Europe led the charge in this week’s 26 FinTech funding rounds, in a rare occasion where the US didn’t hold the lion share of deals.

A total of $1.65bn was raised in the 26 funding rounds to close this week, of which, $1.6bn was raised by the ten biggest deals.

As mentioned, Europe was home to the majority of the deals and capital, with 17 companies securing funds and a total of $1.54bn raised. This comes against the usual trend that sees the US dominate FinTech funding activity in terms of deals and capital.

This is not the first time this week that FinTech Global has reported on Europe’s leading role. In a research piece it found that Europe accounted for 66% of global AML and FinCrime deals in Q2 2023. The continent was responsible for ten deals out of a total of 15 in the sector. While global deal activity saw no change from the previous quarter, the funding volume increased by 21% to $151m in Q2 2023.

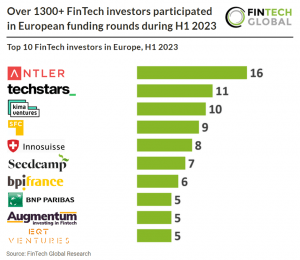

Another report from FinTech Global this week found that over 1300+ unique investors participated in European FinTech funding rounds during H1 2023. Antler, an early stage VC that invests globally, was the most active FinTech investor in Europe, participating in 16 funding rounds during H1 2023.

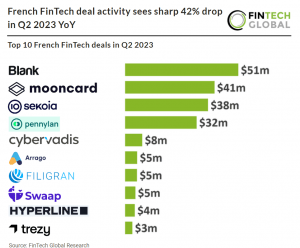

However, not everything was positive this week in Europe. FinTech Global found that French FinTech deal activity witnessed a 42% drop Q2 2023 YoY. There were a total of 40 FinTech deals in France during the quarter. The total capital raised also experienced a dip with a total of $222m raised, representing a 53% decrease compared to the same period in 2022.

Back to this week’s funding rounds, the UK was home to the biggest deals of the week. These were marketplace lending company LendInvest, which bagged £500m, and PayTech player CAB Payments, which secured £335m. Digital bank Tandem also earned its spot in the ten biggest deals of the week with the close of its £20m funding round. In total, there were seven UK FinTech companies to raise funds, which was joint with the US for the most deals of the week. Other UK companies closing funding this week were Glasswall, Go Car Credit, Smarter Contracts and Husmus.

The US was also home to three of the biggest deals of the week, PayTech Clair, InsurTech Steadily and IP Fabric. The US companies were Topkey, Revcast, Bequest Finance and AlloyX.

France and Switzerland each recorded two deals, these were Silvr and Keewe, and Numarics and Selma Finance, respectively.

Other countries represented this week were Belgium (Qover), Thailand (Bitkub), Australia (AUCloud), Nigeria (Zuvy), South Korea (U Fintech Hub), Chile (Shinkansen), Morocco (Chari) and India (50Fin).

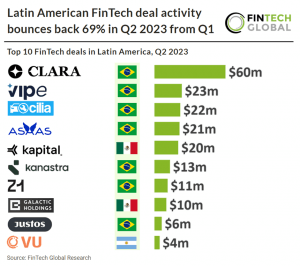

One final research piece to note this week was a focus on Latin America. Latin American FinTech saw a strong Q2 with a 69% increase in deal activity from Q1 2023. In total there were 76 FinTech deals and they collectively raised $254 million during this period.

In terms of sectors, the most popular of the week was PayTech with six deals. Of these, two were in the top ten deals (CAB Payments and Clair). The other PayTech companies securing funds this week were U Fintech Hub, Shinkansen, Chari and Keewe.

The next most popular sector was marketplace lending, which recorded five deals. These were LendInvest, Silvr, Go Car Credit, Zuvy and 50Fin. Three WealthTech (Tandem, Bequest Finance and Selma Finance) and three CyberTech (IP Fabric, AUCloud and Glasswall) companies secured deals.

The remaining sectors to see deals close this week were, InsurTech (Qover and Steadily), Infrastructure & Enterprise Software (Numarics and Revcast), PropTech (Topkey and Husmus), cryptocurrency and blockchain (Bitkub and AlloyX), and RegTech (Smarter Contracts).

Here are this week’s 26 funding rounds.

LendInvest secures £500m ($641.8m) investment for mortgage growth

London-based LendInvest, the UK’s foremost platform for property finance, has today confirmed the receipt of a £500m investment.

