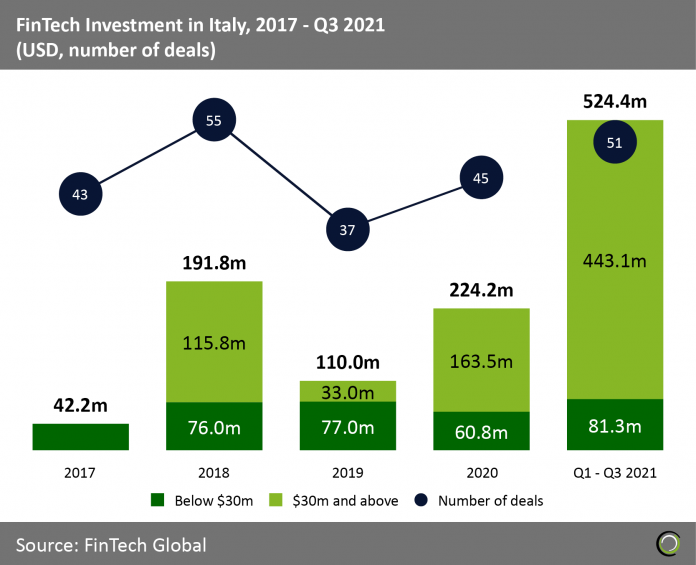

After a big decrease in the number of deals in 2019, in the first three quarters of 2021 the country’s FinTech deal activity has almost reached 2018 level, with a total of 51 transactions recorded.

- The FinTech industry in Italy recorded ups and downs between 2017 and 2021 with firms raising $1.1bn across 231 deals over the period. According to a report carried out by PwC in 2020, things are starting to change in Italy despite FinTech immaturity. In fact, in Italy the majority FinTech companies are either startups or very small firms counting less than ten employees. Thanks to the FinTech Milan Hub by the Bank of Italy launched in September 2021, benefits for both new and established FinTech businesses are going to be raised through experimentation, selection of contributors, collaborations for institutions and strong dialogue with market operators.

- 2020 was one of the toughest years for the Italian economy, but it represented a turning point for the Italian FinTech Industry. Not only the amount of funds invested in FinTech increased by +110% from 2019 to 2020, but also there was a 13.3% rise in the number of deals – from 37 deals recorded in 2019 to 45 in 2020.

- However, if we consider the period between 2017 and 2020, the number of deals has not increased much – 45 deals on average per year – even if investments have grown exponentially reaching $224.2m at the end of 2020. Bigger rounds of funding are now more common than smaller ones. Investors, indeed, see the potential of FinTech firms in Italy since Covid-19 raised awareness in the necessity of remotely available services. With a funding amount of $800k on average per startup, investors’ interest is shifting from early-stage companies to more matured ones similar to other leading economies in Europe such as Germany and France.

- As investors’ interested rebounded post Covid-19, the majority of FinTech deals in 2020 (40 out of 45) were signed between Q2 and Q4, preparing the ground for 2021. In the first three quarters of 2021, funding raised by FinTech companies hit $524.4m, already more than doubling the total capital invested in the whole 2020.

