Key Indian FinTech investment stats in 2023:

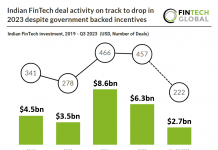

• Indian FinTech companies raised a combined $3.2bn in 2023, a 49% drop from 2022

• Indian FinTech deal activity totalled at 275 deals in 2023, a 40% drop from the previous year

• Lending Technology was the most active Indian FinTech subsector in 2023 with 58 transactions, a 21% share of total deals

In 2023, Indian FinTech firms faced a notable decline in their fundraising efforts, collectively securing $3.2bn, which marked a significant 49% decrease compared to the previous year. This downturn was mirrored in the deal activity within the Indian FinTech sector, as the number of deals dwindled to 275, reflecting a substantial 40% drop from 2022.

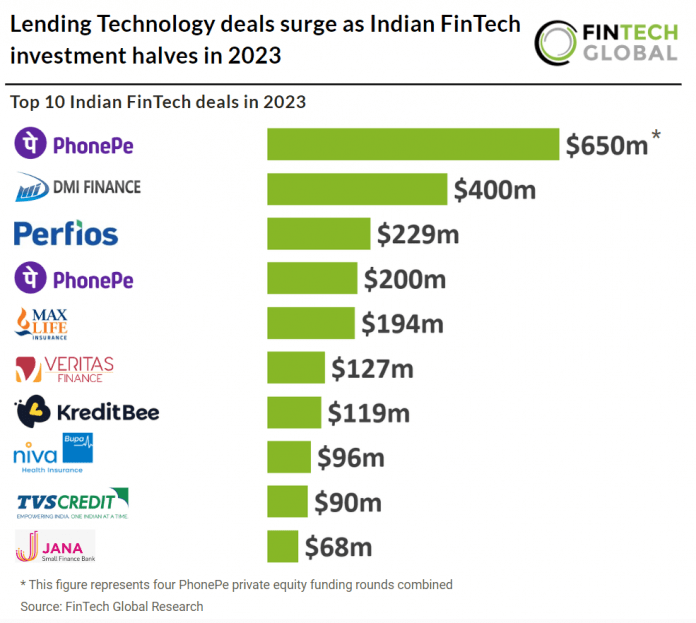

PhonePe, an Indian payments application, raised the largest amount of funding in India during 2023, raising $850m in total during the year. PhonePe plans touse the funding to enter and scale new businesses such as insurance, wealth management, lending, shopping and account aggregators with the new funding. PhonePe most recent update was releasing Share.Market, a stock broking app, is available as a mobile app or web platform and will enable retail investors and traders to purchase stocks, mutual funds, and ETFs. Established in 2015, PhonePe claims to be India’s largest payments app, catering to both consumers and merchants, serving over 440 million users across the subcontinent. It offers payment services, including bill payments, as well as investments and insurance products.

Lending Technology was the most active Indian FinTech subsector in 2023 with 58 deals, a 21% share of total deals. This was followed by WealthTech with 41 deals, a 15% share of deals and third was RegTech with 39 deals, a 14% share of total deals.

In India’s 2023-2024 financial budget, the Government of India allocated INR 1,500 crores ($180m) for FinTechs and banks. Earlier, they had announced a separate incentive of INR 2,600 crores ($312m) to support fintech startups and banks, particularly in promoting Unified Payments Interface (UPI) transactions. The government is also taking steps to encourage investments in technology, fintech, and startup sectors. Furthermore, the International Financial Services Centre Authority (IFSCA) introduced an incentive scheme, facilitating access to overseas markets for domestic FinTechs and foreign FinTechs looking to enter IFSCs in India. Additionally, the government proposed various tax-related relaxations, such as extending the deadline for funds relocation to IFSC GIFT City from March 31, 2023, to March 31, 2025.