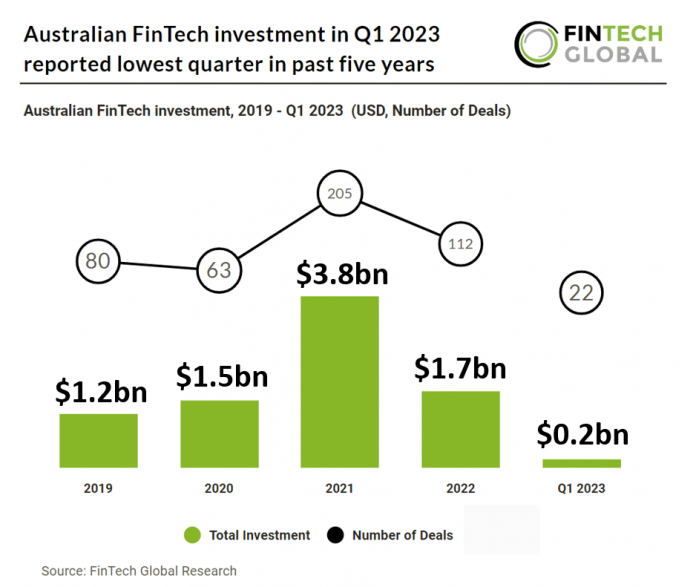

Key Australian FinTech investment stats in Q1 2023:

• Australian FinTech deal activity reached 22 deals in Q1 2023, a 56% drop from Q1 2022

• Australian FinTech funding ended the quarter at $226m in Q1 2023, the lowest reported in the past five years

• PayTech and RegTech were the most active FinTech subsectors in Australia during Q1 2023

Australian FinTech saw a rocky start to the year with both deal activity and investment more than halving compared to Q1 2022. FinTech deal activity in Australia dropped by 56% YoY to a total of 22 transactions. Australian FinTech capital invested totalled at $226m in Q1 2023, a 62% reduction YoY. Based on Q1 2023 deal activity, Australian FinTech deal activity is expected to drop 22%. Average FinTech deal size decreased to $10.2m, a 15% drop.

Orro, a cyber security service provider, was the largest Australian FinTech deal in Q1 2023, raising $99m in their latest Venture round, led by Macquarie Capital. The fresh capital has been designated for future acquisitions. Orro, previously known as Cirrus HoldCo, rebranded itself in 2021 and acquired eSecure, a security services provider, in the same year. Liverpool Partners, an Australian mid-market private equity firm, and Parc Capital, a specialized advisory and investment firm, are the owners of Orro. Orro Group offers end-to-end platform-enabled solutions, including cloud, collaboration, cyber, and data services to more than 400 businesses every day.

RegTech and PayTech were the two most active FinTech subsectors in Q1 2023 with six deals each. Combined the sectors accounted for 55% of Australian FinTech deals in Q1 2023. Infrastructure & Enterprise Software was the second most active FinTech sector with four deals, an 18% share of total deals.

The ASX (Australian Securities Exchange) continues to progress its plans to adopt a blockchain-based technology for its clearing and settlement system called CHESS. A likely update will occur in H1 2023. CHESS stands for Clearing House Electronic Subregister System and is the computer system used by the ASX to manage the settlement of share transactions and to record shareholdings. In practical terms, it allows brokers and other market participants to settle trades via CHESS by themselves or on behalf of their clients.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global