Nearly $1bn is raised across 20 FinTech funding rounds closed this week, propped up by three sizeable deals.

It proved to be a bigger week for funding rounds compared to last week, which saw just $317m invested across 12 deals. Of that funding, a third came from just one deal that closed on $100m.

This week saw three deals lead the way for funding, with Rain, NinjaOne and ID Finance all raising more than $100m.

The biggest deal of the week was secured by financial wellness platform Rain, which garnered $300m in financing from Clear Haven Capital Management. The FinTech company aims to help those in the US that live paycheck to paycheck by giving them real-time access to their earn wages.

NinjaOne was the second biggest deal of the week, pulling in a total of $231.5m for its Series C round, which was led by ICONIQ Growth. The company automates endpoint management for organisations striving for enhanced visibility, security, and control over their IT environments.

ID Finance was the last company to raise more than $100m, pulling in $150m in a financing round led by i80 Group. ID Finance is a WealthTech company that provides users with the tools to improve the management of their personal finances.

These three deals made a big impact on the total funds raised this week, accounting for $681.5m of the total capital raised by FinTech this week. Expanding this to the top 10 deals, a total of $856m was raised.

In terms of the most popular sectors for the week, InsurTech and CyberTech both accounted for four deals. The CyberTechs were NinjaOne, IONIX, LimaCharlie and Device Authority, while the InsurTechs were Kin Insurance, Shepherd, Artificial Labs and MediConCen.

One of the InsurTech funding rounds that is worth noting is Kin Insurance, which raised $15m in a round led by led by Activate Capital. What makes this deal notable is that it brings the InsurTech’s valuation to over $1bn, earning itself a spot among the highly-coveted group of Unicorns.

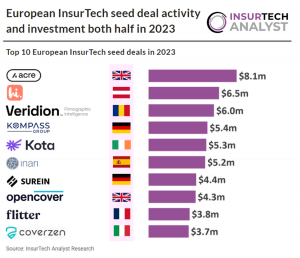

Despite the popularity of InsurTech this week a recent report from FinTech Global found that European InsurTech seed deal actvity and investment both halved in 2023. In 2023, European InsurTech seed companies raised a total of $87m, reflecting a 52% drop compared to 2022. Similarly, the number of seed deals in the European InsurTech sector decreased by 51%, with only 57 deals recorded in 2023.

Infrastructure & enterprise software and WealthTech were the next most popular sectors, each recording three deals. The Infrastructure & enterprise software companies were Pennylane, Tuum, and finally, while the WealthTechs were Rain, ID Finance and SUMA Wealth.

Wrapping up the sectors, there were two RegTech deals (Closinglock and docStribute), two marketplace lending (Traive and Candor), one PayTech (Navro) and one PropTech (Spotr).

In terms of countries, the US accounted for nine of the deals, which was the same amount as last week. These companies were Rain, NinjaOne, Kin Insurance, Shepherd, Closinglock, LimaCharlie, finally, SUMA Wealth and Candor. Following behind the US was the UK with four deals (Navro, Artificial Labs, Device Authority and docStribute).

The other countries represented this week were Spain (ID Finance), France (Pennylane), Israel (IONIX), Estonia (Tuum), Brazil (Traive) and the Netherlands (Spotr). Finally, MediConCen is based in Hong Kong.

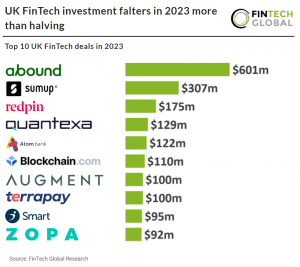

Similar to the trends faced by European InsurTech activity, UK FinTech activity dropped by 50% in 2023. FinTechs in the UK raised a total of $4.1bn, marking a substantial 59% decline compared to the previous year. This decline in funding was accompanied by a notable decrease in deal activity, with a total of 396 deals recorded in 2023, representing a 31% reduction YoY. Additionally, the average deal size for FinTech ventures in the UK also witnessed a significant drop, declining by 38% to $10.9m in 2023 compared to the figures from 2022.