The investment comes from Chetwood Financial Limited and is intended to finance a portion of the future mortgage originations of LendInvest’s Buy-to-Let and Residential Mortgage products.

The staggering £500m funding was secured from Chetwood Financial Limited. This investment will fuel the expansion of LendInvest’s Buy-to-Let business, aimed at professional landlords, as well as its newly unveiled Residential Mortgage range. This range has been engineered to assist customers who find high street mortgage providers to be lacking in service.

LendInvest operates on a proprietary technology platform which simplifies even the most intricate cases. By speeding up the process, this platform improves the experience for potential homeowners, property developers, and professional landlords.

The new funding will be channelled towards fostering growth in LendInvest’s Buy-to-Let business and its recently launched Residential Mortgage range. These initiatives are geared towards supporting professional landlords and customers who are underserved by mainstream mortgage providers.

Chetwood Financial Limited joins the burgeoning list of world-renowned financial establishments that support LendInvest’s mortgage products. Some of the noteworthy names on this list include Barclays Bank, BNP Paribas, Citi, HSBC, JP Morgan, Lloyds, National Australia Bank, and Wells Fargo.

CAB Payments makes a splash in London’s IPO market with an impressive £851m valuation

CAB Payments, a leading player in business-to-business (B2B) money transfers, has entered the public domain, brandishing a valuation of £851m, thereby injecting much-needed dynamism into London’s somewhat subdued initial public offering (IPO) markets.

In the initial listing, CAB Payments managed to secure up to £335m ($430m). The shares were launched at a fixed rate of £3.35 in conditional trading on the London Stock Exchange. Complete admission to the premium listing segment of the Exchange is set for 11 July.

Focusing on the provision of infrastructure for money transfers, CAB Payments originated from Crown Agents Bank, a British lending institution with a rich history spanning 190 years. Now, CAB Payments stands as the parent company to this historical entity. Based in Sutton, CAB Payments’ services facilitate cross-border payment flows to and from more than 150 countries.

The company intends to utilise the freshly secured funds to expand its client base and continue to innovate in the FinTech industry. Bhairav Trivedi, CEO of CAB Payments, marked the day as a significant milestone for the company and expressed confidence in its growth and expansion strategies.

Additional data reveals the company’s healthy financial performance. In 2022, it reported a revenue of £109.9m and a pre-tax profit of £43.5m. It’s noteworthy that CAB Payments’ arrival on the London Stock Exchange is happening at a time when the IPO market has been somewhat sluggish, both in the UK and worldwide. EY’s recent figures indicated that only 18 issuers entered the London stock market in the first half of the year, amassing a combined £593m.

Neo-lender Silvr lands €200m ($219.3m) securitised facility deal

Silvr, an innovative neo-lender focused on serving small and medium-sized enterprises (SMEs), has achieved significant strides in the past few years since its inception in 2020.

The company has underwritten its 100th loan within its first year and deployed €100m towards SMEs by its second year, earning its place as the fastest-growing neo-lender in continental Europe. Now, in celebration of its third anniversary, Silvr has revealed a groundbreaking milestone; the signing of a new securitised facility of up to €200m with Citi and Channel.

The raised funds are intended to accelerate Silvr’s growth and expand its lending capacity. Silvr’s Chief Capital Officer, Benjamin Soussan, stated his excitement about the concluded transaction, which he described as a resilient source of debt capital that the company has been nurturing since its early days.

Silvr’s mission is centred around providing SMEs with accessible and timely funding, helping them scale in a challenging European market. The company uses real-time data-scoring algorithms to approve loan applications within hours, effectively enabling quick, easy and reliable financing. Silvr’s innovative model aims to bridge the growing funding gap for SMEs, a problem underscored by the European Central Bank’s recent survey that predicts a 2.7% contraction in corporate lending in 2023.

With the newly raised €200m, Silvr plans to offer up to €200m worth of new loans, potentially aiding thousands of businesses in securing funds within 48 hours. This strategy aims to tackle the significant issue of limited funding access, as indicated by European SMEs’ average rating of their current funding access being a mere 4.2 out of 10.

Clair, scoops $175m for a novel, on-demand payment solution

Clair, the innovative FinTech firm dedicated to transforming financial services for workers, has successfully secured a substantial $175m in its latest funding round.

Clair’s commitment to aiding frontline workers gain immediate access to their wages has paved the way for an exciting development in the financial landscape.

The financial boost comprised of $150m for its consumer lending program, backed by FDIC-insured bank, Pathward N.A., and an additional $25m in equity.

