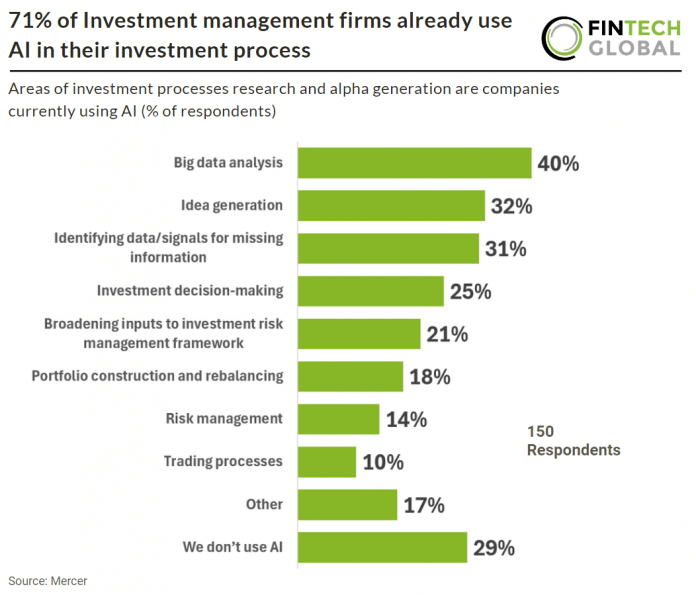

A recent report conducted by Mercer in December 2023 – January 2024 surveyed 150 asset management managers from various asset classes. The survey focused on AI adoption in investment management.

Currently, only 29% of investment firms don’t use AI in their investment process research or alpha generation. Although AI and ML have a potentially significant role in optimizing trading activity, only 10% of respondents are using it in trading processes. Just 35% of firms already using AI cited use cases aimed at improving execution (such as trading costs) as a significant potential driver of alpha.

Big data analysis saw the widest implementation at 41%. This is no surprise as big data and artificial intelligence are intrinsically linked. Big data analytics employs AI to deepen and improve data analysis. At the same time artificial intelligence thrives on the extensive datasets provided by big data to enhance its learning algorithms and refine decision-making capabilities. This interplay facilitates the use of advanced analytical tools, such as augmented and predictive analytics, allowing for a more effective extraction of actionable insights from large data repositories.