Key FinTech investment stats in Canada, Q1 2023:

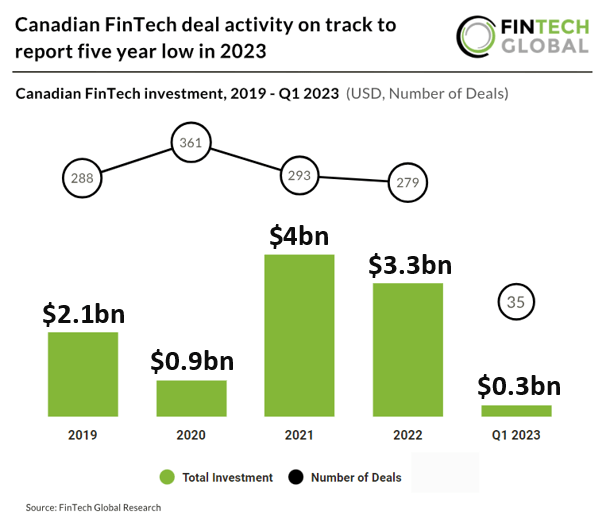

• Canadian FinTech companies raised a combined $286m in the first quarter of 2023, an 85% drop YoY

• Canadian FinTech deal activity reached 35 deals in Q1 2023, a 48% decline compared to the same period last year

• RegTech was the most active FinTech subsector with seven deals, a 20% share of all transactions in the country

Canadian FinTech saw a rocky start to the year with both investment and deal activity substantially dropping in Q1 YoY. Canadian FinTech companies raised a combined $286m in the first quarter of 2023, an 85% drop from the same period in 2022. Canadian FinTech deal activity also decreased in Q1 2023 reaching a total of 35 deals in Q1 2023, a 48% drop from Q1 2022.

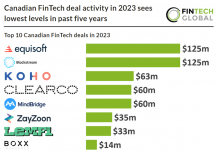

Equisoft, an insurance and investment software developer, and Blockstream, a digital asset infrastructure company, were the joint largest deals in Canada during Q1 2023. Equisoft raised $125m in their latest private equity funding round from Investissement Quebec, Export Development Canada, Fondaction and the Government Of Quebec. The company intends to use the funds for global expansion, both organically and through strategic acquisitions, further development of its integrated life insurance software platform, and wealth products to better serve its global customer base. The company now serves over 250 financial institutions in 17 countries. Blockstream raised $125m in their latest convertible note funding round, led by Kingsway Capital. The funding will enable Blockstream to expand mining capacity for institutional hosting customers, a segment the company said was “resilient” in the face of Bitcoin price volatility compared to so-called prop miners. This latter segment is “more directly exposed to Bitcoin price volatility and compressed margins,” Blockstream said.

In March 2022, the Canadian government appointed Abraham Tachjian to lead the development of an Open Banking framework in Canada. His mandate is to consult with the industry, regulators, and consumer representatives. The objective of these consultations is to design and implement the key elements of an Open Banking framework. The initial release date was expected in January 2023 although this has been postponed.

RegTech was the most active Canadian FinTech subsector in Q1 2023 with seven deals, a 20% share of total funding rounds announced in Canada during Q1 2023. PropTech was the second most active FinTech subsector in Q1 2023 with six deals.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global