Key Indian FinTech investment stats in Q1 2024:

• Indian FinTech deal activity reached 56 funding rounds in Q1 2024, a 33% drop from Q1 2023

• Indian FinTech companies raised a combined $653m in Q1 2024, a 37% reduction YoY

• Lending Technology was the most active FinTech subsector in Q1 2024 with a 22% share of deals

In the first quarter of 2024, the Indian FinTech sector saw a notable decline in deal activity, totalling 56 deals, marking a significant 33% drop from the same period in 2023. Despite ongoing investment, Indian FinTech companies collectively raised $653m during Q1 2024, reflecting a substantial 37% reduction compared to the previous year.

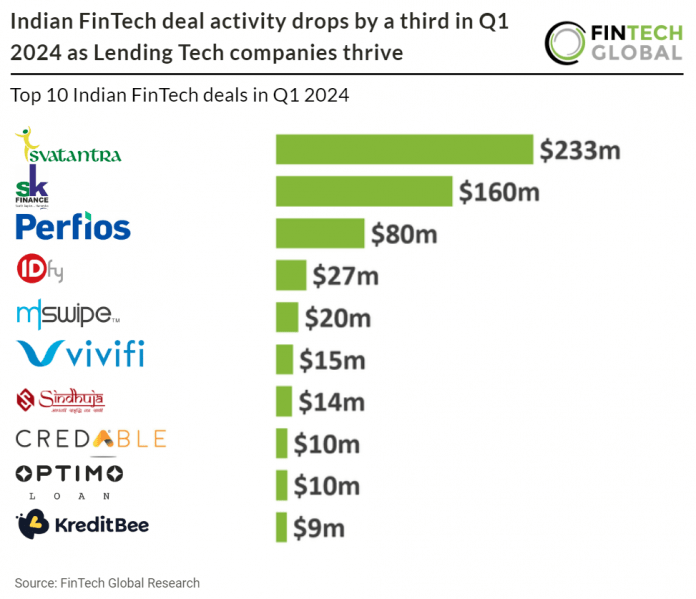

Svatantra, a next-gen microfinance provider, had the largest Indian FinTech deal in Q1 2024 after raising $233m in their latest private equity funding round, led by Advent International and Multiples. Svatantra’s latest investment follows its recent acquisition of Chaitanya India Fin Credit Limited (“Chaitanya”). Upon finalization of the proposed transaction and merger with Chaitanya, the combined entity is poised to become one of India’s largest non-banking microfinance companies. Ms. Ananya Birla and the current promoter group will retain a significant majority stake. Since its establishment in 2013, Svatantra has distinguished itself as a leading microfinance provider, offering affordable financial and non-financial solutions to women entrepreneurs. With its wholly owned subsidiary, Chaitanya, the company now boasts a workforce of over 17,000 employees and serves more than 4.2m customers across 20+ states in India, leveraging advanced processes and technology.

Lending Technology was the most active FinTech subsector in Q1 2024 with 12 deals, a 22% share of total deals. RegTech was the second most active with 10 deals, a 18% share of deals. Third was WealthTech with nine deals, a 16% share.

The Reserve Bank of India introduced draft guidelines for a regulatory framework concerning the aggregation of loan products by lending service providers (LSP). This move aims to bolster transparency and provide borrowers with advance knowledge about potential lenders. LSPs, which are third-party entities engaged by banks or non-banking finance companies (NBFCs), facilitate functions like customer acquisition and loan recovery on digital platforms. The RBI mandates that banks and NBFCs ensure their LSPs offer a digital overview of loan offers from all affiliated lenders, detailing key terms like loan amount, tenure, annual percentage rate, and other conditions to enable borrowers to compare offers effectively. This initiative follows the central bank’s decision after its December 2023 monetary policy meeting to address concerns regarding loan products’ impact on customer interests by formulating a regulatory framework for web aggregation of loan products.