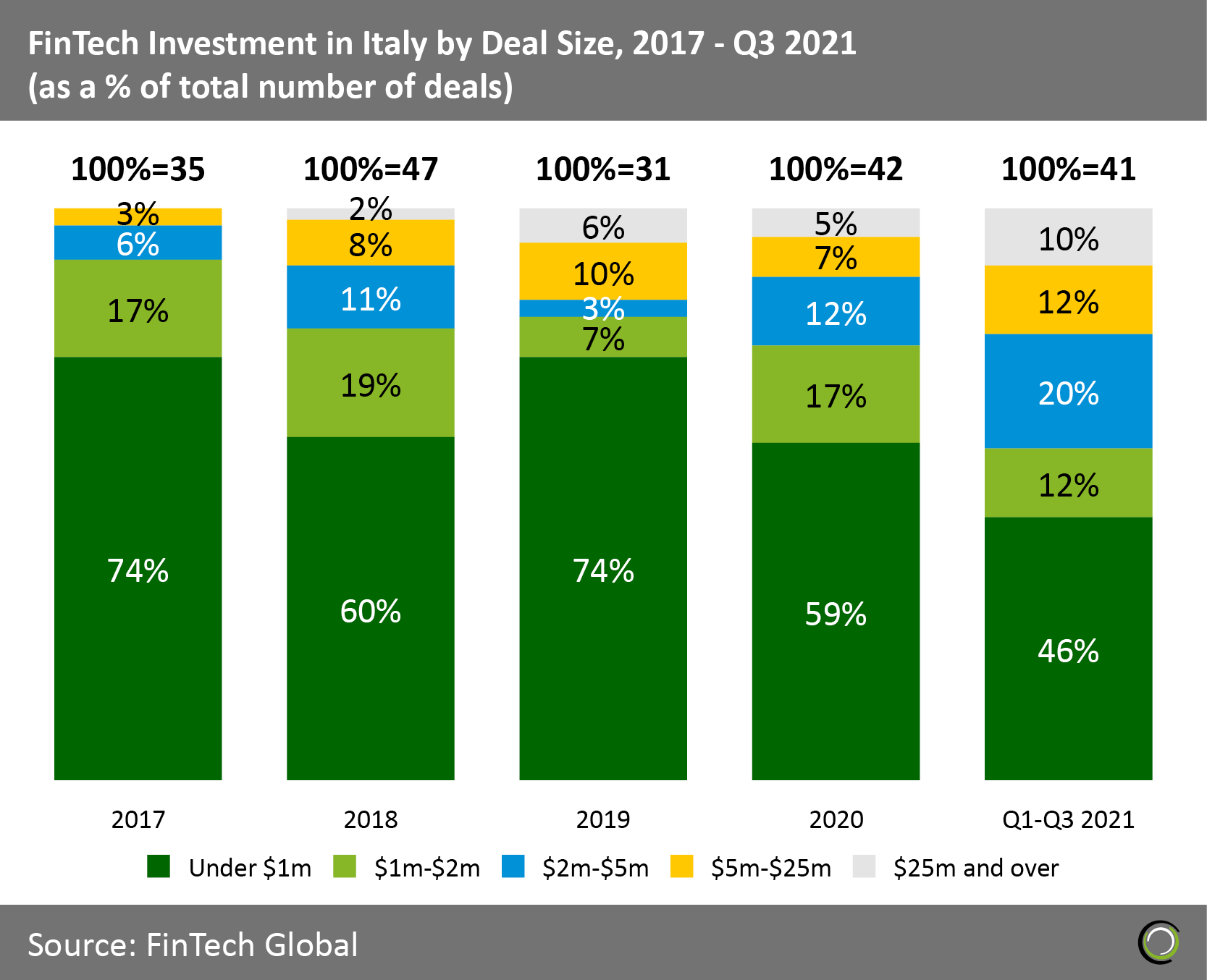

Growing investments above $25m signals the rise of well-established companies in the FinTech landscape in Italy.

- The number of deals under $1m declined sharply from 74% in 2017 to 46% in 2021. This is a sign that the FinTech industry is maturing in Italy. However, the process is still at an early stage given just nine Series B and Series C rounds have been recorded throughout this period, and only one IPO for Illimity, an Online Banking service, in the second quarter of 2021.

- People are starting to take more advantage of FinTech services thanks to the Digital Agenda for Europe and other regulatory initiatives by the European Commissions. Italian FinTech companies have raised more than $1bn since 2017 testifying the growing trend in the development and adoption of FinTech services in the country. As of Q3 2021, Italy has more than 345 operating FinTech startups in its territory.

- Despite big expectation on a future decline of the FinTech sector in Italy, after the coronavirus lockdowns FinTech companies managed to raise big amounts securing follow-on funding. This was possible thanks to the accelerated shift towards digital solutions during the Covid-19 pandemic. As of Q3 2021, the country counts 41 publicly reported deals, already reaching the level of the whole 2020. There are strong signals that the record level of 2018 with 47 public deals recorded may be overtaken by the end of the year.

