Key European AI FinTech investment stats in Q1 2024:

• European AI FinTech deal activity reached 50 deals in Q1 2024, a 21% increase YoY

• European AI FinTech companies raised a combined $289m in Q1 2024, a 12% decrease from Q1 2023

• The UK was the most active AI FinTech country in Q1 2024 with 16 deals, a 32% share of all transactions

In the first quarter of 2024, the European AI FinTech sector experienced significant growth, with deal activity reaching 50 transactions, marking a 21% increase year-over-year. Additionally, European AI FinTech companies successfully raised a combined total of $434 million during this period, representing a substantial 31% increase from the first quarter of 2023.

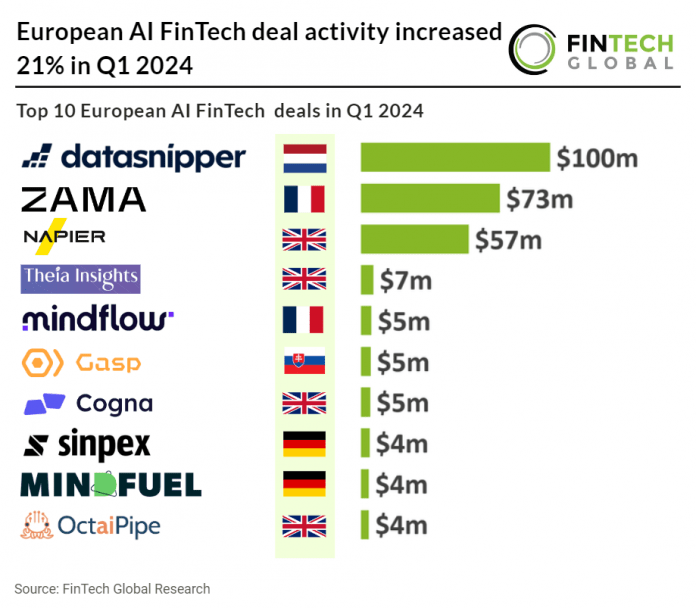

Datasnipper, which allows financial audit teams to meet regulatory demands, had the largest European AI FinTech deal in Q1 2024 after they raised $100m in its Series B round of funding putting their valuation to $1bn. Index Ventures, a venture capital firm based in London, spearheaded the investment. This funding milestone follows a period of significant growth for DataSnipper, which reports a doubling of both its customer base and revenue within the past year.

The UK was the most active European AI FinTech country in Q1 2024 with 16 deals, a 32% share of all funding rounds. France was the second most active country with six deals, a 12% share and Germany was third with five deals, a 10% share of deals.

The latest European AI regulation update came from the UK with the Artificial Intelligence (Regulation) Bill which proposes the creation of an AI Authority to oversee and coordinate AI regulation. This new body would ensure that existing regulators consider AI impacts, align their approaches, and conduct a gap analysis on regulatory responsibilities. Additionally, it would monitor economic risks, scan emerging technologies, support sandbox testing for new AI models, and accredit AI auditors. The bill also introduces regulatory principles for AI development and use, marking a shift from the current UK government strategy which favours sectoral regulation with centralized support and considers it premature to legislate AI comprehensively. This cautious approach includes issuing voluntary regulatory principles and has received mixed responses, with endorsements from major tech companies and criticism from academic bodies like the Ada Lovelace Institute for not mandating legal standards.