Here are the 20 FinTech funding rounds covered on FinTech Global this week.

Rain partners with Clear Haven to secure $300m for financial wellness expansion

Rain, the pioneering financial wellness platform known for empowering companies to offer employees enhanced control over their finances, has successfully secured $300m in financing from Clear Haven Capital Management.

This strategic move provides Rain with a substantial credit facility, significantly enhancing its capacity to service its expanding customer base.

Rain offers a solution that addresses the critical issue of traditional pay cycles hindering savings and financial well-being. In the United States alone, it is estimated that people spend over $170bn waiting for their next paycheck. Rain’s platform mitigates this issue by providing employees with real-time access to their hard-earned wages, eliminating the typical wait for payday.

The recent infusion of $300m from Clear Haven will enable Rain to scale its services, offering this vital benefit to a broader array of employers interested in adopting earned wage access (EWA) as a part of their employee benefits package.

In addition to its pay-on-demand feature, which operates similarly to an ATM charge, Rain offers a suite of financial wellness tools and adheres to stringent compliance standards. The platform is designed to integrate seamlessly with existing payroll systems, requiring minimal data for operation, and is offered free of charge to employers. This approach not only simplifies the implementation of EWA benefits but also supports employers in boosting retention, engagement, and productivity among their workforce. Rain’s efforts have already yielded significant savings for its users, avoiding over $51m in overdraft fees and payday loan interest, further underscoring its commitment to financial wellness.

Automating endpoint security: NinjaOne raises $231.5m in its Series C

NinjaOne, a forefront player in the IT management sector known for its endpoint management, security, and visibility solutions, has successfully secured a $231.5m Series C funding.

The round was led by ICONIQ Growth, with significant contributions from notable investors such as Frank Slootman, Chairman and CEO of Snowflake, and Amit Agarwal, President of Datadog. This strategic investment has brought ICONIQ Growth General Partner Roy Luo onto NinjaOne’s board of directors, marking a new chapter in the company’s journey towards innovation and market expansion.

At its core, NinjaOne is dedicated to automating endpoint management for organisations striving for enhanced visibility, security, and control over their IT environments. Founded by Sal Sferlazza and Chris Matarese in 2013, the company initially aimed to revolutionise remote monitoring and management (RMM) for Managed Service Providers (MSPs). Since its inception, NinjaOne has grown significantly, managing over seven million endpoints for MSP and IT teams across more than 80 countries, serving esteemed clients like Hello Fresh, Nissan, and the University of Oxford.

The recent funding is earmarked for multiple strategic initiatives aimed at bolstering customer success and support, driving product innovation, and ensuring scalable growth.

i80 Group leads $150m financing round for FinTech leader ID Finance

ID Finance, a leading FinTech based in Spain and Mexico, has recently concluded a significant financial milestone by securing $150m in debt financing.

This round was led by the i80 Group, marking the largest financing round in the company’s history. The fresh capital infusion is earmarked for the acceleration of their flagship financial wellness application, Plazo, underpinning the company’s strategic growth initiatives. This deal stands out as one of the largest financing rounds for a Spanish FinTech in recent times, propelling ID Finance towards achieving its ambitious growth targets.

At the core of ID Finance’s operations is its pioneering role in the FinTech industry, particularly in alternative lending. The company is renowned for offering innovative financial solutions that blend technology with financial wellness. ID Finance has made significant strides in the sector, with its operations primarily focused on the Spanish and Mexican markets.

The newly secured funds from the i80 Group will be directed towards expanding Plazo, ID Finance’s financial wellness app. This expansion includes scaling its lending capabilities and adding innovative, value-added features to its service offering.

Adding to the narrative of growth and innovation, ID Finance has shown remarkable financial resilience and expansion over the past year. The group reported a consolidated revenue of €180m, with a net income of €7.1m, indicating a 13% growth year-over-year. The Spanish division remains a pivotal profit center, further solidifying ID Finance’s leadership in the consumer lending market.

Pennylane raises €40m ($43m) to empower accountants with AI

Pennylane, a France-based FinTech offering an all-in-one financial tool, has successfully raised €40m from Sequoia Capital and DST Global.

