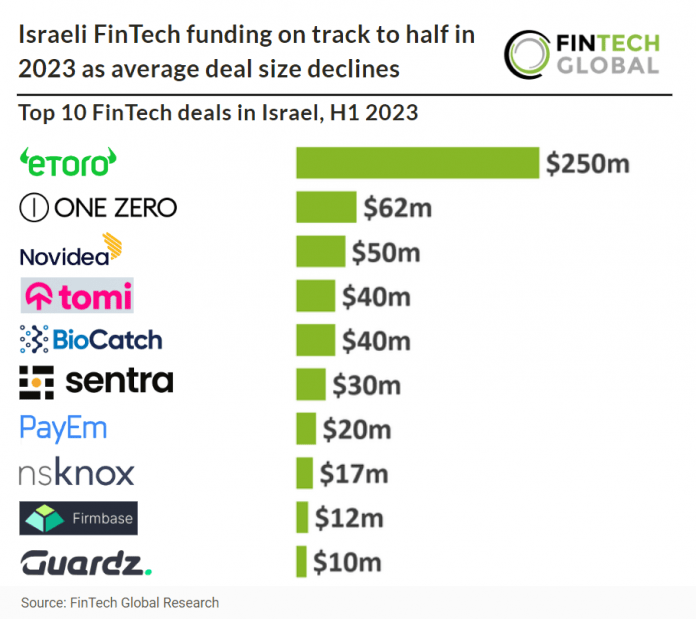

Key Israeli FinTech investment stats in H1 2023:

• Israeli FinTech companies raised a combined investment of $617m during the first six months of 2023, a 30% decrease YoY

• FinTech companies in Isreal are on track to raise $1.2bn in 2023, a 57% reduction from 2022

• Israeli FinTech deal activity remained similar in H1 2023 YoY at 35 deals one more, than H1 2023

Israeli FinTech has seen a resilient H1 2023 with deal activity barely changing although investment has dropped significantly. In the first half of 2023, Israeli FinTech firms secured a total investment of $617 million, marking a substantial 30% YoY decrease. Israeli FinTech investment is projected to reach $1.2 billion in 2023, representing a notable 57% drop compared to the previous year, 2022. In the first half of 2023, Israeli FinTech deal activity remained consistent year-over-year, with 35 deals, just one more than in the same period of 2022. The average FinTech deal size was $18.17m in H1 2023, a 28% drop from H1 2022.

eToro, a social investment and trading platform, had the largest Israeli FinTech deal in H1 2023 after raising $250m in their latest corporate funding round. Investors include ION Group, Social Leverage, SoftBank and Spark Capital. This funding came from an Advance Investment Agreement (AIA) which eToro entered into in February 2021 as part of its proposed SPAC transaction. The company also acquired options trading app Gatsby to continue the diversification of eToro’s US offering after the launch of stocks and ETFs, and Bullsheet, a provider of portfolio management tools designed exclusively for eToro users. eToro is also expanding its global footprint by partnering with regulators around the world in the evolution of the digital assets ecosystem securing registrations in France, Italy, and most recently a licence in New York. It also secured an approval in-principle to operate as a broker in Abu Dhabi.

The Israel Securities Authority and the Central Bank of Bahrain signed a FinTech cooperation agreement on September 4, 2023. This agreement aims to enhance innovation and regulatory support for the FinTech industry in both countries, strengthening their trade ties. The signing occurred during Israel’s Foreign Minister Eli Cohen’s visit to Bahrain, focusing on strengthening economic and civil relations, including finalizing a free trade agreement. This collaboration is a result of the normalization of ties between Israel and Bahrain in 2020 through the US-brokered Abraham Accords, which also led to diplomatic relations with the United Arab Emirates and Morocco. The agreement involves regulatory guidance and support for FinTech startups in both countries, promoting innovation and facilitating access to global markets for financial services entrepreneurs.