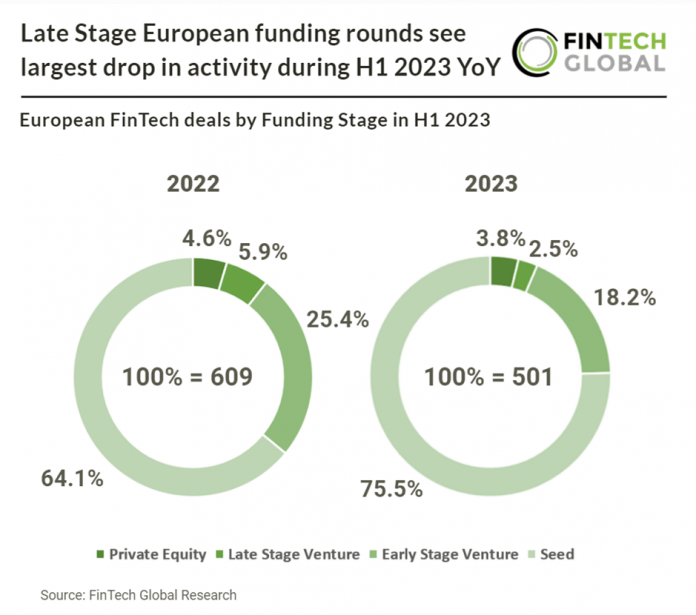

Late stage FinTech funding rounds in Europe have fallen 64% to 13 deals in H1 2023 from the previous year, a significant drop compared to other funding stages. Seed deals have been the most resilient funding stage in H1 2023 with only a 3% drop to 378 deals. Private equity saw a 32% decrease to 19 deals and early stage funding rounds saw a 42% drop to 91 deals.

The significance decrease of late-stage dealmaking is good or bad depending on your job position and perspective regarding the potential size of the startup market before it becomes saturated with too many companies attempting to scale concurrently.

On one side of the argument, a more substantial drop in late-stage deal activity would imply that startups in their later phases, such as Series B and C companies, would encounter greater challenges in securing pre-IPO funding from venture investors. Conversely, these different startup stages serve not only as a means to categorize the venture market into distinct segments but also function as a filter to identify companies that fail to meet growth and scalability expectations.

Viewed from this angle, a reduced late-stage market could mean that less robust startups would be unable to access capital they couldn’t efficiently utilize. While this may be harsh for startups caught between funding rounds and developmental stages, it might actually benefit the FinTech market. Swift failures lead to a quicker recycling of human capital compared to heavily funded startups that eventually become costly and unproductive “zombies.”