Thrive Capital headlined the equity round, with contributing investments from Upfront Ventures and Kairos, further strengthening Clair’s venture capital coffers to a total of $45m. As part of the agreement, Michael Presser, an investing partner at Kairos, will join Clair’s team as a board observer.

The company’s unique proposition lies in its provision of a consumer-friendly, on-demand pay solution. The system enables frontline workers to procure wage advances from Pathward N.A., fostering access to Clair’s FDIC-insured spending and savings accounts among other financial amenities.

With the fresh funding, Clair aims to expand its team and catalyse wider adoption of its services, primarily focusing on the 56% of the US workforce comprised of 76 million hourly workers. Clair’s app, already assisting more than 50,000 workers in receiving their pay as soon as their shifts end, provides a meaningful alternative to waiting weeks for paycheques, entirely free of charges.

Additional features included in the service offering are Clair for Employers, a holistic financial wellness benefit package for employees of firms not already partnering with Clair. By integrating with payroll providers seamlessly and at no cost, the service enables HR teams to save time and resources while maintaining full compliance.

InsurTech leader Qover secures $30m in Series C funding round

In the increasingly competitive InsurTech market, Qover, a pioneering firm specialising in the orchestration of embedded insurance, stands out as it successfully wraps up a $30m Series C funding round.

Qover’s mission, to craft a comprehensive safety net that safeguards everyone, globally, underscores its commitment to innovative solutions in the InsurTech space.

A dynamic array of investors, namely Alven, Anthemis, Kreos Capital, and Zurich Global Ventures, participated in this funding round. Their investment underscores Qover’s potential for sustainable growth and its capability to empower brands to orchestrate insurance through technology. This new funding is expected to turbocharge Qover’s expansion efforts, catalyse technological development, and facilitate strategic partnerships.

Qover’s key offering lies in its embedded insurance orchestration. Through a platform that smoothly integrates with any insurer or broker, Qover facilitates essential collaborations with major brands. Numerous leading companies, including Revolut, Qonto, Monzo, ING, Monese, Fisker, Nio, Volta Trucks, Niu, and Lucid, have chosen Qover as their go-to platform for embedded insurance orchestration.

Top-rated landlord insurer Steadily secures $28.5m in Series B funding

Steadily, America’s highly-rated landlord insurance company, announced today that it has successfully raised $28.5m in a Series B funding round.

The company is known for its efficient and affordable insurance offerings that cater to the 18 million individual rental property owners across the US, who own the vast majority of single family and small multi-family rentals.

The fresh funding has brought Steadily’s total capital to $59.5m, following a $16m Series A funding round in 2021. The new investment round was led by Zigg Capital and saw participation from Matrix Partners, Koch Real Estate Investments, Clocktower Technology Ventures, and Nine Four Ventures.

Steadily offers a unique digital platform that allows landlords to obtain insurance quotes in minutes, 24/7, from any location across all 50 states. The intuitive platform is designed to deliver a superior customer experience at every touch point, aiding real estate investors to easily access insurance throughout their customer lifecycle.

Steadily co-founder Datha Santomieri said, “As property investors ourselves, we understand the unique challenges and needs of rental property owners. Our product is built to deliver an exceptional customer experience at every touch point, enabling real estate investors to easily access insurance at all stages of their customer lifecycle. The ongoing support from our investors enables Steadily to continue scaling quickly to meet the growing demand of our product with investors nationwide.”

Steadily has been gaining traction in the real estate investor space as an easy, intuitive direct-to-consumer insurance provider. The company has also integrated its product into the broader real estate ecosystem, offering embedded insurance solutions for independent agents, property management systems, lender software, and more. Steadily’s meticulously designed mobile-first experience saves the user time and hassle by pre-filling many data points such as property size and year of construction. Users can obtain an insurance estimate online within minutes and communicate with a team of specialized insurance agents via phone, email, or SMS.

Tandem Bank’s green agenda gets £20m ($25.7m) boost from Quilam Capital

Tandem Bank, a UK-based digital institution renowned for its sustainability focus, has recently secured £20m from Quilam Capital.

Quilam, a seasoned investor specialising in the speciality finance sector, was instrumental in this capital raise.

In a significant boost to its expansion plans, Tandem bank has raised this considerable amount from Quilam Capital. The Tier 2 capital was secured in late June 2023, with financial services advisor Alantra playing a key role in the process.

