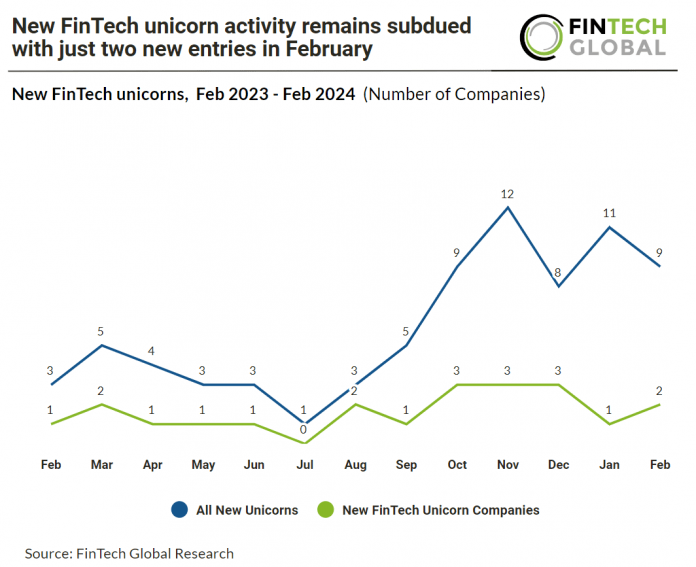

Overall there were two new FinTech unicorns in February 2024, double the amount in January and a 22% share of total new unicorns in the month. These new companies reaching unicorn status were Kin Insurance, a US-based, digital, direct-to-consumer home insurance provider, which secured $15m in financing to take its value past the $1bn-mark. This latest funding round, led by Activate Capital, underscores Kin’s continued growth trajectory and commitment to revolutionising the home insurance market. The investment comes at a pivotal moment as Kin surpasses a valuation exceeding $1bn, a notable achievement amidst the challenges faced by many technology companies in accessing capital. Kin has distinguished itself through its systematic, capital-efficient approach, achieving over 50% year-over-year revenue growth while maintaining positive net income in 2023.

Pennylane, a French accounting software company, was the second new FinTech unicorn in February 2024 after they raised a €40m Series C that brings the company’s valuation to €1bn. The all-equity round was led by UK investor DST Global with participation from US VC giant Sequoia Capital, both historical backers of the company. The funds will largely be used to finance acquisitions as the company looks to expand its technology and services portfolio. This will support Pennylane’s efforts to develop new features within its platform, which helps accountants and enterprises keep track of financial transactions such as spending and sales.