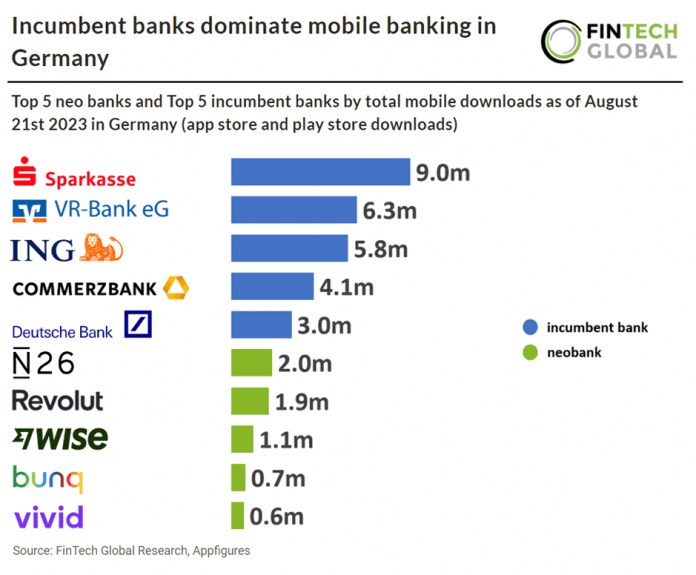

Key German mobile banking download stats as of August 21st 2023:

• VR Bank was the most downloaded mobile banking app in 2022 with 5.6m downloads

• Combined app downloads from incumbent banks totalled at 28.2m compared to 6.3m from neobanks

• Neobanks listed above have seen an average CAGR of 23.7% from 2020 – 2022 for app downloads

The divide between neobanks and established incumbent banks is narrowing, with agile and technology-driven approaches seemingly delivering greater value than traditional banking models. Despite the current dominance from incumbent banks, CAGR for neobanks is considerably higher than incumbent banks indicating an overtake in future years. Neobanks listed have seen an average CAGR of 23.7% from 2020 – 2022 for app downloads and incumbents have seen an average of 2.4% over the same period (excluding VR Bank who launched their app in 2021). The most likely candidate to catch up with Sparkasse is Revolut, a UK based neobank, as their current CAGR from 2017-2022 is 119%. If Revolut continues to grow at this rate they will catch up with Sparkasse within three years although this growth will likely plateau. VR Bank was the most downloaded mobile banking app in 2022 with 4.6m downloads whilst Revolut was the most downloaded neobank with 0.6m downloads.

Sparkassen-Finanzgruppe, a network of public banks that together form the largest financial services group in Europe, have the most downloaded banking app in Germany, as of August 21st 2023 with 9.0m downloads. The group consist of 510 companies, around 11,000 branches and boasts 40m checking accounts in 2022.

N26, a German neobank with a full German banking license, is the most popular neobank in Germany as of August 21st 2023 with 2m downloads. N26 has 8m customers across 24 countries as of 2023. N26 offers several key advantages: no ATM withdrawal fees, with 3 free monthly withdrawals; no monthly account fees; accessibility in English; online-based operations, eliminating the need for physical visits; quick card blocking and replacement; availability in multiple languages; and avoidance of time-consuming in-person banking tasks.