Tandem Bank is on a mission, aiming to be the leading purpose-led, profitable digital banking platform in the UK. Committed to aiding households reduce their carbon footprints, Tandem is a proponent of the UK’s transition to a carbon-neutral economy. The bank has made a significant name for itself as a viable choice for those wishing to save, borrow, spend, and share a little bit greener.

Tandem intends to utilise this fresh capital to fuel their green lending proposition. As a bank, Tandem has consistently focused on sustainable and simple ways to save, borrow, and spend. With offerings like market-leading savings, home improvement loans, mortgages, motor financing, and consumer sharing, the bank is poised to capitalise on several exciting growth opportunities.

Automated network assurance pioneer IP Fabric bags $25m

IP Fabric, a market frontrunner in automated network assurance, has successfully procured $25m in a Series B funding round.

The funding endeavour was spearheaded by One Peak, with contributions from Senovo and Presto Ventures. This capital injection bolsters IP Fabric’s objective of universalising network assurance, mitigating the considerable risks posed by network failures or outages for individuals, businesses, and governments.

IP Fabric, a trailblazer in network assurance, assists organisations in navigating network complexity, securing network automation, and bolstering network security. Network assurance is gaining traction as a key component for managing private network infrastructure. This infrastructure, immensely larger than the internet, underpins the modern economy and forms the backbone for every facet of contemporary life, from airports and factories to public utilities and financial systems.

Despite this, rising complexity makes it increasingly challenging for human operators to comprehend and manage networks. This renders network automation unpredictable, particularly if organisations cannot discern whether automation has achieved the intended effect, and verify that it hasn’t adversely affected the rest of the network. The escalating complexity also hinders organisations from identifying and mitigating network vulnerabilities, thereby creating blind spots that attackers could potentially exploit.

AI-powered Numarics secures €10.2m ($11.3m) funding for DACH region expansion

Numarics, a Zurich-based firm known for developing an AI-powered “business OS”, has raised €10.2m. Notably, the company has acquired four businesses this year and aims to broaden its expansion across the DACH region by engaging in more M&A activities and developing its range of services.

The seed funding round amounting to €10.2m was co-led by UBS through UBS Next, the company’s venture and innovation unit, and FiveT FinTech, formerly known as Avaloq Ventures. Other participants in the round included previous investors Wingman Ventures and Seed X. This funding follows the company’s previous fundraising activities that have brought in just under €20m since the start of 2020.

Numarics is revolutionising business administration processes that have been time-consuming and unchanged for decades. Their comprehensive CFO solution consolidates accounting and finance software, providing SMEs with the necessary support from their robust operations and expert team. This aims to eliminate the barriers outdated business software can place on business growth, and in some cases, cause failure.

AUCloud nets $8.5m investment to boost cyber security and multi-cloud operations

ASX-listed cloud infrastructure-as-a-service (IaaS) provider, AUCloud, has successfully closed an $8.5m capital raise, marking an important milestone in the company’s growth journey.

The capital infusion was fully subscribed and underwritten by NextDC, businesswoman Cathie Reid, and newly appointed CEO of AUCloud, Peter Maloney, according to a report from ARN.

Established as an industry leader, AUCloud offers IaaS solutions, facilitating businesses with their cloud computing needs. It specialises in delivering highly secure and sovereign cloud services, aiding federal government agencies and private corporations to transition from on-premises infrastructure to flexible multi-cloud models.

The fresh funding will be channelled towards expanding the firm’s sales and marketing prowess. The main thrust is to seize the positive momentum in the market, which will enable the company to venture deeper into the cyber security and multi-cloud sectors.

In addition to sales and marketing, the Australian-based company is intent on furthering its cyber security and multi-cloud capabilities. Earlier this year, the company significantly invested in developing accredited sovereign cloud and cyber security capabilities nationally, setting up sovereign zones in Canberra, Sydney, Brisbane, and Melbourne.

HSBC fuels Glasswall’s expansion with a £5m (6.4m) loan

HSBC UK, an established banking institution, is investing £5m in Glasswall, a London-based cybersecurity firm with a second headquarters in the US.

Specialising in file-level security, Glasswall has become an essential tool for businesses globally, protecting them from hidden threats within their files.

The £5m investment stems from HSBC UK’s Growth Lending fund, indicating HSBC’s interest and ongoing support for tech scale-ups with high-growth potential, according to a report from UKTN. This move marks the fund’s eighth deal, illustrating the bank’s commitment to the technology sector.