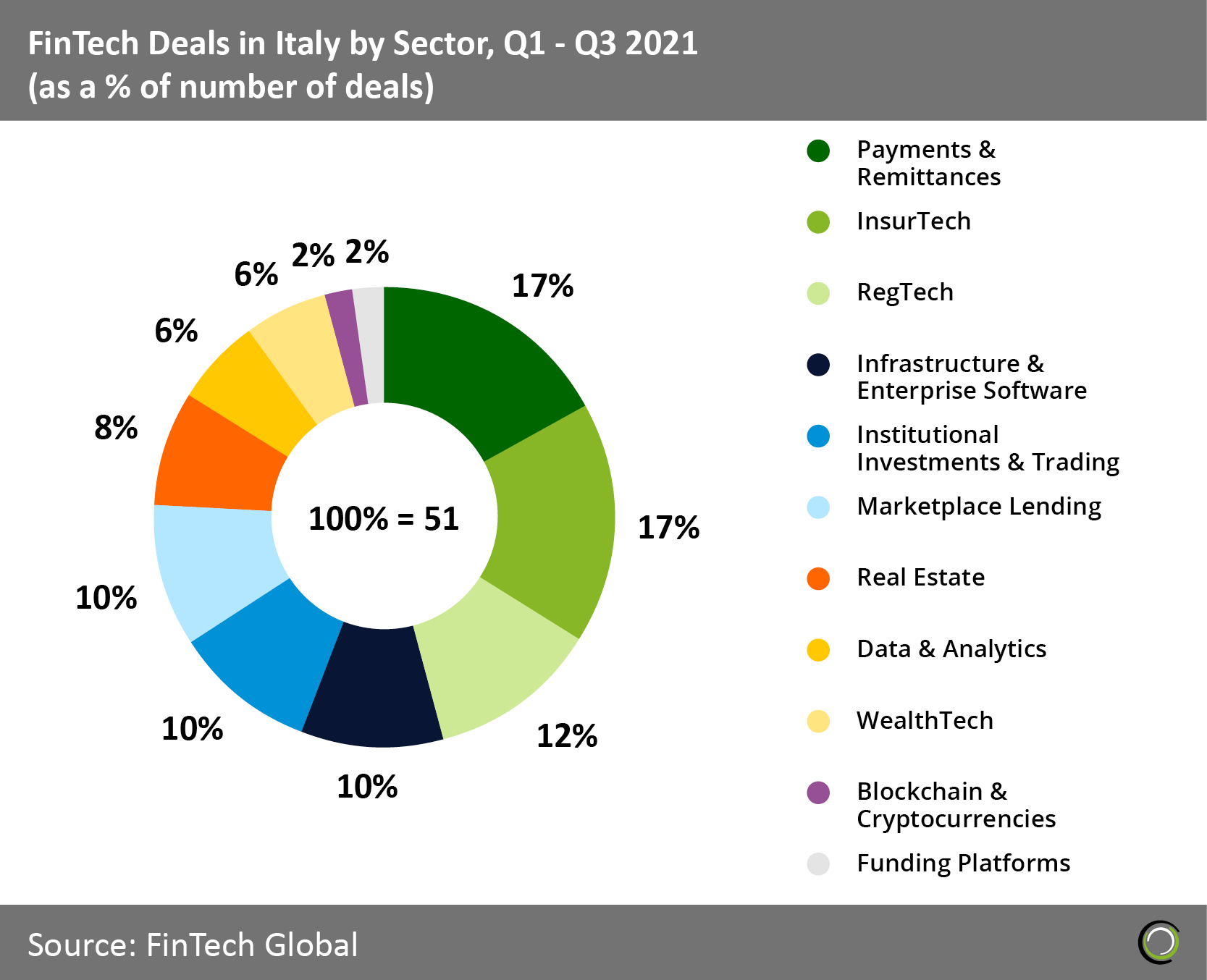

Investor’s focus has shifted to Payments services in Italy driven by demands from the pandemic

- From 2016 to 2020, InsurTech companies completed 40 funding rounds, leading the way in FinTech investments. In 2021, Italy moved the centre of attention from InsurTech to Payment services, which collected more than 17% of all deals in the country. Digital Payments are expected to have an estimated total transaction value of $74.2bn becoming the largest segment of the Italian FinTech market at the end of 2021.

- The InsurTech sector is still very strong in the Italian Market especially after the coronavirus pandemic, seen as the black swan of 2020. Since March 2020, there has been a strong necessity of rethinking existing strategies, rationalising businesses and expanding into new markets and products. Even though the InsurTech market is just a small slice of the total Italian Insurance Market, there is a big request for P&C and life/health insurance via FinTech companies, which collected 12% of all deals in the country.

- While Marketplace Lending has suffered a huge decline giving space to Equity Crowdfunding, Real Estate has seen a big growth during the first nine months of 2021 with respect to the 2020 levels, recording an increase from two deals in 2020 to nine deals in 2021 in Italy. Interest rates on mortgages were reduced after the pandemic, and this brought Italians to secure their savings into houses, perceived as comfortable living environments. During the pandemic, Italians felt the necessity to find larger and quieter spaces where to spend their time, with gardens and terraces and situated outside the city centre area.

- Investment & Trading and Blockchian & Cryptocurrencies companies hold together 12% of FinTech deal activity in 2021. These investment practices are becoming popular especially among Italian millennials, as they prefer trading and managing their savings online instead of dealing with physical consultants.