This funding reflects the company’s success in expanding its reach, having increased its small and medium-sized enterprise (SME) client base on its platform by 40-fold in just 24 months, thanks to collaboration with over 2,000 accounting firms.

At its core, Pennylane offers a unique business model within the FinTech sector. The company provides accounting firms with an accounting production tool for a fee, whilst also generating additional income when these firms outfit their clients with Pennylane’s comprehensive management tool, which includes a professional account.

The newly acquired funds are earmarked for a series of ambitious projects. Pennylane plans to fast-track the development of its various modules, make substantial investments in artificial intelligence to support accountants, and pursue an external growth strategy by partnering with companies that offer complementary expertise.

Since its inception in 2020, Pennylane has played a pivotal role in transforming the accounting industry. It champions the enhancement of accountants’ roles over the wholesale automation of accounting processes. Pennylane has won over financial professionals by offering significant time savings, improved financial visibility for client companies, and enabling accountants to act as trusted advisors.

Cybersecurity firm IONIX clinches $42m in landmark Series A financing

IONIX, a trailblazer in the attack surface management (ASM) sphere, has proudly announced the completion of its Series A financing round, amassing a notable $42m.

The latest tranche of $15m in funding was contributed by new investors, Maor Investments, and saw continued support from previous backers including Hyperwise Ventures, Team8, and U.S. Venture Partners (USVP), pushing the total investment in the company to an impressive $50.3m.

Furthermore, cybersecurity luminary Chad Kinzelberg is poised to bring his extensive expertise to the IONIX Board of Directors.

IONIX is revolutionising the way organisations perceive and manage their digital vulnerabilities. The firm’s proprietary technology, ‘Connective Intelligence’, illuminates and prioritises exploitable risks strewn across an entity’s entire digital footprint, encompassing cloud infrastructures, on-premise assets, SaaS components, and the digital supply chain. This holistic approach empowers businesses to proactively defend against threats in an increasingly interconnected digital landscape.

The infusion of fresh capital is earmarked for accelerating IONIX’s market penetration, enhancing product development, and expanding its Threat Exposure Management capabilities.

Next-gen core banking leader Tuum bags €25m ($27m) in Series B investment

Tuum, the cutting-edge core banking provider, proudly announces the successful closure of its series B financing round, amassing €25m.

The round witnessed leadership from CommerzVentures, accompanied by contributions from Speedinvest and several returning investors.

The company, renowned for its groundbreaking approach to banking technology, has been on a rapid growth trajectory since its first client partnership in February 2019. Tuum stands at the forefront of digital transformation in the banking sector, offering flexible, cost-effective systems that liberate banks to innovate, develop new products, and penetrate fresh markets.

Boasting a diverse customer base across 10 countries, with a significant footprint in the UK and the Nordics, Tuum’s financial performance has been stellar, showcasing a compound annual growth rate exceeding 250% over the last three years.

The newly secured funds are earmarked for an ambitious expansion plan. Tuum aims to strengthen its international presence, targeting pivotal markets in the DACH region, Southern Europe, and the Middle East, including the establishment of a new office.

Additionally, the investment will enable Tuum to bolster its direct sales and marketing efforts and fortify its partner channel.

Traive, agricultural FinTech, clinches $20m for international expansion

Traive, a company operating at the intersection of agriculture and financial technology, has successfully secured a $20m investment, marking a significant milestone in its journey.

The funding round was led by Banco do Brasil through the BB Impacto ASG I Fund, managed by Vox Capital, according to a report from Contxto.

This infusion of capital is dedicated to accelerating technological advancements, expanding the company’s footprint in Brazil, and launching a novel credit trading platform designed to bridge the gap between the agricultural supply chain and capital markets.

At its core, Traive is a trailblazer in the agricultural FinTech sector, employing artificial intelligence to analyze over 2,500 data points. This comprehensive risk profile analysis offers a more accurate reflection of the agricultural business sector’s realities.