Established in 2010, Glasswall’s unique cybersecurity software offers businesses an unmatched level of protection. The technology works at an individual file level, validating, reconstructing, and cleansing each file to eradicate potential security risks. By providing a system that is both robust and scalable, Glasswall addresses the evolving cybersecurity needs of businesses worldwide.

Glasswall plans to utilise the new funding to expand its operations to Canada, Australia, and New Zealand. The company aims to continue its growth rate and achieve profitability in these markets, adding to their current reach in the UK and US.

Apart from this transaction, the text also reveals HSBC’s continuous efforts to strengthen its position in the UK tech industry. Last year, it launched the £250m Growth Lending fund to support tech scale-ups.

The fund has previously invested in companies spanning various sectors, such as nanotech firm P2i, women’s health company Elvie, and edtech firm Kortext. HSBC also acquired and rebranded Silicon Valley Bank UK, further expanding its footprint in the tech industry.

Short-term rental FinTech Topkey raises $5.2m in seed funding round

Topkey, a financial operating system designed to ease the operations of short-term rental property managers, recently announced a successful seed funding round.

The company successfully raised $5.2m in its seed round, with Felicis taking the lead among the investors, according to a report from Short Term Rentalz. Other prominent contributors included Andreessen Horowitz, Y Combinator, Liquid 2 Ventures, Assurant Ventures, and Derive Ventures.

Topkey’s unique business model revolves around providing a comprehensive financial operation system to property managers. Initially launched as a marketplace for property owners and managers, the company pivoted in mid-2021 to focus on financial operations. Their platform, currently in a beta phase, offers an array of services, including billings, payments, and expense management. The aim is to streamline the process of payments, banking, invoicing, and business intelligence for property managers, thereby making their workflow less fragmented.

The newly acquired funds are earmarked for several purposes. Topkey plans to integrate with more property management systems in the vacation rental space, and there is potential for expansion into other hospitality verticals.

Topkey’s platform promises to revolutionise how property managers operate by automating tasks like expense categorisation by property, issue cards with custom limits, tag receipts, and earn cashback. It also seeks to end manual data entry by seamlessly importing transaction details into accounting software.

Go Car Credit secures £4m ($5.1m) monthly loan support from Fintex Capital

Fintex Capital, an innovative FinTech investment firm focused on alternative credit, has announced a long-term partnership with Go Car Credit, a specialist in motor finance lending. This partnership will support Go Car Credit in originating around £4m of car loans each month.

This move sees Fintex Capital providing a new funding line to Go Car Credit to back its monthly car loan origination. This generous provision will enhance Go Car Credit’s existing loan book, which currently stands at approximately £60m.

Go Car Credit specialises in providing financial solutions to consumers seeking to purchase cars. With a rigorous, data-driven underwriting process, they support a diverse spectrum of consumers, making car ownership more accessible for work and family life needs.

The newly injected funds are set to expand Go Car Credit’s responsible lending operations. With more financial capacity, they can now serve a wider demographic of customers, helping them to secure the cars they need for their daily lives.

In the current economic climate, Fintex Capital continues to show its commitment to businesses that exemplify responsible lending practices, best-in-class underwriting, and excellent customer service, all of which are traits of Go Car Credit. This new partnership is the latest in a string of multiple facilities that Fintex has recently closed as it pursues growth opportunities across the capital stack.

Zuvy, the Nigerian FinTech, scoops $4.5m for SME liquidity solutions

Zuvy, a dynamic Nigerian invoice financing company, has bagged a substantial $4.5m in a debt and equity funding round.

The firm, known for its innovative approach to managing invoice software and providing discounting services, has drawn global investors keen on supporting its mission.

The funding, which attracted a host of international investors, was led by TLG Capital, with other contributors including Dunbar Capital, Next Chymia Consulting HK, Advent International’s Chairman David Mussafer, and Khalil Osman from Vicus Ventures, according to a report from Business Day.

Zuvy’s core objective is to streamline the vendor-buyer relationship within the sphere of small and medium-sized enterprises (SMEs). Recognised for its pioneering solutions, Zuvy has risen as a provider of liquidity to burgeoning businesses, not just in Nigeria but further afield.

The company intends to use the fresh funding to continue its mission of supporting the digital shift of SMEs. By offering effective financial solutions and software tools, Zuvy aims to resolve challenges relating to administrative burdens and cash flow management often encountered by Nigerian entrepreneurs.

Since its launch in late 2021, Zuvy has expanded its service offering beyond being an invoice financing platform. Today, it provides free software tools that facilitate procurement and vendor management for larger enterprises. Initially serving the fast-moving consumer goods sector, Zuvy has witnessed impressive growth, expanding its presence into the healthcare and supply chain industries.

