Key European Blockchain & Digital Asset investment stats in 2023

• European Blockchain & Digital Asset companies raised a combined $1.5bn in 2023, a 70% reduction from 2022

• European Blockchain & Digital Asset deal activity totalled at 322 transactions in 2023, a 44% drop YoY

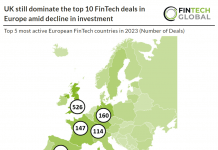

• The UK was the most active European Blockchain & Digital Asset country with a 34% share of deals

In 2023, European Blockchain & Digital Asset companies experienced a significant downturn in funding, raising a combined total of $1.5bn, which marked a substantial 70% reduction compared to the previous year. Similarly, deal activity within the sector saw a notable decline, with only 322 transactions recorded, reflecting a decrease of 44% YoY.

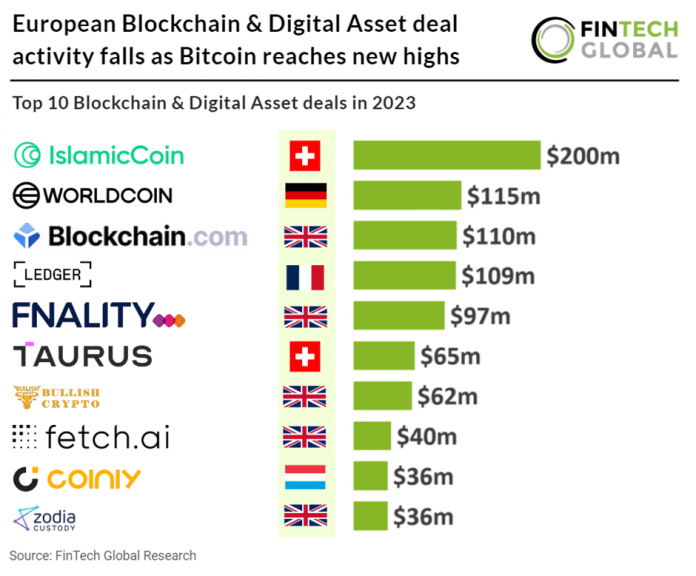

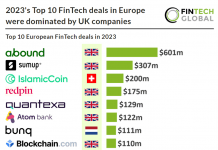

IslamicCoin, a native currency of Haqq that focuses on empowering the Muslim community with a financial instrument for the digital age, had the largest European Blockchain & Digital Asset deal in 2023, raising $200m in their latest private equity round, led by ABO Digital. Islamic Coin, a digital money platform catering to the global Muslim community, has secured a significant funding round of $400 million. This funding surpasses prominent players in the digital asset industry such as Circle, BlockFi, and Solana, making it one of the largest funding rounds in digital asset history. Islamic Coin has garnered international recognition, including accolades like the Most Promising ESG Digital Asset at the Abu Dhabi Blockchain Awards. The partnership with ABO Digital will enable Islamic Coin to introduce its Shariah-compliant financial products to the ABO network of investors and access up to $200m for future growth. ABO Digital CEO Amine Nedjai expressed excitement about collaborating with Islamic Coin and praised their ambitious project as a revolutionary force in the Shariah-compliant market.

The UK was the most active European Blockchain & Digital Asset country with 112 deals, a 34% share of all transactions. It was followed by Switzerland with 37 deals, a 11% share of total deals and France in third place with 24 deals, a 7% share of total deals.

Bitcoin was trading at $71,588 on March 11th, having overtaken its previous November 2021 high of nearly $69,000. The latest price move came as The UK’s Financial Conduct Authority (FCA) announced on March 11th that recognised investment exchanges in the UK can establish a market segment for digital asset-backed Exchange Traded Notes (cETNs) tailored for professional investors. These investors, including authorised investment firms and credit institutions, can access these cETNs provided they adhere to UK listing requirements, ensuring proper disclosure and ongoing obligations. The FCA emphasizes the need for robust controls by exchanges to safeguard professional investors and maintain orderly trading. However, the ban on selling cETNs and crypto derivatives to retail consumers remains in place due to their high-risk nature and lack of regulation. The UK introduced its first cryptocurrency regulations in October 2023, focusing on protecting consumers and financial stability. The FCA collaborates with various stakeholders to develop and implement the UK’s digital oasset regulatory framework, aiming to set international standards. Each cETN listing will be assessed individually by the FCA, with exchanges responsible for establishing professional-only market segments and mitigating associated risks. Professional investors, defined as authorised or regulated firms in financial markets, are the intended beneficiaries of this initiative.