Kin Insurance surpasses $1bn valuation and gains Unicorn status

Kin Insurance, the pioneering digital, direct-to-consumer home insurance company, has secured $15m in financing to take its value passed $1bn and secure the highly-coveted Unicorn status.

This latest funding round, led by Activate Capital, underscores Kin’s continued growth trajectory and commitment to revolutionising the home insurance market.

The investment comes at a pivotal moment as Kin surpasses a valuation exceeding $1bn, a notable achievement amidst the challenges faced by many technology companies in accessing capital.

Kin has distinguished itself through its systematic, capital-efficient approach, achieving over 50% year-over-year revenue growth while maintaining positive net income in 2023.

The infusion of additional capital will empower Kin to accelerate its expansion efforts, including entry into multiple new markets and the introduction of innovative products.

These strategic investments will further solidify Kin’s position as a leader in the industry, setting it apart from legacy insurers struggling to adapt to evolving climate, technology, and consumer preferences.

Kin currently operates in eight states, serving approximately 115,000 policyholders, with its reciprocal exchanges managing nearly $345m of premium in force.

The company’s direct-to-consumer model, coupled with its advanced technology platform, delivers a seamless user experience, customised coverage options, and efficient claims service.

Navro secures EMI licence and raises $14m to revolutionise global payments

Navro, formerly known as Paytrix, has secured $14m in its latest funding round and has concurrently announced that the Central Bank of Ireland has authorised its EMI licence.

The round was led by existing investors Bain Capital and Unusual Ventures, with participation from Motive Partners and prior investors Fin Capital. This investment bolsters Navro’s reserves, enabling it to meet the capital requirements of tier-one regulators, clients, and banks.

The newly raised funds will support Navro’s expansion plans and enhance its capabilities to meet the evolving needs of its clients.

With a focus on growth and innovation, Navro aims to further develop its global payments network and infrastructure to provide seamless and regulated payment solutions to international businesses.

By securing an EMI licence from both the Central Bank of Ireland and the UK’s Financial Conduct Authority (FCA) underscores its commitment to regulatory compliance and governance.

Shepherd bags $13.5m and unveils new AI-powered offering

Shepherd has recently concluded a $13.5m Series A funding round and concurrently launched an innovative AI-powered offering known as Shepherd Compliance.

This latest tranche was secured from a host of investors- Costanoa Ventures from Palo Alto, California led the investment round, with contributions from Intact Ventures, Era Ventures, Greenlight Re, and Spark Capital added to the figure, according to InsurTech Insights.

The newly acquired funds will be allocated towards strengthening Shepherd’s underwriting and software teams, accelerating product development, and expanding its software portfolio.

The firm also revealed its latest offering, Shepherd Compliance, which is set to integrate AI-powered software with insurance offerings to aid contractors in reducing premiums, streamlining processes, and enhancing risk management.

The commercial construction sector is grappling with a host of obstacles, including rising claim severity, outdated underwriting methods, and a reluctance to embrace technology.

These issues are placing the long-term viability of insurance within the industry in jeopardy. Shepherd, a leading figure in the insurance technology realm, has issued a stark warning, suggesting that without significant advancements, the $10tn commercial construction industry may face insurmountable challenges.

Responding to these urgent issues, Shepherd has unveiled Shepherd Compliance, an innovative software solution tailored to automate and streamline the process of vendor compliance reviews. This critical procedure is essential for large enterprises, as it involves verifying coverage from downstream vendors for each project.

However, it is often riddled with errors and inefficiencies. Shepherd Compliance harnesses the power of artificial intelligence to meticulously analyse PDF-based data and automate associated workflows, thus ensuring a seamless integration with popular project management platforms like Procore.

Closinglock secures $12m Series A to expand its technological infrastructure

Closinglock, a prominent FinTech and fraud prevention technology provider for the real estate industry, has successfully concluded its Series A funding round, securing a substantial investment of $12m.

The significant influx of capital will enable Closinglock to expedite product development, expand its technological infrastructure, and further enhance its capabilities in safeguarding and streamlining real estate transactions.

With fraudulent schemes evolving, Closinglock remains steadfast in advancing its product offerings and improving security through cutting-edge technology and a customer-centric approach.

