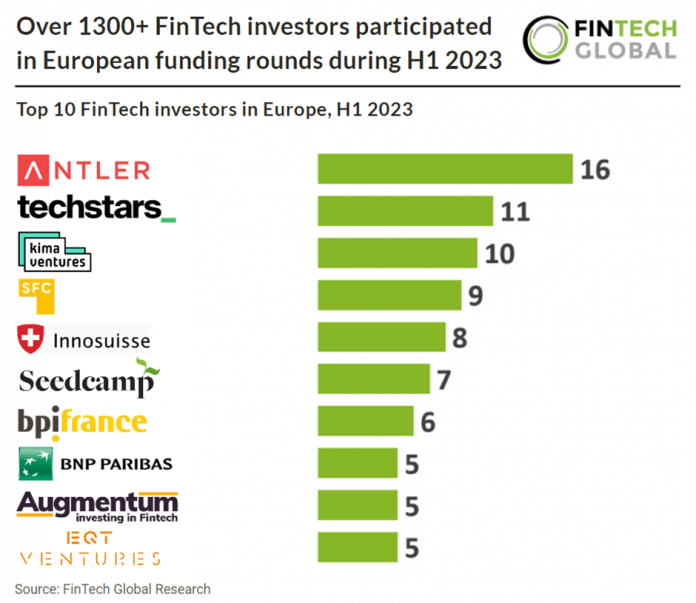

European FinTech saw strong investor participation in H1 2023 with 1370 unique investors participating in European FinTech funding rounds. A recent report from EY in May 2023 suggests for the immediate future, VCs likely will become even more selective about how they deploy capital, and EY anticipate that VC investment will continue to drop off from the levels of 2021 and 2022. EY may continue to see large fund flows occur, but they’re likely to be undertaken from a defensive position to shore up companies in situations where investors are doubling down. Seed and Series A rounds may become more challenging as VCs will likely prioritize existing portfolio companies.

Antler, an early stage VC that invests globally, was the most active FinTech investor in Europe, participating in 16 funding rounds during H1 2023. Antler has invested in 553 Fintech companies globally as of 3rd July 2023. Founded on the belief that innovation is essential for a better future, antler collaborates with exceptional founders worldwide to launch and grow startups that tackle meaningful challenges. With offices in 25 cities across six continents, including major global hubs, Antler embraces founders from diverse backgrounds. Their global community supports entrepreneurs from the earliest stages, even before forming a team or idea. Since 2018, they have assisted in creating and investing in over 600 startups across various industries, with a goal of backing over 6,000 by 2030. Antler emphasizes the importance of determined, ambitious, and resilient founders in shaping the future, and they are fully committed to supporting these individuals and driving progress forward.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global