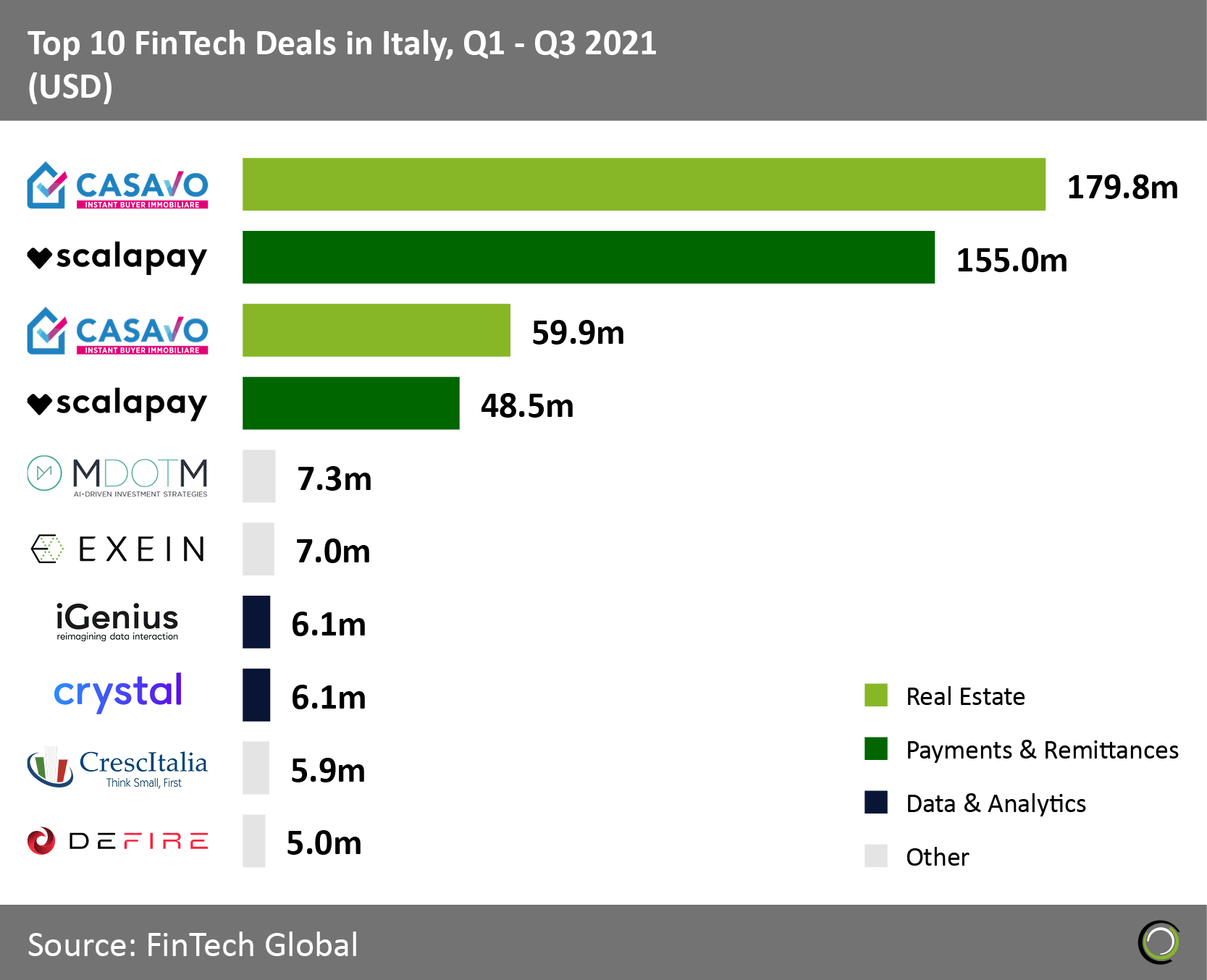

Real Estate and Payments & Remittances are on the podium of the top ten deals in Italy during the first nine months of 2021.

- Among the top ten Italian FinTech deals completed between 1 January 2021 and 30 September 2021, six were finalised during the first three months of 2021. With a total of $480.4m raised, these top ten deals made up the 92% of the overall investment period. This is not a surprising result since the number of deals below $2m accounts for almost 60% in 2021.

- Casavo is an Italian FinTech operating in the real estate sector since 2017. The company offers a real estate instant-buying service, i.e. uses a large amount of data and tools to assess the value of the property and present a purchasing offer in a short time. Like in 2020, Casavo is still on top of the list in 2021 raising $179.8m in one round from Goldman Sachs. The next largest funding round was completed by Scalapay, a tech-enabled Payments & Remittances platform that managed to raise $155m in September 2021.

- InsurTech companies disappeared from the scene, highlighting even more the shift towards more high-revenue sectors. After the pandemic the attention moved to IT security measures and Big Data, used primary for the prevention and identification of risks. In the ranking, we spot iGenius, a Data & Analytics scaleup which uses AI to augment human intelligence. The company managed to get $6.1m via debt financing in January 2021.