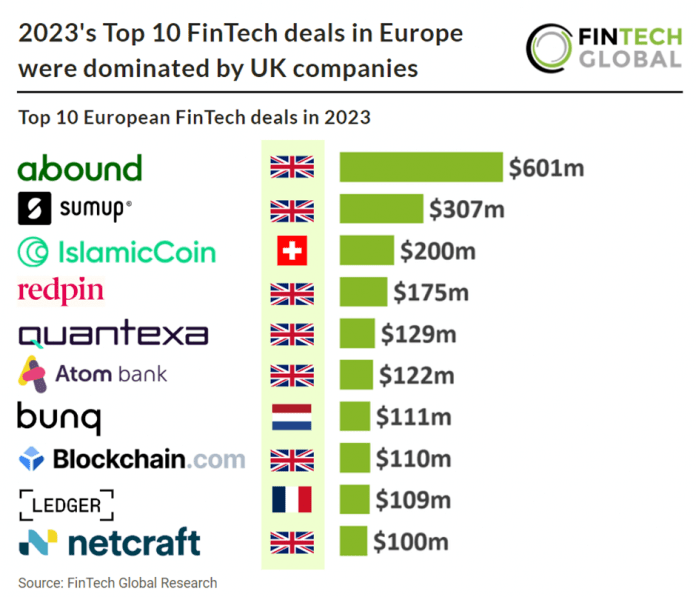

2023 has seen a stark comparison to the previous year with no European FinTech deals reaching the $1bn mark, compared to two in 2022. The UK accounted for the majority of the top 10 deals with seven deals making the list. Blockchain & Digital Asset technologies was the most active FinTech subsector on the list with three deals. This was followed by PayTech and WealthTech which both had two deals each on the list.

Blockchain & Digital Asset technologies remain innovative in 2023 with digital assets such as Bitcoin reemerging. Bitcoin’s price increased 155% in December 2023 from December 2022. The number of jurisdictions creating regulatory frameworks has also significantly increased in 2023, for example MiCA in the EU which cements Blockchain & Digital Assets importance going forward in 2024.

European PayTech’s total transaction value is projected to reach $2,144bn in 2024, a 20.1% share of global payments . Europe’s total transaction value is expected to show an annual growth rate (CAGR 2024-2027) of 12.6% resulting in a projected total amount of $3,061bn by 2027.

Digital banking in Europe saw a major increase in usage during the Covid pandemic although figures in the following years have not really increased so dramatically, peaking at an average of 61.9% by the end of 2022, across all EU countries. EU countries that have the most online banking penetration are Finland (94.5%), Ireland (84.9%) and Sweden (84.5%).