Zuvy has also introduced an integration with WhatsApp, enabling vendors to send invoices to buyers seamlessly. This innovative feature eradicates the time-consuming processes associated with paper invoicing, offering larger buyers considerable time and resource savings, while vendors enjoy discounts on invoice payments.

Utransfer of U Fintech Hub bags $4m in funding for global expansion

South Korean powerhouse, U Fintech Hub, a renowned FinTech company, recently announced the successful completion of its latest funding round. The firm specialises in remittance services, operating the widely used Utransfer platform.

In its most recent capital drive, U Fintech Hub successfully amassed $4m. The round was led by Forest Partners, a rapidly ascending venture capital firm noted for its yearly growth rate exceeding 200%. With this latest injection, U Fintech Hub’s total raised capital is now approximately $10m, bolstering its financial stability and priming it for sustained growth and innovation in the intensely competitive FinTech industry.

At the heart of U Fintech Hub’s operations lies Utransfer, a global remittance platform that caters to both B2B and C2C markets. The platform facilitates local payouts, money exchange services, and several other business services related to foreign currencies. As a licenced “Electronic financial business operator,” “Overseas remittance service provider,” and “Online exchange business operator,” U Fintech Hub adheres to stringent industry regulations, ensuring the highest standards are met.

The funds raised will propel U Fintech Hub’s long-term global strategies and support its ongoing expansion. This fresh capital will offer the firm enhanced flexibility to navigate the demanding market conditions and aid in the development of new, innovative products and solutions.

Despite the harsh business conditions imposed by the global pandemic, U Fintech Hub managed to extend its reach, establishing entities and offices in Singapore and procuring local licenses. This commitment to growth and adaptability has secured U Fintech Hub’s standing as a significant player in the FinTech arena.

Keewe secures €3m ($3.3m) funding to enhance international green payments

Revcast, the pioneer of modern RevOps, secures a robust $3m seed round

The revolution in Revenue Operations (RevOps) continues to gather pace, with the announcement that Revcast has secured a $3m seed funding round.

Founded as the first startup from venture studio 24 and Up, Revcast has carved out a niche as a pioneering platform in the world of modern RevOps.

The seed funding round was spearheaded by CRV and saw substantial contributions from a cadre of investors, including Coughdrop Capital, Firsthand Alliance, IDEA Fund Partners, Lorimer Ventures, Tiferes Ventures, and Oldslip.

Revcast is driven by a mission to overhaul the traditionally spreadsheet-dominated realm of RevOps, with a focus on quotas, hiring plans, ramps, and attrition rates. Their approach aims to increase transparency, identify hidden risks, and uncover missed opportunities, with a firm belief that purpose-built software can significantly improve revenue planning.

This latest capital injection will be employed to further their ambition of creating a central, transparent hub that aids organisations in building and managing revenue plans. Revcast’s software offers real-time insight into sales team staffing, ‘quota-on-the-street’, onboarding ramp times, and performance against projections, by integrating with CRM and HR systems.

In tandem with improving the RevOps process, Revcast is committed to raising visibility into revenue planning across an enterprise, recognising the growing importance of the modern RevOps function. Their vision extends to providing agile data and transparency that enable CEOs, CFOs, CROs, and sales leaders to better understand their business, manage risks, and optimise revenue.

Chilean FinTech firm Shinkansen nets $3m for cross-border expansion

Shinkansen, a burgeoning FinTech start-up hailing from Chile, has recently celebrated the successful closure of a seed investment round.

The young company is known for its revolutionary approach to speedy financial transactions, reflecting the swift movement of Japan’s Shinkansen train network which inspired its name.

A considerable $3m was raised in this funding round, which was spearheaded by Mexico’s eminent venture capital firm, ALLVP, according to a report from Tech Gist Africa. Notably, the round also saw contributions from Salkantay, Chileventures, and Pedro Pineda, the co-founder of Fintual and a Sequoia Scout, who all threw their financial support behind Shinkansen.

The company, named after the famous Japanese high-speed railway system, has carved a niche in the FinTech sector by focusing on expediting money transfers and transactions. Its innovative application programming interface (API) integration system is a game-changer for the Latin American market, which has often grappled with the challenges of country-specific integrations.

The raised funding is set to underpin Shinkansen’s growth ambitions, with a particular focus on expanding its presence across Latin America, including markets such as Mexico and Peru. This move aims to streamline money movement in these fragmented markets, boosting efficiency and bypassing regulatory roadblocks.

