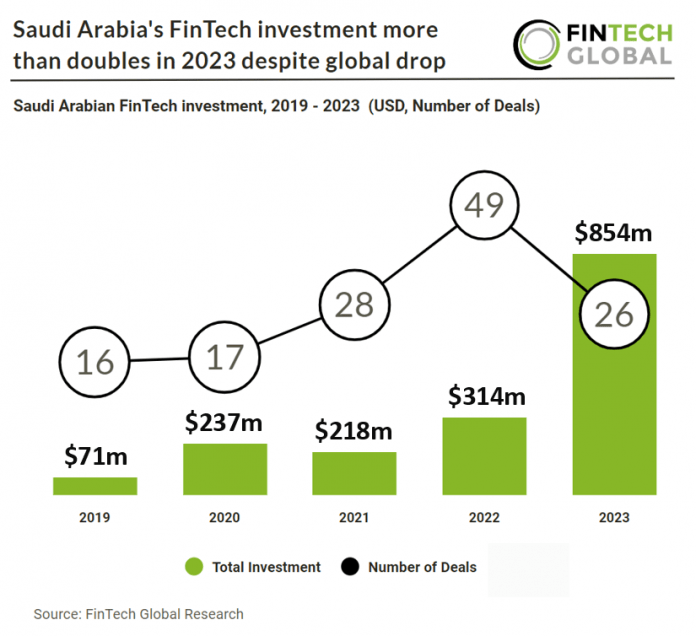

Saudi Arabia’s FinTech investment more than doubles in 2023 despite global drop

Key Saudi FinTech investment stats in 2023:

• Saudi FinTech companies raised a combined $854m in 2023, a 270% increase from 2022

• Saudi FinTech deal activity totalled at 26 deals in 2023, a 47% reduction from 2022

• Two large FinTech deals accounted for 69% of Saudi FinTech investment in 2023

In 2023, the FinTech sector in Saudi Arabia witnessed remarkable growth, with companies collectively raising $854 million, marking a substantial 270% surge compared to the previous year. Despite this surge in funding, deal activity experienced a notable decline, with only 26 deals completed, reflecting a 47% reduction from 2022 levels. Notably, the sector was influenced by two large deals, which together constituted a substantial 69% of the total funding to Saudi FinTech for the year. These cam from Tamara ($340m) and Tabby ($250m).

Tamara, a FinTech platform for shopping, paying, bnpl and banking, secured $340m in their latest Series C funding round, led by Sanabil and Saudi National Bank. The company has become the Kingdom’s first homegrown FinTech unicorn. The new funding will be utilized by the company to fuel its continued growth and expansion endeavours. Abdulmajeed Alsukhan, CEO of Tamara, conveyed his pride in this accomplishment, highlighting the company’s determination to advance further, saying, “Saudi Arabia deserves its place on the world stage for financial technology. Just as Tamara was created by local entrepreneurs, nurtured by a supportive local ecosystem and market regulators, we stand here today, humbled and hungry, ready for our own leapfrog moment. This achievement is a testament to the ecosystem, to our incredible team, investors, and the collaborative spirit that makes this region a great place for talent to flourish.

PayTech was the most active FinTech subsector in Saudia Arabia during 2023 with 11 deals, a 42% share of total deals. PropTech was the second most active FinTech subsector with fives deals, a 19% share of deals.

On 7th July 2023, the Saudi Central Bank (SAMA) introduced Implementing Regulations for the Law of Payments and Payment Services. These regulations establish fresh regulatory and supervisory frameworks for payments, with the aim of enhancing alignment with analogous international principles and standards, such as the Principles for Financial Market Infrastructures (PFMI) provided by the Bank for International Settlements. Anticipated outcomes include the creation of a more enticing investment environment, stimulation of innovation and competition within the region, and encouragement for the financial industry to offer clients payment products and services that align closely with their requirements and conform to the latest international standards, as highlighted by SAMA. Consequently, the previous Payment Service Provider Regulations have been replaced by these Implementing Regulations for the Law of Payments and Payment Services.