The round was led by Headline and supported by LiveOak Ventures, RWT Horizons, and GTMfund, further advancing Closinglock’s mission to revolutionise the transfer of funds and information within the real estate sector.

LimaCharlie lands $10.2m to redefine cybersecurity

LimaCharlie, a pioneer in Security Operations (SecOps) Cloud Platform development, has secured a significant investment of $10.2m in a Series A funding round.

The round was led by Sands Capital, with participation from both new and existing investors such as CoFound Partners, Long Journey Ventures, Lytical Ventures, Myriad Venture Partners, StoneMill Ventures, and Strategic Cyber Ventures.

The investment marks a pivotal moment for LimaCharlie as it continues to redefine cybersecurity through its innovative SecOps Cloud Platform.

This platform, the first of its kind, aims to offer a flexible and scalable approach to security operations, addressing the increasing demand for adaptable security solutions.

Unlike traditional vendors, LimaCharlie offers organisations the ability to customise their security stack through an open API, providing greater control and visibility into their environments.

This approach simplifies integrations and allows security teams to tailor their defences to suit their specific requirements.

Despite the challenges faced by cybersecurity startups, LimaCharlie has demonstrated impressive growth, attracting hundreds of customers across various sectors including enterprise security, managed service providers, and cybersecurity vendors.

The company’s continued expansion underscores the market’s appetite for a modernised approach to security operations.

FinTech startup finally secures $10m boost for SMB finance revolution

finally, a pioneering FinTech startup dedicated to automating accounting and finance operations for small and medium-sized businesses (SMBs), has successfully closed a $10m funding round.

This significant investment was led by PeakSpan Capital, with Active Capital also contributing.

At its core, finally offers a comprehensive suite of financial services, including bookkeeping, expense management, bill payment, and payroll, all integrated into a single automated platform. This innovative approach aims to simplify and streamline the financial operations of SMBs, enabling them to focus more on their core business activities rather than being bogged down by complex financial processes.

With the fresh capital at its disposal, finally plans to aggressively scale its go-to-market (GTM) strategy and further expand its product lineup. Among the planned initiatives are the development and release of mobile versions of its bookkeeping, expense management, and business banking applications. Moreover, the company intends to augment its sales teams focused on bookkeeping and expense management, thereby reaching new customers and continuing on its path of rapid growth towards becoming a comprehensive financial hub for SMBs.

Artificial Labs raises £8m ($10m) Series A+ round to drive growth

Artificial Labs, a leading algorithmic underwriting InsurTech, has successfully concluded an £8M Series A+ funding round, as it looks to drive company growth.

The investment round was spearheaded by Augmentum Fintech, Europe’s premier publicly listed FinTech fund, but also featured with contributions from existing investors MS&AD Ventures and FOMCAP IV.

The newly secured capital injection will empower Artificial Labs to strengthen its position as a leader in algorithmic underwriting.

The company aims to drive product development initiatives and expand its footprint in the digital insurance market. Additionally, it will accelerate the development and deployment of advanced AI tools, further enhancing its offerings to brokers and underwriter partners.

Since its previous Series A funding round in June 2022, Artificial Labs has significantly expanded its team and added to its leadership team through the the appointments of Ascot founder Martin Reith as Chairman in 2022 and, in 2023, Deana Murfitt as Chief Operating Officer and Jen Tan as Head of Portfolio Strategy.

In August 2023, the firm announced its Smart Follow collaboration with insurer Apollo, now active in the London Market for Marine Hull, General Aviation, and Marine Cargo.

The company also rolled out its new broker tool, Contract Builder, in late 2023 through partnerships with Lockton and Placing Platform Limited.

Device Authority attracts $7m in Series A funding from cybersecurity specialists

Device Authority, a global leader in Identity and Access Management (IAM) for Enterprise IoT ecosystems, has announced a significant financial milestone, securing $7m in Series A funding.

The investment comes from Ten Eleven Ventures, a global venture capital firm with a focus on cybersecurity.

