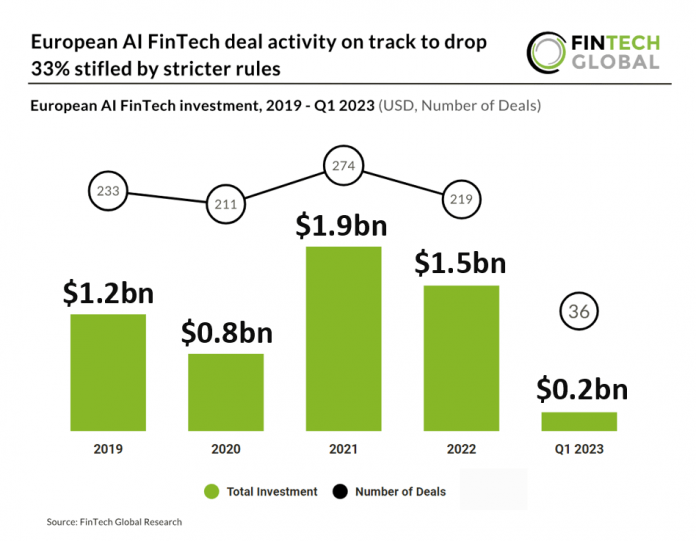

Key European AI FinTech investment stats in Q1 2023:

• European AI FinTech deal activity reached 36 transactions in Q1 2023, a 40% drop compared to the same period last year

• European AI FinTech companies raised a combined $184m during the opening quarter of 2023, down 53% YoY

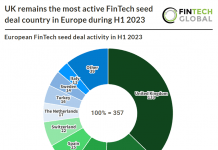

• The UK was the most active country for AI FinTech investment with ten deals completed in Q1 2023

European AI FinTech investment recorded a slow start to the year with a drop in both deal activity and investment YoY despite the hype, new AI technologies such as ChatGPT and Bard have brought to the services industry. In the first quarter of 2023, there was a decline of 40% in European AI FinTech deal activity compared to the same period in 2022, with a total of 36 deals. In Q1 2023, European AI FinTech companies witnessed a year-over-year decrease of 53% in their total funding, raising a combined amount of $184m. Based on Q1 2023 deal activity European AI FinTech companies are expected to close 144 funding rounds in 2023, 33% lower than 2022.

StudentFinance, a flexible financing company for education, had the largest European AI FinTech funding deal in Q1 2023, raising $41m in their latest Series A funding round, led by Iberis Capital. The funds obtained from the latest round will be allocated towards expanding into the UK and Germany. The company received authorization from the Financial Conduct Authority (FCA) and German financial regulators last year, enabling them to target these markets. Additionally, they will also focus on the Spanish market following their recent partnership with the European Investment Fund. Since its launch in 2020, StudentFinance has helped “thousands” of people access more than 250 upskilling programs through more than 50 education providers. StudentFinance plans to grow into new channels too, helping corporates to help employees upskill at scale, for example, car manufacturers shifting away from combustion engines to electric cars. It offers both two models of payment. “Success-based” financing and more typical fixed instalments. Users only start paying back once they are employed and earning above a minimum income threshold. The former is dependent on a formula based on future earnings.

The UK was the most active AI FinTech country in Q1 2023 with ten deals, a 27.7% share of total deals. France was the second most active country with five deals and Italy was third with four deals.

In May 2023, EU MEPs have endorsed new rules for Artificial Intelligence (AI) systems in Europe to ensure human-centric and ethical development. The rules aim to oversee AI systems, ensuring they are safe, transparent, traceable, non-discriminatory, and environmentally friendly. A risk-based approach is followed, prohibiting AI practices with unacceptable risks, including manipulative techniques, social scoring, and discriminatory uses of biometric identification. High-risk areas are expanded to include health, safety, fundamental rights, and environmental harm. Transparency measures are introduced for general-purpose AI, including obligations for providers of foundation models. The rules support innovation through exemptions for research activities and open-source AI components. Citizens’ rights are protected, allowing complaints and explanations for decisions made by high-risk AI systems. The EU AI Office will monitor the implementation of the AI rulebook.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global