Key Swiss FinTech investment stats in 2023:

• Swiss FinTech companies raised a combined $451m in 2023, a 62% drop YoY

• Swiss FinTech deal activity totalled at 114 transactions in 2023, a 20% reduction from 2022

• Blockchain was the most active FinTech subsector with a 33% share of all deals.

In 2023, Swiss FinTech companies faced a notable challenge as they collectively raised $451m in funding, a substantial 62% drop compared to the previous year. The Swiss FinTech landscape also saw a decrease in deal activity, with a total of 114 deals recorded in 2023, representing a 20% reduction from the previous year.

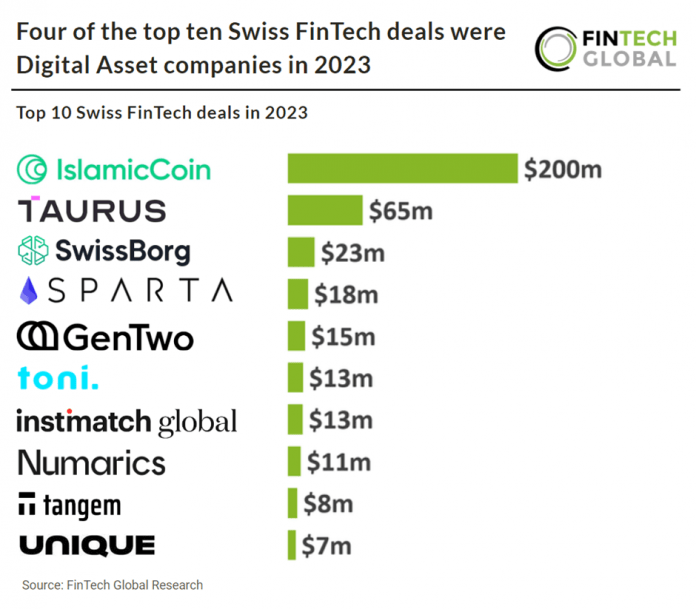

IslamicCoin, a native currency of Haqq that focuses on empowering the Muslim community with a financial instrument for the digital age, had the largest Swiss FinTech deal in 2023, raising $200m in their latest private equity round, led by ABO Digital. Islamic Coin, a digital money platform catering to the global Muslim community, has secured a significant funding round of $400 million. This funding surpasses prominent players in the digital asset industry such as Circle, BlockFi, and Solana, making it one of the largest funding rounds in digital asset history. Islamic Coin has garnered international recognition, including accolades like the Most Promising ESG Digital Asset at the Abu Dhabi Blockchain Awards. The partnership with ABO Digital will enable Islamic Coin to introduce its Shariah-compliant financial products to the ABO network of investors and access up to $200m for future growth. ABO Digital CEO Amine Nedjai expressed excitement about collaborating with Islamic Coin and praised their ambitious project as a revolutionary force in the Shariah-compliant market.

Blockchain was the most active Swiss FinTech subsector with 38 funding rounds, a 33% share of all deals. Switzerland’s latest blockchain development is their Central Bank Digital Currency (CBDC) which unfolds through Project Mariana, which commenced on November 2, 2022. This collaborative effort involves Switzerland, Singapore, and Eurosystem Centers, in conjunction with the Bank of France, the Monetary Authority of Singapore, and the Swiss National Bank. The project’s core objective is to explore the possibilities of employing wholesale CBDCs in automated market-makers to enhance the efficiency, security, and transparency of FX trading and settlement while mitigating associated risks. Furthermore, it delves into the realm of cross-border interoperability, employing standardized technical frameworks to ensure adaptability in the future. An interim report issued on June 28, 2023, unveiled a promising solution design for potential future applications.

Switzerland had a large amount of grants given to FinTech companies compared to other European countries with 23 in total, mainly from Innosuise, a 20% share of deals. The was the second highest Funding type behind Seed deals, which had 34 deals, a 30% share of total deals. Innosuisse, the Swiss Innovation Agency, plays a crucial role in boosting the Swiss economy, particularly in sectors like fintech. Its primary goal is to strengthen the long-term competitiveness and economic potential of Switzerland through various funding programs. This support extends to enhancing positive economic, social, and ecological development.