The investment is poised to bolster Device Authority’s pioneering efforts in securing Enterprise IoT ecosystems. With the global count of IoT devices expected to hit 41.6bn by 2025 and IoT-focused cyber attacks surpassing 112m in 2022, the importance of robust identity and access management solutions cannot be overstated. Device Authority’s KeyScaler-as-a-Service (KSaaS) platform is at the forefront of providing automated device identity security throughout the device lifecycle, ensuring unparalleled device and data trust.

The Series A funding is earmarked for expanding Device Authority’s product suite and enhancing its North American market presence. Accompanying the investment, the company is welcoming three new board members: Timothy Eades, an esteemed cyber CEO and investor, as Chair of the Board; Dave Palmer, General Partner of Ten Eleven Ventures and co-founder of Darktrace; and Grace Cassy, co-founder of CyLon Ventures and former advisor to UK Prime Minister Tony Blair.

Device Authority CEO Darron Antill expressed enthusiasm over the investment, highlighting the strategic value of Ten Eleven Ventures’ involvement. “We are delighted to welcome Ten Eleven Ventures as a new investor. This investment is a significant step in Device Authority’s journey as we continue to help new and existing customers solve their device security challenges.

Hong Kong InsurTech MediConCen secures $6.85m in latest funding round

MediConCen Limited, an InsurTech company specialising in automating insurance claims using AI, has raised $6.85m in a Series A funding round.

This investment round was led by HSBC Asset Management, with additional support from existing investors such as G&M Capital, ParticleX, and new investor Wings Capital Ventures.

With this latest injection of capital, MediConCen’s total funding now stands at $12.7 million, fuelling its expansion plans in international markets, particularly in the Middle East and Southeast Asia.

MediConCen aims to revolutionise the insurance industry by leveraging AI and blockchain to streamline the claims process, enhancing efficiency and customer satisfaction.

The Hong Kong-based firm is a member of Cyberport’s community, after participating in the company’s Cyberport Incubation Programme in 2018. Leveraging this backing, MediConCen has flourished,even receiving additional co-investments facilitated by the Cyberport Macro Fund.

Spotr secures €4.5m ($4.8m) to build world’s largest image-driven property database

Spotr, a Dutch AI-powered property data platform, has recently garnered €4.5m in funding to bolster its mission of constructing the world’s most reliable and expansive image-driven property database.

The funding round, led by EDF Pulse Ventures and supported by existing investors Volta Ventures and InnovationQuarter, has injected €4.5m into Spotr’s ambitious endeavour.

The firm specialises in harnessing AI technology to compile comprehensive property data globally, offering swift and hassle-free solutions to its clientele.

Spotr’s distinctive approach involves gathering images from various sources, including satellites and street views, to create digital twins of properties worldwide.

This, coupled with machine learning and AI capabilities, enables Spotr to conduct large-scale property inspections efficiently.

SUMA Wealth secures $2.2m funding to empower U.S. Latinos in wealth building

docStribute secures £820k, pioneering future of financial services communication

docStribute, a trailblazing RegTech firm based in London, has successfully completed a pre-Series A funding round.

This significant investment of £820,000 was primarily contributed by financial service angels, highlighting the confidence and potential seen in docStribute’s vision and technology.

At its core, docStribute specialises in leveraging Distributed Ledger Technology (DLT) to revolutionise the way financial institutions communicate with their clients. This cutting-edge technology ensures the absolute integrity of information, fully complying with the stringent guidelines set by the Financial Conduct Authority (FCA) for durable mediums.

The capital influx will be strategically deployed to bolster both the development and marketing arms of the company. This move aims to enhance customer integration and accelerate the scale-up of the business.

Christopher Ansara, the visionary Founder of docStribute, shared his insights on this remarkable milestone. “Securing £820k in pre-Series A funding allows docStribute to continue to redefine financial services communication. Our commitment goes beyond compliance, as it is changing our clients’ relationships with their customers by ensuring crucial financial information is communicated effectively and efficiently.

Candor secures Series B backing from Rice Park to revolutionise mortgage industry

Keep up with all the latest FinTech news here

Copyright © 2024 FinTech Global