An additional standout feature of Shinkansen is its adept use of artificial intelligence to automate operations, allowing for seamless integration of its APIs with banks in Chile, Colombia, Mexico, and soon, Peru. Further underlining its innovativeness, Shinkansen operates a “regulator-friendly” model that ensures security and traceability by not directly handling money flow.

The company’s early clientele list boasts notable names like Xepelin, Buk, and Buda, alongside stockbrokers, insurance companies, and retail chains. Its technical prowess and emphasis on AI have been commended by investors, marking Shinkansen as part of a new generation of companies that give priority to AI from the outset.

Digital asset management pioneer Bequest Finance secures $2.75m

Pioneering the digital asset management realm, Bequest Finance, has announced the successful acquisition of $2.75m in a recent funding round.

The funding round, which stood at $2.75m, was headed by leading FinTech venture capital firm, Nyca Partners. In addition to this, Bequest Finance attracted investment from the esteemed investor Mark Cuban, alongside other notable firms based in Silicon Valley.

Set to revolutionise the multi-trillion dollar trusts and estates industry, Bequest Finance offers non-custodial distribution solutions that enhance the legal processes surrounding digital assets.

Founded by co-partners Anna Mouland and Robert Muresan, the company’s inception was sparked by the recognised limitations of digital asset succession. In effect, Bequest Finance aspires to streamline the integration of all digital assets into the global trusts and estates industry. Through their platform, they aim to enable estate planners to add any digital asset, from Bitcoin to email and photo or video content, to their client’s estate in a compliant manner.

With their recently raised funds, Bequest Finance plans to further develop their innovative solutions. These solutions not only contribute to market expansion but also help facilitate a potential inflow of tens of billions of dollars annually.

DeFi platform AlloyX secures $2m pre-seed round

AlloyX, a platform in the DeFi sector that specialises in aggregating tokenised credit, has bagged $2m in pre-seed funding and launched a new product.

The firm has successfully closed a $2m pre-seed funding round and simultaneously launched a pioneering product: a liquid real-world asset (RWA) vault.

This substantial $2m pre-seed funding round was spearheaded by Hack VC and saw participation from numerous investors including Circle Ventures, Digital Currency Group, Stratos, Lecca Ventures, MH Ventures, very early Ventures, Archblock, dao5, and Credix Finance.

AlloyX’s modus operandi is integrating diverse credit protocols into a single, cohesive platform. So far, the firm has integrated with nine such protocols, and is working to create the industry’s first blended investment vault, in collaboration with partners Credix Finance and a tokenised U.S. Treasury Bills protocol.

The recent launch of the RWA vault is an innovative move by AlloyX to tap into the more than $530m active loans on-chain in the private credit market. This product amalgamates Credix’s high-yield, over-collateralised tokenised private credit investment with highly liquid tokenised U.S. T-bills. This development allows investors such as decentralised autonomous organisations (DAOs) to gain access to liquidity, yield and diversification in tokenised credit.

AlloyX’s new funding will fuel the further development of their robust platform. They intend to build upon their industry-first blended investment vault and explore further opportunities to diversify and enhance the platform’s offerings.

Moroccan B2B e-commerce player, Chari, seizes $1.5m in funding

Chari, a Morocco-based company specialising in B2B e-commerce, is making considerable strides in the African market.

Chari has successfully raised $1.5m, with Verod-Kepple Africa Ventures (VKAV) leading the investment round. In a bold move, VKAV’s partner, Ryosuke (Rio) Yamawaki, will also join the company as a Strategic Advisor, emphasising VKAV’s commitment to Chari’s vision and expansion plans.

Chari has emerged as a game-changer in the region by capitalising on the largely informal retail shops that constitute over 80% of Morocco’s fast-moving consumer goods (FMCG) trade. This sector, prevalent across many African countries, often faces hurdles due to multiple intermediaries, insufficient digitalisation, and scarce access to trade finance. Chari offers a revolutionary model, supplying essential goods and services more efficiently and economically to these informal retail shops.

The newly-acquired funding will aid Chari in its ambitious mission to transform the informal retail sector, driving economic growth in the region. Chari aims to leverage VKAV’s widespread African network and profound connections within the Japanese corporate society to deliver cutting-edge financial services infrastructure to the mass market.

