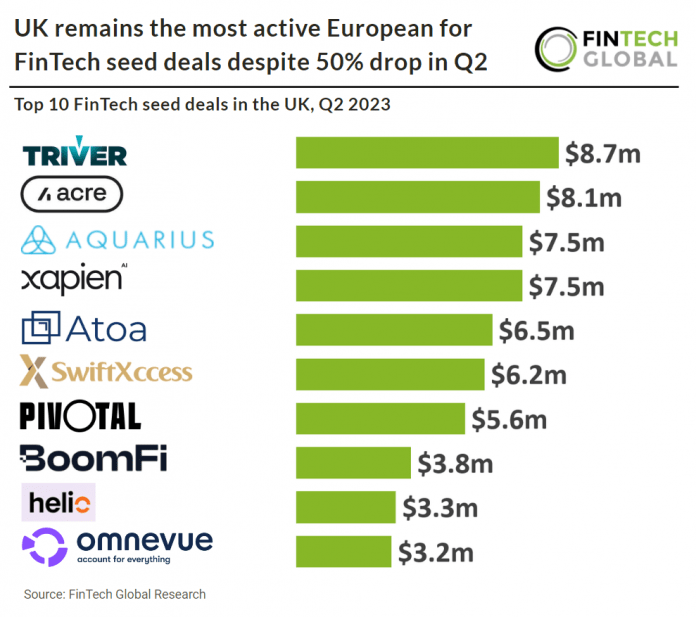

Key UK FinTech seed deal investment stats in Q2 2023

• UK FinTech seed deal activity reached 60 transactions in Q2 2023, a 50% drop YoY

• UK FinTech companies raised a combined total of $91m at the seed stage during the second quarter, a 49% drop from Q2 2022

• The average UK FinTech seed deal size decreased 18% YoY to $1.51m in Q2 2023

The UK retains the title of the most active FinTech seed deal country in Europe with a 32% share of seed transactions on the continent despite a significant drop during the second quarter of 2023. During the quarter, there were 60 deals in the UK FinTech seed investment landscape, marking a 50% decrease compared to the previous year. UK FinTech firms secured a total combined investment of $91m, reflecting a 49% decline in Q2 2023 compared to the same period in 2022. In comparison to Q2 2022, the average deal size among UK FinTech seed deals expesrienced a decline of 18%, reaching $1.51 million in Q2 2023.

Triver, which provide instant capital in a click for small businesses, via partners through embedded finance, had the largest FinTech seed deal in the UK during Q2 2023 after raising $8.7m (£7m) in their seed round from ten investors. Investors included, Stride, Axeleo Capital, and Motive Partners, with scout investment from Andreessen Horowitz and Sequoia Capital. Founded by Jerome Le Luel, a former chief risk officer at Funding Circle and former global head of risk analytics for Barclays, Triver funds SMEs’ short-term working capital needs, providing advances on a business’s client invoices with the click of a mouse. Le Luel says SMEs can access finance equivalent to up to 20% of their annual turnover, instantly, and at a more competitive rate than other small business financing options in the market. “Existing short-term finance solutions rarely fully satisfy small businesses,” he says. “Yet it’s not a simple puzzle to solve. SMEs have complex cash flow management and underwriting their credit risk automatically is very hard – it has not been a priority for banks. But at Triver, we’ve cracked the code.” Using transaction-level insights, Triver is designed to be embedded within digital service providers already serving SMEs, such as accounting platforms, digital banks, payment providers, and procurement tools.

Blockchain & Crypto was the most active UK FinTech subsector for seed deals in Q2 2023 with 17 deals, a 28% share of total deals. RegTech was second with nine deals, a 15% share and WealthTech was third with eight transactions.

In February 2023, the UK government unveiled its vision for the future regulatory framework for cryptoassets. This proposal aims to integrate various cryptoasset activities, such as custody, issuance, and operating trading venues, into the existing Financial Services and Markets Act 2000 (FSMA) regime. This shift would replace the current registration system for cryptoasset exchange and custodian wallet providers under the MLRs since January 2020. The approach builds upon existing regulatory structures, like the E-Money Regulations and Payment Services Regulations, to encompass cryptoassets, expanding the regulatory scope.

UK remains the most active European for FinTech seed deals despite 50% drop in Q2

Investors

The following investor(s) were tagged in this article.