VKAV’s commitment doesn’t end with the financial investment. Yamawaki’s role as a strategic advisor underscores the firm’s investment in Chari’s growth and commitment to the broader African economy. By uniting their efforts, the partnership will facilitate Chari’s growth plans and continue to push the development of its groundbreaking financial services infrastructure.

WealthTech platform Selma Finance surpasses target, raises €1.3m ($1.4m)

Selma Finance, a Switzerland-based WealthTech platform, recently concluded a successful crowdinvesting campaign. This innovative digital financial advisor secured more than €1.3m from its vibrant community of supporters, exceeding its original fundraising target by a significant 30%.

The successful campaign attracted investments from over 550 investors, a majority of whom are Selma’s existing clients. The platform’s commitment to community involvement and customer centricity is clearly demonstrated by its clients’ eagerness to take on active shareholder roles in the company. This strategy has yielded fruitful results, as the platform was able to raise €300k more than its initial goal of €1m.

Specialising in personalised financial advice, Selma’s offering is tailored to each client’s unique circumstances. Their comprehensive wealth management service factors in clients’ current financial situation, market conditions, and individual financial goals, presenting customised investment suggestions through their user-friendly application.

The newly raised funds will primarily be directed towards enhancing the features of Selma’s WealthTech platform, as suggested by their community. This includes refining the advice Selma provides to clients, improving transaction visibility and performance details within the app, and exploring suitable solutions for joint accounts, families, and diverse investment objectives. With these planned improvements, Selma aims to secure its position as the leading wealth management app in Switzerland.

The crowdinvesting campaign has underlined the importance of Selma’s community, which the company acknowledges as its most significant growth driver. This close-knit community’s unwavering support was particularly felt during the campaign’s launch, which witnessed a rapidly increasing investor percentage.

Smarter Contracts seals $1m in backing for its blockchain consent platform

Smarter Contracts, the pioneering marketing and privacy technology firm, has successfully raised $1.095m in a funding round.

This round has been led by a couple of private investors and bolstered by a prize from the Amazon AWS FinTech Accelerator, administered by Vestbee, according to a report from City AM.

The funds raised will significantly boost Smarter Contracts’ ongoing development of their unique blockchain-based consent and permissions management platform, named Pulse®. This investment will act as a springboard for the continuous enhancement of Pulse® and the creation of new product features.

Smarter Contracts’ platform, Pulse®, operates within the blockchain ecosystem to provide consent and permissions management. By leveraging blockchain technology, the platform ensures that users have complete control over their data and its usage, a feature that is increasingly sought-after in today’s digital era.

The raised capital will be invested in several areas of the company. Primarily, it will help Smarter Contracts to broaden its team. In addition to this, the firm plans to increase its focus on research and development initiatives, as well as form more strategic partnerships, thereby strengthening its position in the tech market.

This fundraising event serves as a testament to the resilience and perseverance of the Smarter Contracts team. Wayne Lloyd, founder and CEO of Smarter Contracts, spoke about the company’s inception four years ago and the gap they identified in the market. He expressed his pride in his team’s unwavering commitment and vision, which he believes is reflected in this significant fundraising achievement.

Indian FinTech innovator 50Fin secures INR 4.25 crore ($525k)

50Fin, an Indian financial technology firm, has announced the successful closure of its recent pre-seed funding round.

The company has raised an impressive INR 4.25 crore ($525,000) in this round, which was led by 100X.VC, Keynote Capital, and Arun Venkatachalam, according to a report from Entrepreneur India.

A host of angel investors also participated, including KRS Jamwal, Aniket Nikumb, Manish Kumar, Sumit Khadria, Rajesh Sawhney, and Dinesh Agarwal, among others.

In the bustling world of FinTech, 50Fin has carved out its niche by offering instant loans against mutual funds and shares to its customers. Operating with an aim to transform the secured credit landscape in India, the company currently is in the process of integrating its platform with leading Asset Management Companies and Portfolio Management Services. Additionally, the firm is on a mission to disburse INR 100 crore loans by the end of the current financial year.

50Fin intends to channel the newly raised funds towards the further enhancement of its embedded solutions and to bolster its product portfolio and customer service. The company’s commitment to revolutionise the financial landscape, combined with its vision for the future, sets the stage for exciting advancements.

Beyond the details of the funding round, 50Fin has received praise from the market. Its innovative solutions, such as the fully digital process for instant underwriting of mutual funds and shares, have earned a positive response from users.

Husmus secures backing from Google and Innovate UK to tackle housing financial exclusion

Keep up with all the latest FinTech news here

Copyright © 2023 FinTech Global